If you could only buy two high dividend companies in March 2024

NoDerog/iStock not released via Getty Images

investment thesis

Receiving regular dividend income along with the prospect of capital appreciation is one of the key benefits for those who invest in high dividend yield companies.

However, identifying companies with high dividend yields is difficult. Providing sustainable dividends can be difficult. Companies that pay sustainable dividends not only offer the opportunity to pay immediate dividends, but also provide a steadily growing income stream. Identifying companies that pay sustainable dividends is especially important when it comes to retirement planning.

Additionally, choosing a company that offers a sustainable dividend reduces the likelihood of experiencing a dividend cut, which can have a significant impact on the stock price of the company you choose. As a result, this can have a negative impact on the total return of your investment portfolio, especially if those stocks represent a relatively large percentage of your overall portfolio.

In this article, we’ve filtered out two high dividend yield companies that we think are attractive to dividend income investors right now. This takes into account its current valuation, strong financial strength, income generating ability, and record of dividend growth.

However, it’s worth noting that I perceive either of these choices as having a higher risk of dividend reduction. That’s why I suggest underweighting this company in your investment portfolio.

To be included in pre-selection, a company must meet the following requirements:

- Dividend yield (FWD) > 3%

- P/E (FWD) ratio < 30

- Return on equity > 10%

In March 2024, the following two companies were selected:

- CVS Health Corporation (NYSE:CVS)

- Bank of Nova Scotia (NYSE:BNS)

CVS Health Corporation

CVS Health Corporation is a health solutions provider that currently has a market capitalization of $93.55 billion.

CVS Health Corporation offers investors an attractive combination of dividend income and dividend growth, with a dividend yield (FWD) of 3.59% and a 10-year dividend growth rate (CAGR) of 10.07%. These metrics indicate that the company should be an attractive candidate for investors looking to invest for the long term and benefit from a steadily increasing dividend enhancement.

Among CVS Health Corporation’s competitive advantages are its extensive network within the healthcare industry, strong brand recognition, diverse business models (which help mitigate risk), and economies of scale (which help reduce costs).

CVS Health Corporation in terms of valuation

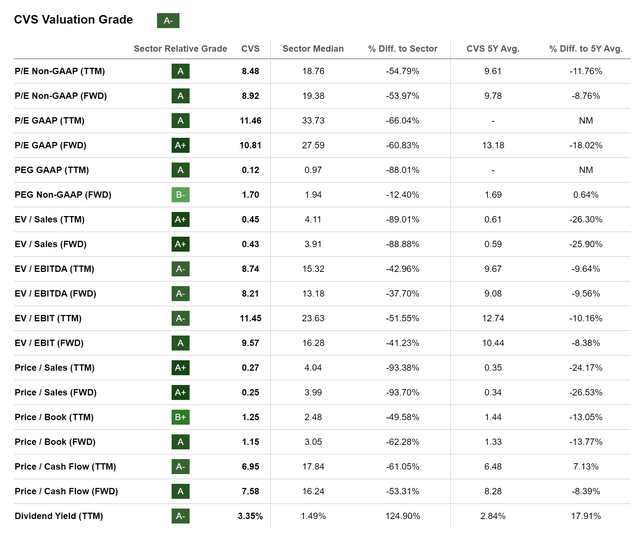

I believe CVS Health Corporation is currently undervalued. First, the company’s current P/E (FWD) ratio of 10.81 is not only 18.01% below the five-year average, but also 60.83% below the industry median, clearly indicating that the company is currently undervalued.

Second, the price/sales (FWD) ratio of 10.25 is not only 26.53% below the company’s five-year average, but also 93.70% below the industry median.

Third, CVS Health Corporation’s dividend yield (TTM) of 3.35% is 17.91% higher than the five-year average and 124.90% higher than the industry median, further strengthening my belief that the company is undervalued.

This undervaluation is further reflected in the company’s Seeking Alpha Valuation Grade, which can be found below.

Source: Seeking Alpha

CVS Health Corporation’s Attractive Dividend

Various indicators highlight the attractiveness of CVS Health Corporation’s dividend. The company’s dividend yield (FWD), currently at 3.59%, is not only higher than the past five-year average (2.90%), but also well above the sector median (1.62%).

Additionally, the company’s free cash flow yield (TTM) of 10.91% reflects an attractive risk-reward profile, highlighting that the stock price is not a result of high growth expectations. This reinforces my belief that you can invest in CVS Health Corporation with a margin of safety today.

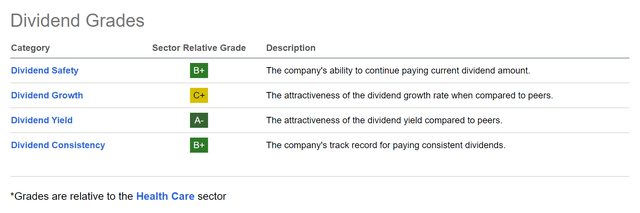

CVS Health Corporation Seeks Alpha Dividend Rating

The attractiveness of the company’s dividend is further emphasized when looking at the Seeking Alpha Dividend Rating results. CVS Health Corporation receives an A grade for Dividend Yield and a B+ grade for Dividend Safety and Dividend Consistency. For dividend growth, the company gets a C+.

Source: Seeking Alpha

Bank of Nova Scotia

The Bank of Nova Scotia is headquartered in Toronto and was founded in 1832. Bank of Canada operates through the following segments:

- bank of canada

- international finance

- Global Asset Management

- Global Banking and Markets Sector

Bank of Nova Scotia in terms of valuation

I believe Bank of Nova Scotia is currently undervalued. This is because the bank’s P/E (FWD) ratio of 10.33 is slightly below the industry median of 10.47. Additionally, we can highlight that the price/book value (FWD) ratio of 1.13 is 11.04% below the five-year average (1.27), which further indicates that Canadian banks are undervalued at the time of this writing.

When compared to U.S. banks like JPMorgan (NYSE:JPM) and Bank of America (NYSE:BAC), Bank of Nova Scotia has a slightly lower valuation, while the Canadian bank sports a P/E (FWD) ratio of 10.33. . JPMorgan is at 11.76 and Bank of America is at 11.21.

It’s also worth highlighting that Bank of Nova Scotia pays a significantly higher dividend yield than its U.S. peers (6.39%, compared to Bank of America’s 2.71% and JPMorgan’s 2.23%).

Bank of Nova Scotia in terms of profitability

Bank of Nova Scotia’s net profit margin of 26.75% (14.11% above the sector median) and return on equity of 10.34% reflect the bank’s strong profitability and financial strength. Financial strength is further emphasized by Moody’s Aa2 credit rating.

The appeal of Bank of Nova Scotia dividends

I’m confident that the Bank of Canada’s combination of an attractive dividend yield (FWD) of 6.39% and a five-year dividend growth rate (CAGR) of 4.28% makes it particularly attractive to dividend income investors.

The attractiveness of The Bank of Nova Scotia’s dividend yield, combined with its dividend growth potential, strengthens our confidence that the Canadian bank is a potential candidate for inclusion in The Dividend Income Accelerator Portfolio.

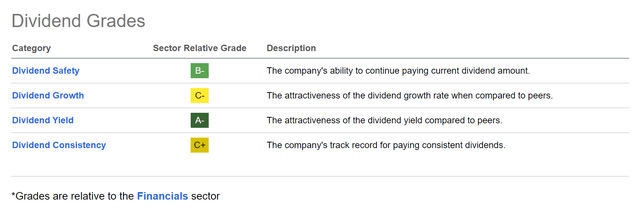

Bank of Nova Scotia by Alpha Dividend Rating Pursued

Pursuing an Alpha Dividend Rating further emphasizes my theory that Bank of Nova Scotia is an attractive choice for dividend income investors. It receives an A- for dividend yield, a B- for dividend safety, a C+ for dividend consistency, and a C- for dividend growth.

Source: Seeking Alpha

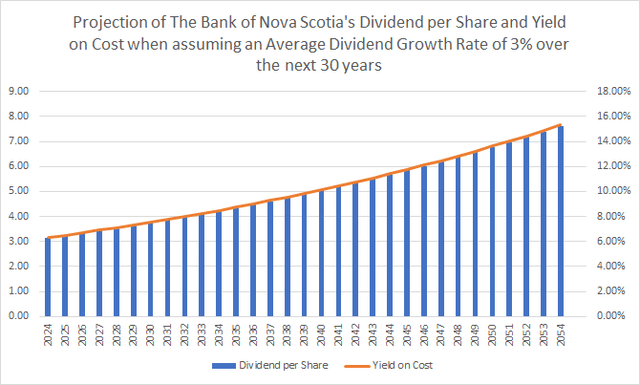

Dividend and Cost Return Forecast for Bank of Nova Scotia

The graphic below shows forecasts for the Bank of Nova Scotia’s dividend and cost yield assuming an average dividend growth rate of 3% over the next 30 years, further supporting the Bank of Canada’s attractiveness to dividend income investors.

Source: Author

risk factors

Considering the risks associated with CVS Health Corporation and The Bank of Nova Scotia, we believe the risk level for investors in Canadian banks is slightly higher.

This higher risk level is reflected in the company’s high 24M beta factor of 1.00, compared to CVS Health Corporation’s 24M beta factor of 0.48.

CVS Health Corporation’s relatively low beta factor of 24M indicates that including it in your portfolio can significantly reduce the volatility of your investment portfolio. 24M With a beta factor of 1.00, Bank of Nova Scotia reflects the beta factor of the broader stock market, indicating the same level of volatility.

Additionally, we can highlight that Bank of Nova Scotia has a significantly higher payout ratio of 66.59% compared to CVS Health Corporation’s payout ratio of 27.69%. This shows that the potential for a dividend cut is quite high for investors in The Bank of Nova Scotia.

This theory is further supported by Bank of Nova Scotia’s negative EPS growth rate dilution (FWD) of -5.93% compared to CVS Health Corporation’s positive EPS growth rate dilution (FWD) of -5.93%. These indicators further demonstrate that The Bank of Nova Scotia’s dividend cut is more likely when compared to CVS Health Corporation.

Because of the high potential for dividend reductions, we recommend reducing Bank of Nova Scotia’s weight in a balanced dividend portfolio with reduced risk levels, giving the company a dividend of no more than 2.5% relative to the overall portfolio. This approach reduces the level of risk in your portfolio and increases your chances of achieving positive investment results when investing over the long term.

conclusion

I am confident that CVS Health Corporation and The Bank of Nova Scotia can be excellent integrations into your investment portfolio and contribute greatly to generating additional income through dividend payments.

CVS Health Corporation and Bank of Nova Scotia have both shown dividend growth in recent years, paying attractive dividend yields (FWD) of 3.59% and 6.39%, respectively (5-year dividend growth rates (CAGR) of 4.40% and 4.28%, respectively). They represent attractive valuations (their current P/E(FWD) ratio is below the sector median) and both are financially sound (Baa2 and Aa2 credit ratings from Moody’s).

Including both CVS Health Corporation and The Bank of Nova Scotia in a broadly diversified dividend portfolio that incorporates high dividend yield and dividend growth companies offers many benefits to investors.

You can use the additional income from dividends to reinvest to further strengthen your investment portfolio or manage everyday expenses.

Wouldn’t it be a good idea to look into the possibility of using dividends from CVS Health Corporation and The Bank of Nova Scotia to fund your next family vacation?

Author’s note: I’d love to hear your thoughts on this article! If you can only choose 2 high odds March Company of the Month, which would you choose?