Impact of Red Sea shipping disruption on North American supply chain

djtrener/iStock via Getty Images

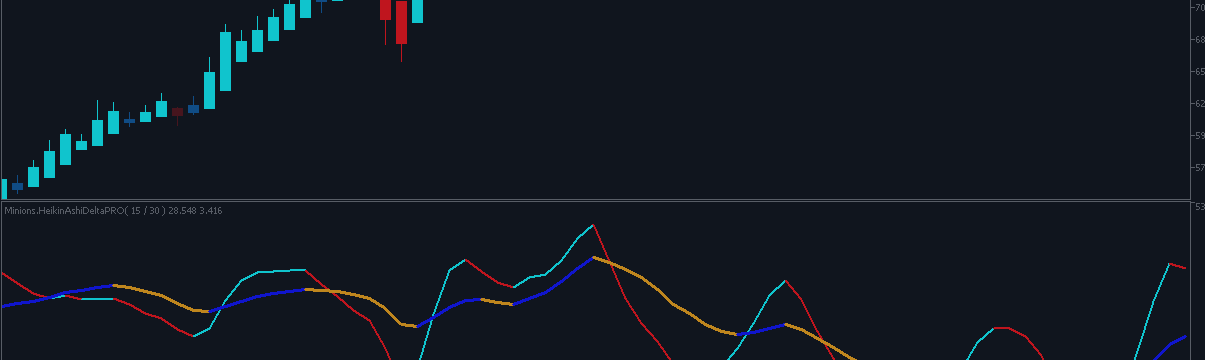

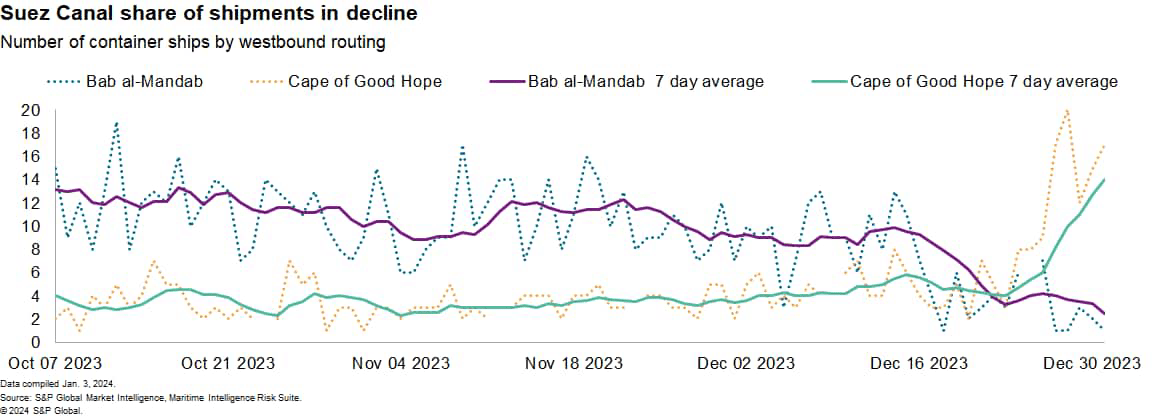

The disruption to shipping through the Suez Canal has the most direct impact on supply chains linking Asia and Europe. Alternative shipping routes result in higher shipping costs and delays of approximately 10 days for the Cape of. Good Hope sailings may require additional capacity on slower round-trip routes.

S&P Global Market Intelligence, Maritime Intelligence Risk Suite

Consumer goods such as toys, appliances and clothing will be most affected. Within materials and components, a significant proportion of chemicals, rolled steel, automotive wires and batteries are shipped via this route.

The implications of reduced shipping through the Suez Canal are not limited to the Europe-Asia supply chain. Freight rates for container routes from North Asia to the east coast of the United States, west coast, and east coast of South America have increased to similar levels to those to Europe. Route.

In theory, the impact on the North American supply chain should essentially be smaller than the impact on Europe, given the availability of trans-Pacific routes to the US West Coast. But the Americas have been more directly affected by reduced shipping capacity through the Panama Canal. Shipping through the Suez Canal was a second option for liners looking to reduce their exposure to the Panama Canal.

The time it takes to ship from Asia to the East Coast of the United States via Panama or Suez depends on the overall service string or number of temporary ports. In any case, using the Cape of Good Hope instead of the Suez Canal could add a similar 10 days of time to the Asia-US East Coast route as to the Asia-North Europe route.

Elimination of the route: Canal shipping options are limited and require additional costs and capacity.

If the Suez Canal situation is not resolved in a timely manner, container lines may choose to review their route schedules to optimize sea times for their most heavily used port pairs. This could be as simple as reducing the number of sailing combinations or switching to a more radical route construction model.

Other shipping options to the US East/Asia supply chain may prove more practical, although they involve different risks and may be more expensive. Shipping from Asia to the US West Coast and use of rail or trucking may be limited in terms of capacity during peak seasons. This has been demonstrated during the pandemic, when excess consumer goods shipments were diverted from the West to U.S. East Coast ports.

A clear preference for US West Coast ports has already emerged once again. Our data shows that maritime imports of leisure goods (toys and exercise equipment) destined for U.S. East Coast ports decreased to 40.5% of total imports in December 2023 from 44.5% the previous year.

Ongoing transitions over longer routes will require additional container transport capacity. High shipping costs and slow delivery times may necessitate reshoring sourcing out of Asia and closer to consumer markets (aka nearshoring). This may include sourcing from the Atlantic basin, especially from a cost perspective, Eastern Europe, Turkey, Africa or Mexico.

However, such reshoring is not practical for all products, and delivery can take years rather than months. Uncertainty about the upcoming U.S. election may force companies to tolerate longer delivery times before making more radical sourcing decisions.

Timing Issue: The East Coast of the United States imports from Asia.

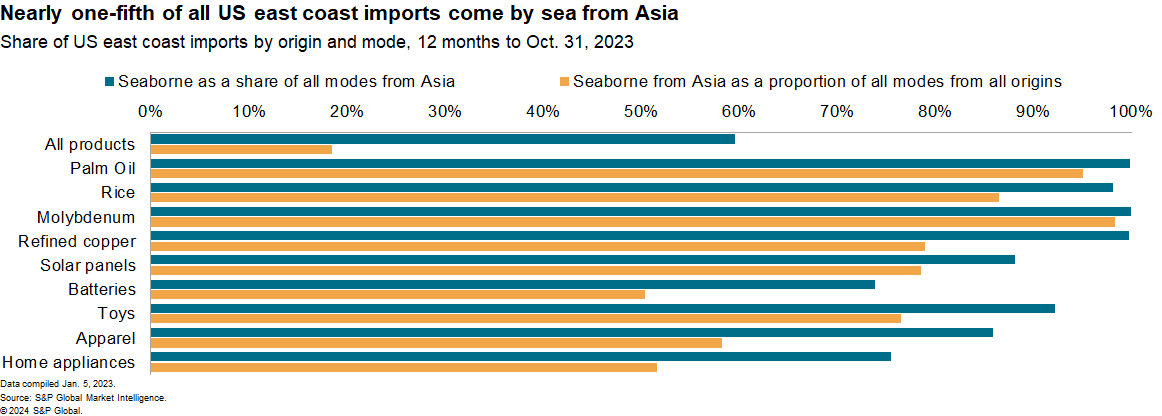

Shipments from Asia to the U.S. East Coast by sea via the Panama Canal, Suez Canal, or Cape of Good Hope accounted for 64% of seaborne imports to the U.S. East Coast, with the remainder from the Atlantic Basin or Latin America.

Among food imports valued at more than $1.5 billion, maritime imports along the Asia-U.S. East Coast accounted for 95.1% of palm oil imports, 86.5% of rice imports, and 87.6% of grape imports.

The industrial materials sector accounted for a significant share of imports of molybdenum, refined copper and alloys, and cyclic hydrocarbons.

The renewable energy and automotive sectors could face challenges, as more than half of solar panels and batteries are shipped via this route.

The short-term impact on the consumer goods sector is mitigated by seasonality, with higher annual imports arriving in the third quarter before the start of the peak season. Nevertheless, exposure to consumer goods such as toys, clothing, vacuum cleaners and kitchen appliances is high.

S&P Global Market Intelligence

Food Storage Problems: Imports from the U.S. East Coast to Asia

American exporters to Asia will face many of the same challenges as importers. An additional challenge is that when profit margins are low, container lines may prioritize quick profits over fully loaded vessels.

Food exports are most exposed to sea transport from Asia as a percentage of total exports, including sorghum, soybeans, wheat, as well as refrigerated products such as poultry.

Chemical-based supply chains may also face disruptions. This is because the pathway accounts for nearly half of the acyclic hydrocarbons and about a third of the ethylene polymers. A disruption to the latter could have a compounding impact on intra-Asian flows, given recent tariff hikes in mainland China.

Among major industrial products, the automotive industry is one of the most vulnerable, with about one-third of U.S. East Coast automobile exports heading to Asia by sea. The model type may mean that an alternative is not readily available.

Oil and natural gas transportation may also be affected. However, due to the global nature of energy trade, additional sales from the United States to Atlantic Basin buyers could offset lower purchases from buyers from Middle Eastern suppliers.

Food supplies are often subject to uncertain delays, especially due to the risk of corruption. For refrigerated cargo, an additional 10 days at sea may reduce marketable time by 10 days, depending on whether the product is fresh or frozen. For bulk grains, crossing the equator twice can cause heating/humidification cycles that can compromise crop quality. Replacement supplies for many of the foods the United States ships to Asia, including soybeans, corn and pork, also rely on canals and cape crossings.

original post

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.