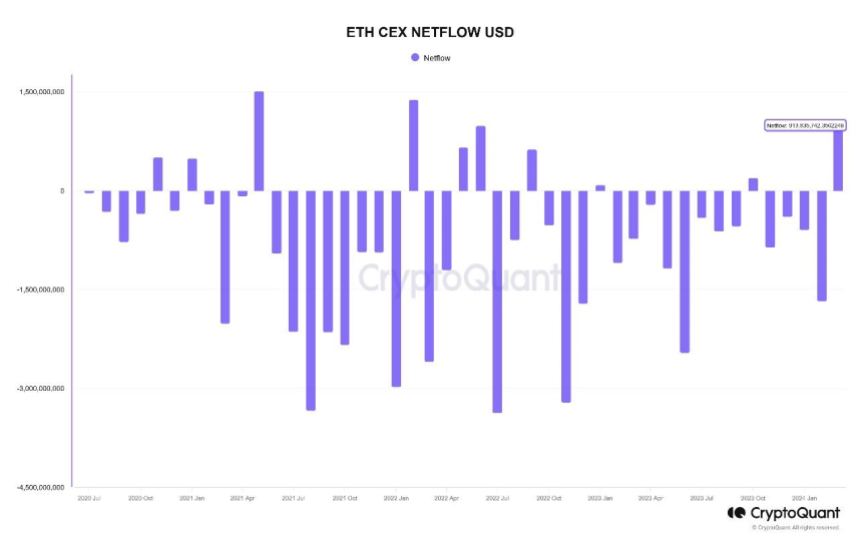

In March, Ethereum Netflow to centralized exchanges reached nearly $1 billion.

Despite a stellar start to the month, Ethereum’s price hasn’t quite lived up to its promise by the end of the month. While these bearish pressures are widespread in the general cryptocurrency market, regulatory uncertainty has become an additional concern for ETH, sparking negative sentiment towards the “king of altcoins.”

Interestingly, recent on-chain revelations show that a significant amount of Ethereum has made its way to exchanges as of March, suggesting that investors may be losing faith in the cryptocurrency’s long-term promise.

Are Investors Losing Confidence in Ethereum?

So far in March, net transfers of ETH to centralized exchanges have amounted to more than $913 million, according to data from CryptoQuant. This on-chain information was revealed through a quick post on a data analytics platform.

This net fund movement represents the largest amount of Ethereum transferred to a centralized exchange in a single month since June 2022. Although there is still a week left until the end of March, these exchange inflows appear to be a complete departure from the patterns observed over the past few years. month.

Chart showing total monthly netflow of ETH on centralized exchanges | Sources: CryptoQuant

As you can see in the chart above, October 2023 was the last time the cryptocurrency exchange saw positive net flows. It is worth noting that there has been significant movement of Ethereum tokens on centralized platforms in the months leading up to this month.

Meanwhile, separate data points have come to light supporting a large-scale movement of ETH to centralized exchanges. Renowned cryptocurrency analyst Ali Martinez Published in X Over the past three weeks, nearly 420,000 Ethereum tokens (equivalent to $1.47 billion) have been transferred to cryptocurrency exchanges.

Large flows of cryptocurrency to centralized exchanges are often seen as a bearish signal because they can be an indication that investors are willing to sell their assets. Ultimately, this could put downward pressure on cryptocurrency prices.

A significant movement of funds into a trading platform may also indicate a change in investor sentiment. This could be a sign that investors are losing confidence in a specific asset (in this case, ETH).

Moreover, the recent regulatory headwinds surrounding Ethereum particularly highlight this hypothesis. According to the latest reports, the U.S. Securities and Exchange Commission is considering investigating ETH tokens’ classification as securities.

ETH price

As of this writing, the value of an Ethereum token is $3,343, reflecting a 4% price decline over the past four hours. ETH fell 11% in the past week, according to data from CoinGecko.

Ethereum loses the $3,400 level again on the daily timeframe | Source: ETHUSDT chart on TradingView

Featured image from Unsplash, chart from TradingView

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.