In this relative rotation graph, the tail splits to reveal a trading opportunity | RRG chart

key

gist

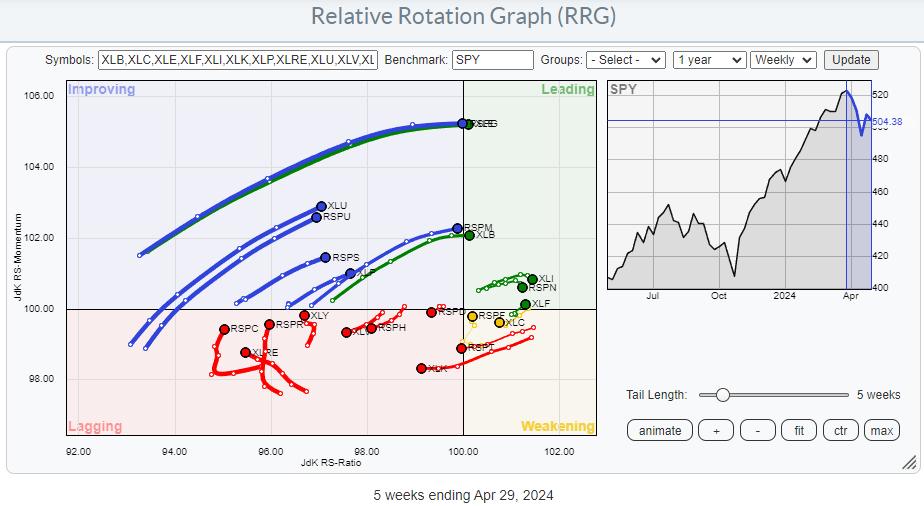

- Comparing equal-weighted and cap-weighted divisions in a relative rotation graph can provide interesting insights.

- If the trajectory of the tail and its position on the chart differ significantly, further investigation is required.

- This difference is currently occurring in two sectors.

Everyone’s on the same track….or what?

The difference between equal-weighted and capital-weighted sectors is clear. Cap weight variations are much heavier and are influenced by changes in some heavyweight, often megacap, stocks.

Nonetheless, when plotting these sectors on a relative rotation graph, you will often find that the tails generally move in the same direction or follow the same path.

If that doesn’t happen, and the tails of two versions of the same sector are on different paths in the RRG, or in completely different locations, it may be time to investigate.

The RRG above shows two universes, cap-weighted and equal-weighted, comparing the same RRG with SPY as a benchmark. If you look closely, you will find most pairs of sectors on the same trajectory. If you have a SC account, you can inspect it further by clicking on the graph and opening the RRG in your account.

*You can save RRG as a bookmark in your browser. That way, you can create custom RRGs and save them for later retrieval. Scroll to the bottom of the page and click ‘Permanent Link’.

enlargement

Then save this link as a bookmark in your browser.

Then save this link as a bookmark in your browser.

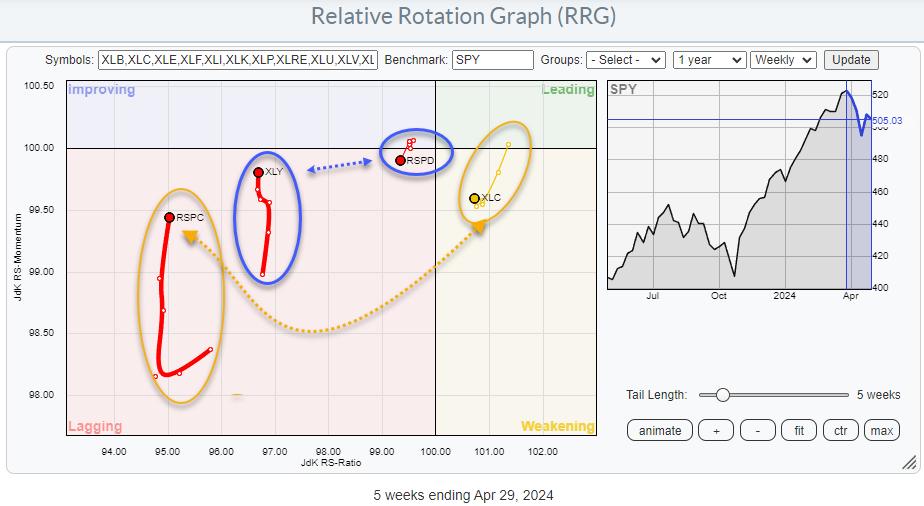

For better handling and to get a clearer picture, we removed sectors where bot tails had similar trajectories and positions, leaving only the different tails in the graph.

There are 2 sectors left. Consumer discretionary goods and communication services.

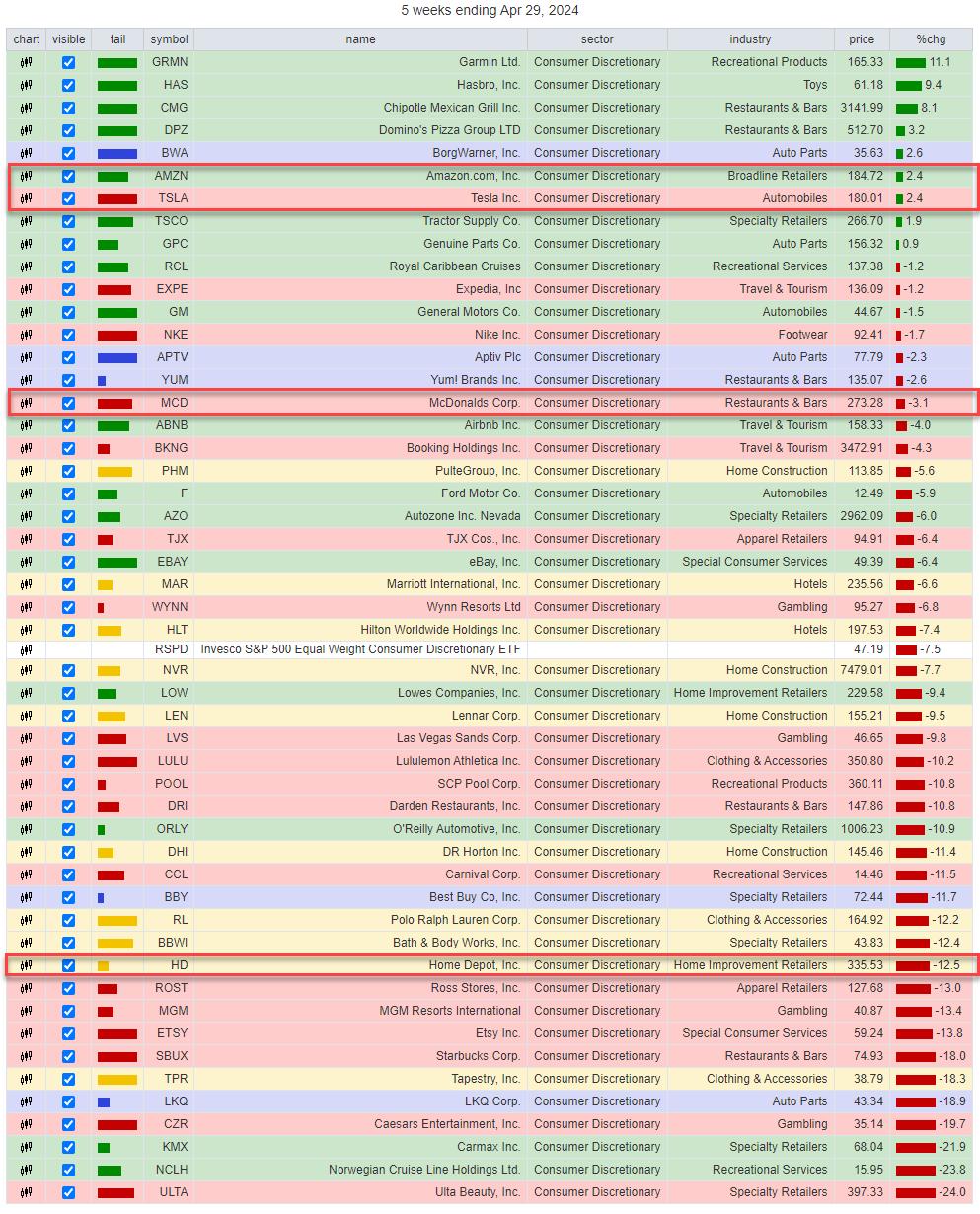

consumer discretionary

Both tails are located inside the lag quadrant. But that’s just a comparison. XLY is moving higher on the RS-Momentum scale, indicating improvement in relative momentum, while RSPD is moving lower and in the direction of negative RRG. Additionally, the XLY’s tail is significantly longer than that of the RSPD, indicating the power behind its movement.

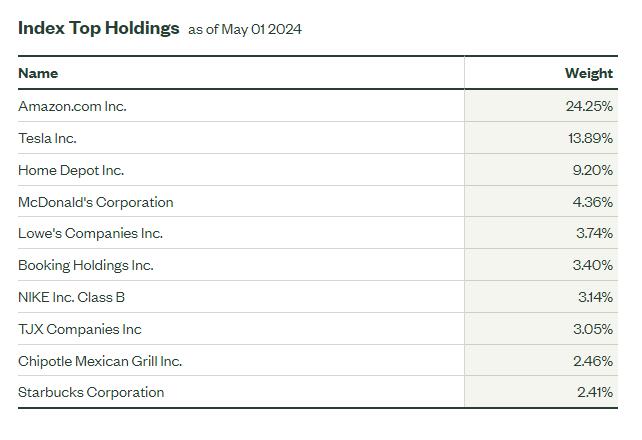

Looking at the composition of the sector, it’s clear which stocks within Consumer Discretionary are making a difference.

AMZN, TSLA, HD and MCD make up 50% of the index, with AMZN and TSLA already accounting for 38%.

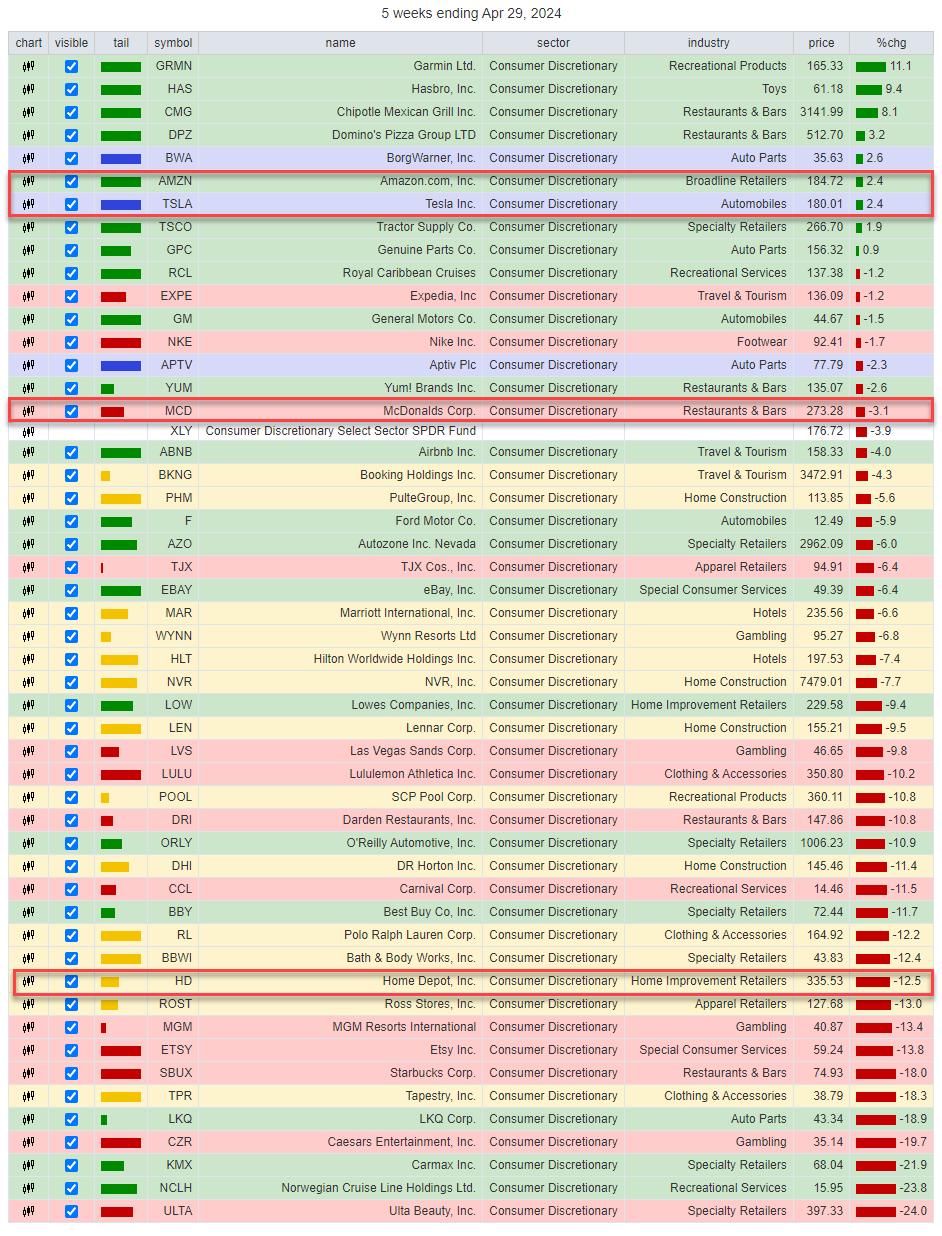

If we look at the performance over the last five weeks (the length of RRG’s tail), we can see how the performance of the sector has shifted towards the larger players. The table above shows the top 50 stocks in a random industry. AMZN and TSLA are at the top of their ranges, and MCD is just above XLY, ranking 17 out of 50.

This means that most stocks are performing worse than their sector indices. The bottom half is seeing double-digit declines. Still, AMZN and TSLA rose “only” 2.4%, pushing the sector index up to about a third of the universe despite HD falling 12.5% during the period.

Now take a look at the same table. Instead of using XLY as a benchmark, we are now using RSPD as a benchmark.

RSPD is displayed at position 27/50. you’re right. This is where equal weight benchmarks are expected. Balance every performance in the middle of space.

The bottom line is that XLY has been on the rise recently because of TSLA, AMZN, and MCD. But internally, most discretionary stocks are going through a terrible correction.

From a trading perspective, these observations can provide great pair trading ideas, such as XLY:RSPD.

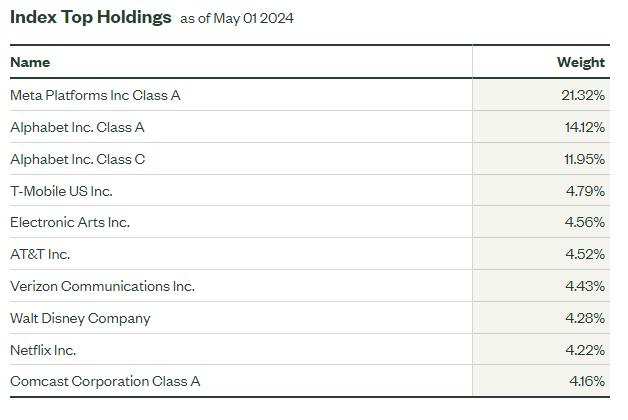

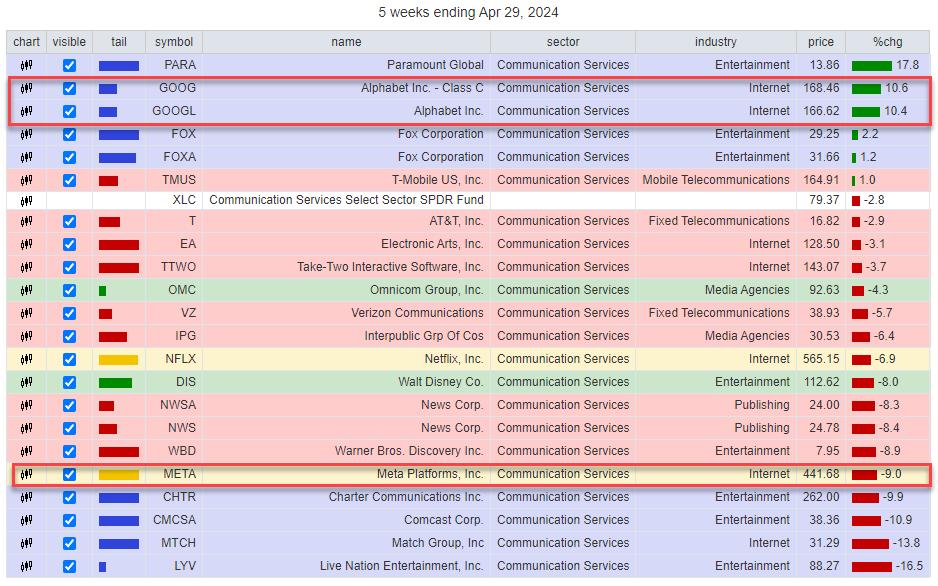

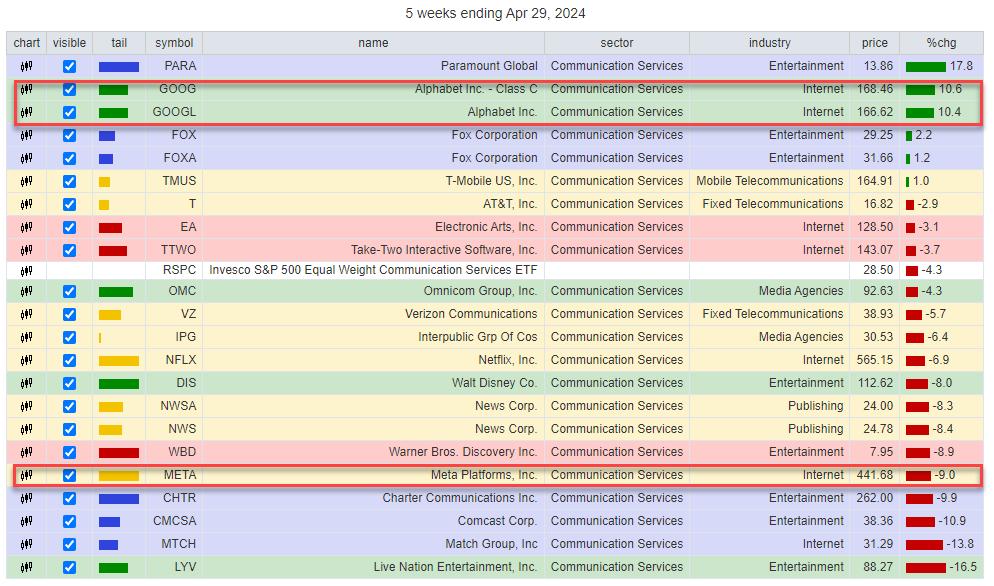

telecommunication services

The tails of XLC and RSPC are also far from RRG. XLC is still within the weakening quadrant and is just starting to show the first signs of recovery. RSPC is deep inside the lagging quadrant with very low readings overall on the RS-Ratio scale and is gaining relative momentum, but no relative trend (RS-Ratio) yet.

In five weeks, XLC is down 2.8% and RSPC is down 4.3%.

The composition of this sector is much more top-heavy than consumer discretionary.

META is listed as the top holder of XLC at 21%. However, if you add up the weights of alphabets A and B, you get 26%. So XLC’s top two stocks combined account for a whopping 47% of the sector.

If you look at the same table for XLC, you will see that Alphabet has been at the top of the list for the past five weeks. The meta is at the bottom at -9%. The sector (XLC) is -2.8%, meaning META is underperforming (-9% + 2.8% =) -6.2%.

However, Alphabet Class A shows a performance of 10.4% + 2.8% = 13.2%, and Alphabet Class C shows a performance of 10.6% + 2.8% = 13.4%. This is a stronger upward pull on the index than the drag caused by META.

If you change the benchmark to the EW version of Communication Services, you will see the following table:

Again, we see returns becoming more evenly balanced, with the equally weighted benchmark (RSPC) falling near the center of the list.

Overall, this offers similar pair trading opportunities. XLC:RSPC

This relative trend is much more mature than the XLY:RSPD pair, but as long as the rhythm of higher highs and higher lows continues, buying dips in this relative line presents an opportunity.

In most cases, the cap and equal weight versions of a sector will move more or less in tandem. But if not, it may present an interesting trading opportunity so it’s worth looking into.

#StayAlert Have a great weekend, –Julius

Julius de Kempenaer

Senior Technical Analyststockchart.com

creatorrelative rotation graph

founderRRG research

owner of: Spotlight by sector

Please find my handle. social media channels It’s under Bio below.

Please send any feedback, comments or questions to Juliusdk@stockcharts.com.. We cannot promise to respond to every message, but we will ensure that we read them and, where reasonably possible, utilize your feedback and comments or answer your questions.

To discuss RRG with me on SCANHey, please tag me using your handle. Julius_RRG.

RRG, Relative Rotation Graph, JdK RS-Ratio, and JdK RS-Momentum are registered trademarks of RRG Research.