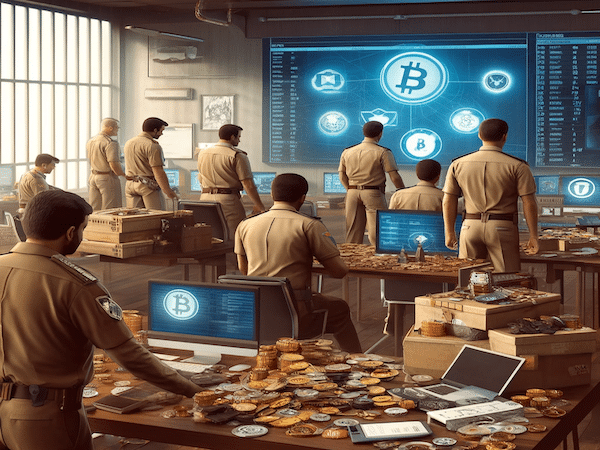

India’s Enforcement Directorate cracks down on cryptocurrency scams

Cryptocurrency fraud is a growing concern around the world, with perpetrators constantly developing new ways to defraud unsuspecting victims. A notable example recently emerged in India, where authorities succeeded in dismantling a sophisticated fraud ring targeting foreigners. This incident highlights the sophisticated tactics used by fraudsters and highlights the need for a vigilant regulatory framework and public awareness.

Investigation initiated in FIR against multiple accused.

India’s Enforcement Directorate (ED) has taken significant action against a cryptocurrency fraud ring targeting foreigners. The raid came after the defendants used unauthorized remote access to the victim’s computer to persuade the victim to transfer $400,000 to a cryptocurrency account set up. As a result of the investigation, the special prosecutor confiscated digital evidence, frozen fixed deposits, and jewelry related to the case. The investigation is ongoing and more details about the fraud network continue to emerge.

Work done in multiple locations

On June 6, ED conducted search operations against Prafful Gupta and his associates in various locations, including Delhi, Haryana and Kanpur (Uttar Pradesh). These searches were part of an ongoing investigation that began with a first information report (FIR) filed by India’s Central Bureau of Investigation (CBI). The FIR names several individuals including Prafful Gupta, Sarita Gupta, Kunal Almadi, Gaurav Pahwa, Rishabh Dixit and other unidentified persons.

Unauthorized access and fraudulent transactions

By convincing the victim that his bank account was not secure, the scammers tricked him into transferring $400,000 to a cryptocurrency account created in his name. Unauthorized remote access was used to set up these accounts using the victims’ mobile phone numbers and email IDs. The transferred funds were converted into cryptocurrency and distributed to various accomplices. According to the ED, the caller gained unauthorized remote access to the victim’s computer and used the victim’s contact information to set up a cryptocurrency account in his name.

Extensive network of fake entities and accounts

Investigation revealed that the cryptocurrency funds were transferred to Praful Gupta and his mother Sarita Gupta. These funds were later sold and the proceeds transferred to a bogus entity within India. The money was further distributed to thousands of accounts set up with fake know-your-customer (KYC) details. Some of the funds ended up in a Gurgaon-based fintech company, which helped stratify the proceeds without conducting proper KYC checks.

Asset seizure and ongoing investigation

The ED’s search operation led to the seizure of significant digital evidence. In addition, the authorities froze term deposits worth 50 million won. 7.25 billion ($880,000) and jewelery worth Rs. 35 million ($42,000). The investigation is still ongoing and ED continues to uncover the extent of the fraud network.

India’s Enforcement Directorate has made significant progress in dismantling cryptocurrency fraud rings targeting foreigners. By seizing assets and freezing funds, ED aims to punish perpetrators and prevent further fraudulent activities. The ongoing investigation will likely reveal more information about the extensive network of fake entities and accounts used in this sophisticated scam.

Cryptocurrency fraud rises in South Asia

Cryptocurrency scams are not limited to India. This is a growing concern across South Asia. As the popularity and adoption of digital currencies increases in this region, such fraudulent activities have increased significantly. Fraudsters take advantage of the relatively low level of cryptocurrency literacy and regulatory oversight in these countries. They use sophisticated techniques, including phishing attacks, Ponzi schemes, and unauthorized remote access, to trick unsuspecting victims. The cross-border nature of cryptocurrency transactions makes it difficult for authorities to track and recover stolen assets. This surge in fraud incidents highlights the urgent need for a stronger regulatory framework and public awareness campaigns to protect investors and curb illegal activity in the cryptocurrency market.

Indian authorities bust cryptocurrency fraud ring targeting foreigners https://t.co/D2FaPtR9g8

— John Morgan (@johnmorganFL) June 9, 2024

Base Dawgz: Promising Crypto Presale with Unique Chain Leap Feature

Base Dawgz, which stood out in the cryptocurrency pre-sale market this year, features a charismatic Shiba Inu mascot. Equipped with base jumping gear, the mascot is depicted soaring through the air and bouncing on a trampoline, and the images are brought to life via the website’s interactive scrolling system. This presentation highlights the token’s unique “chain hopping” capabilities.

Developed on the Base blockchain, Base Dawgz ($DAWGZ) was created as a meme coin aggregator that aims to connect multiple cryptocurrency communities. Leveraging technologies like Wormhole and Portal Bridge, $DAWGZ is a fully interoperable asset that can seamlessly transition between blockchains such as Solana, Ethereum, Avalanche, and BNB Chain.

With a total token supply of 8.453 billion, Base Dawgz is allocating 20% of the supply to the pre-sale. The remaining tokens will be distributed almost evenly to support various tasks that foster a sustainable ecosystem around $DAWGZ. Initially priced at $0.00479, the token’s whitepaper outlines structured weekly price increases and highlights the pre-sale as a key investment opportunity for maximum profit potential.

Base Dawgz’s compelling meme-driven appeal and significant role in the ongoing Base cryptocurrency narrative are compelling reasons for investment. These factors are expected to contribute to an explosive debut for $DAWGZ once it is released on cryptocurrency exchanges.

Visit Base Dawgz Presale

Related news

PlayDoge (PLAY) – Latest ICO on BNB Chain

- 2D Virtual Doji Pet

- Play to get Meme Coin Fusion

- Staking and in-game token rewards

- SolidProof Thanks – playdoge.io