IGRO: Not the Best Fund for Dividend Growth Investors

Klaus Wedfeld

ETF Overview

iShares International Dividend Growth ETF (bat: game) owns a portfolio of international dividend growth stocks. About half of the fund’s portfolio is concentrated in Canada, Japan and Switzerland. IGRO’s fund price has an inverse correlation with U.S. Treasury yields. that Fund prices may also be affected by exchange rates in various countries, which may result in greater volatility. IGRO also has less exposure to the technology sector than its US fund peers. This may limit long-term returns. So I think investors might want to look elsewhere for alternatives.

Y chart

money analysis

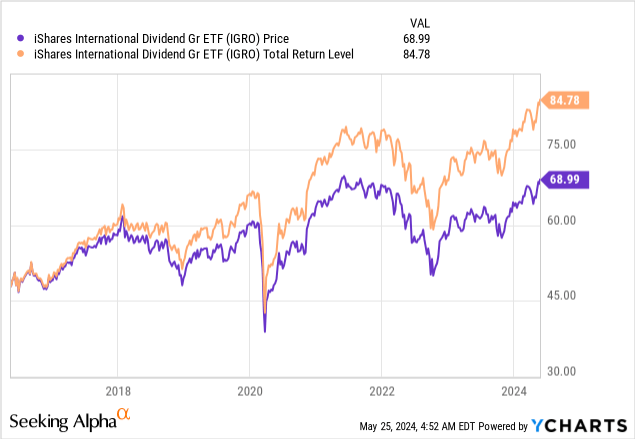

IGRO is finally close to peaking in late 2021.

Like many other funds, IGRO has had a difficult first 10 months of 2022. During this period, the fund lost about 26.5%, slightly more than the S&P 500 index’s 24.8%. Fortunately, the fund Since then, it has recovered almost all of its losses, recording a return of 38.5% as of May 24, 2024. This return was good, but still lower than the S&P 500 index’s 48.1%.

Portfolio Construction Methodology

Now let’s take a look at IGRO’s portfolio construction methodology. The portfolio is constructed by selecting stocks from the Morningstar Global Markets (ex-U.S.) indices that meet the following criteria: (1) at least five years of consecutive annual dividend growth, and (2) a payout ratio of less than 75%. The selection method is valid in three aspects. First, focus on dividend growth. Our methodology of choosing stocks that have increased their dividends over the past five years doesn’t necessarily guarantee future growth, but it does ensure some consistency. Second, limiting stock selection to stocks with a dividend payout ratio of less than 75% reduces the possibility of a dividend cut. Third, a payout ratio below 75% leaves room for future dividend increases, especially during an economic downturn.

Y chart

International Dividend Growth Stock Portfolio

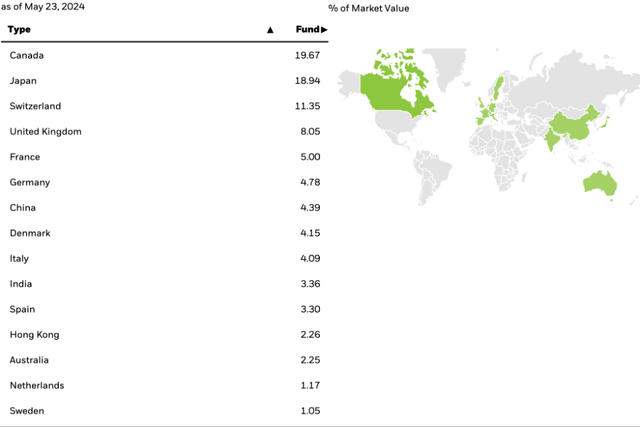

IGRO’s selection methodology resulted in a portfolio of approximately 440 stocks from approximately 15 countries/regions. As you can see from the chart, stocks from Canada, Japan, and Switzerland make up about half of the portfolio.

iShares

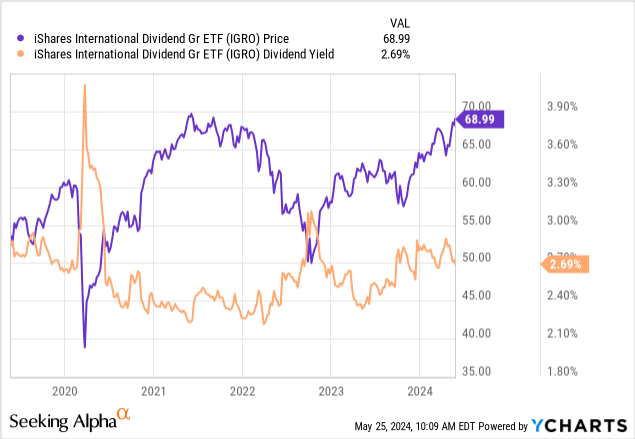

Considering that these stocks are dividend growth stocks rather than high dividend stocks, IGRO’s dividend yield in the past was not very impressive. In fact, dividend yields over the past five years have usually been in the range of 2.2% to 3.0%, except for when COVID-19 first occurred in 2020. The current rate of return is 2.7%, slightly higher than US peer funds. , the iShares Core Dividend Growth ETF (DGRO) returned about 2.4%.

Y chart

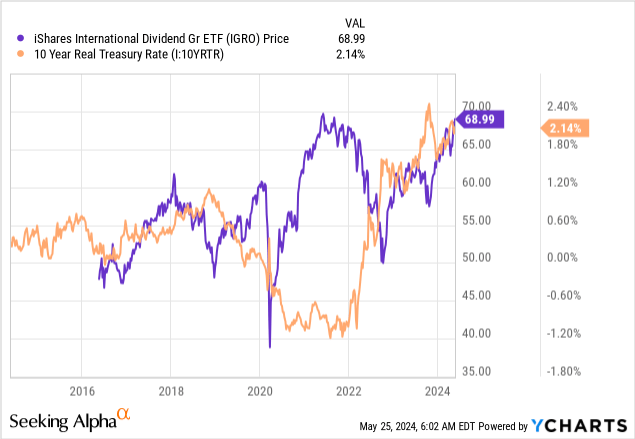

IGRO’s price performance may be affected by the Federal Reserve’s interest rate policy.

Given that IGRO’s portfolio contains only international stocks, the fund’s prices may be affected by exchange rates in various countries. In general, a stronger U.S. dollar generally lowers fund prices and vice versa. The strength of the US dollar is generally influenced by US Treasury yields. As you can see in the chart below, IGRO’s fund prices are generally inversely correlated with U.S. Treasury yields. When the Federal Reserve cut interest rates in 2020, it had an impact on Treasury yields and IGRO’s fund prices saw a strong uptick. On the other hand, when the Federal Reserve aggressively raised interest rates in 2022, IGRO’s fund price plummeted.

Y chart

Going forward, it is likely that we have already reached or are close to the peak of this rate hike cycle. But the fight against inflation is far from over, and given the fact that inflation tends to become a self-fulfilling prophecy, the Fed may need to keep interest rates higher for an extended period of time. So, in our opinion, it is highly unlikely that the Fed will cut interest rates any time soon. So we don’t expect a tailwind from the Fed in the near term.

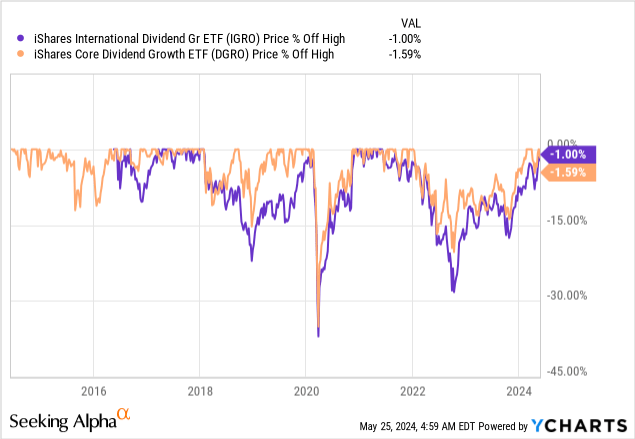

IGRO Could Fall More Than U.S. Peers

IGRO’s fund price may be affected by foreign exchange rates, which may result in greater volatility in the fund’s price compared to its U.S. peer fund, DGRO. In fact, IGRO’s five-year average beta is 0.92, which is higher than DGRO’s 0.83. For reference, beta is a measure of a fund’s volatility in relation to the overall market. Not only is IGRO more volatile, but it also tends to decline much more than DGRO in bear markets. As you can see in the chart below, IGRO’s fund price has seen a much higher decline compared to DGRO during the initial COVID-19 outbreak in 2020 and during the 2022 bear market.

Y chart

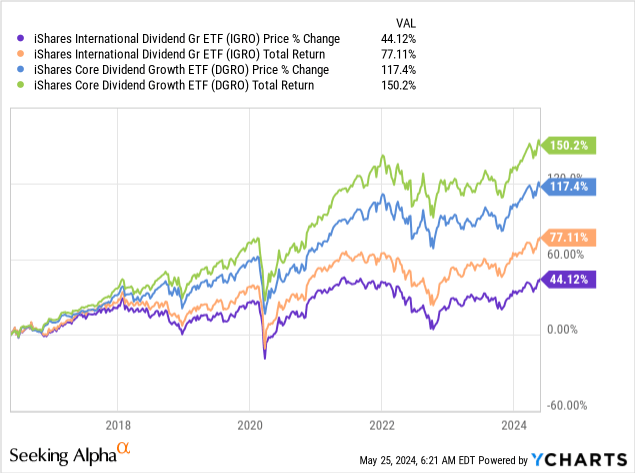

Less attractive than American peers

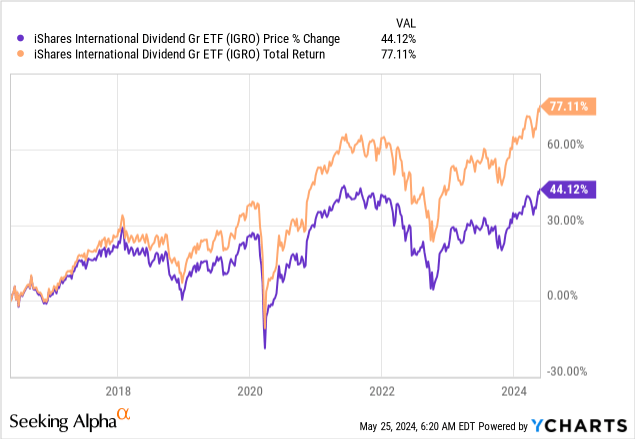

In addition to having higher drawdowns in the past, it also has much lower returns than DGRO in the past. As you can see in the chart below, since its launch in May 2016, the total return and price return have been 77.1% and 44.1%, respectively. This is significantly lower than DGRO’s total return and price return of 150.2% and 117.4%, respectively. .

Y chart

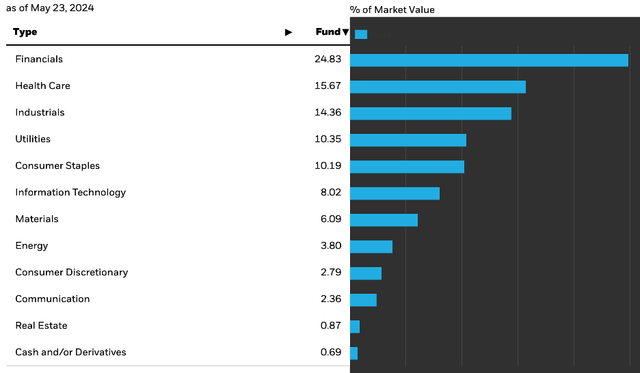

There are two reasons to think IGRO is underperforming DGRO. First, IGRO’s exposure to growth sectors, such as its technology sector, is quite limited. As you can see in the chart below, the technology sector only accounts for about 8.0% of the overall portfolio. In contrast, this sector accounts for approximately 17.0% of DGRO’s portfolio.

iShares

Another reason to think IGRO has trailed its US peer fund DGRO is that most of the stocks in IGRO’s portfolio are not multinational companies. Many of these focus on just one or a few markets. This is quite different from DGRO’s portfolio. The stocks in the DGRO portfolio are U.S. stocks, but most are multinational companies. That means these U.S. stocks do business in most major markets around the world. This is evident in the top holdings in the DGRO portfolio. For example, DGRO’s top two holdings, Microsoft (MSFT) and Apple (AAPL), are significantly more “international” than most, if not all, of the stocks in IGRO’s portfolio. Therefore, these US dividend growth stocks have better growth potential than IGRO’s international dividend growth stocks.

Investor Implications

Our analysis shows that IGRO may not be the best place to invest because it does not offer better returns than its US peer funds and could fall more in a bear market. Therefore, I think investors should look for other funds instead.

Additional disclosures: This is not financial advice and all financial investments involve risk. Investors should seek financial advice from a professional before making any investment.