Inflation expectations: The Fed is doing its job

Image Bank via Rudy Sulgan/Getty Images

The Federal Reserve’s monetary policy is approaching two years of quantitative tightening.

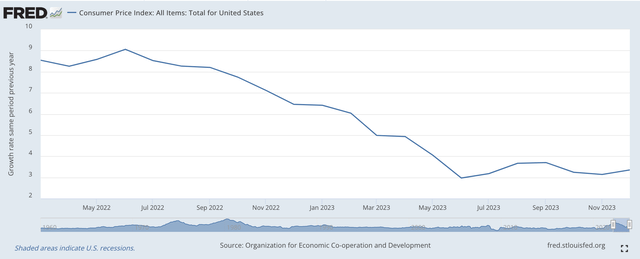

Real inflation has decreased significantly. Last month, the consumer price increase rate was 3.1% compared to the same period last year.

The inflation situation over the past two years is as follows.

Consumer Price Index, YoY (Federal Reserve Bank)

The price increase rate in July 2022 compared to the same period last year was 9.1%.

The Federal Reserve began quantitative tightening efforts on March 16, 2022.

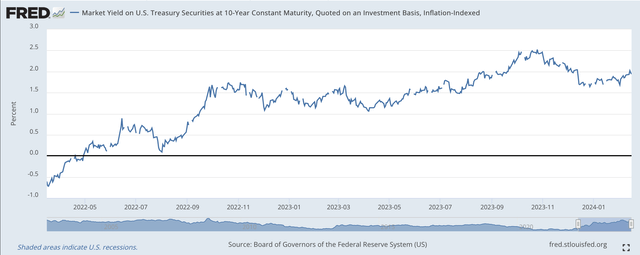

A commonly used estimate of inflation expectations is obtained by subtracting the nominal yield on U.S. Treasury bills from the yield on U.S. Treasury inflation-protected securities of the same maturity.

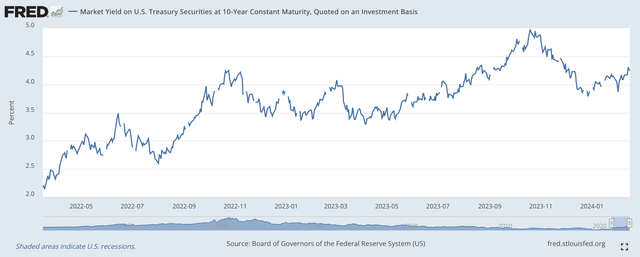

As of March 15, 2024, the nominal yield on 10-year U.S. Treasury bonds was 4.24%. US 10-year TIP yield It was 1.94. Subtracting the latter from the former gives us 2.30%, or 230 basis points.

Doing the same for the numbers for March 16, 2022, we get 2.80%, or 280 basis points.

Bottom line: Inflation expectations implicit in US 10-year Treasury bonds have fallen 50 basis points over the past two years.

In other words, over the next 10 years, bond investors expect inflation to grow at a compounded rate of just 2.30%.

This outlook is very close to the Fed’s inflation target.

I believe the Fed will be very happy if it can achieve this number for the inflation rate over the next 10 years.

A closer look at these numbers tells another interesting story.

If you go back to March 16, 2022, the return on US TIP was actually negative. It was minus 61bp.

Market Return: 10 Year Tips (Federal Reserve Bank)

TIPs If we equate bond yields with the actual growth investors expect for the U.S. economy, it looks like the investment community is looking for a possible recession in 2022.

The economy’s projected growth rate turns positive in mid-2022 and then rises to exceed 2.0% real growth in the fall of 2023.

Compared to the economic expansion period of the 2010s, an economic growth rate exceeding 2.0% is considered acceptable by the Federal Reserve. The entire period of growth achieved during the post-Great Recession economic expansion was only a 2.3% compounded growth rate.

Accordingly, expectations for real economic growth have recovered to a reasonable level.

The yield on the 10-year U.S. Treasury note jumped to 4.0 in the second half of the period under review.

Below is a chart of the nominal yield on a 10-year U.S. Treasury bond.

Market yield, 10-year U.S. Treasury bond (Federal Reserve Bank)

The increase in nominal U.S. Treasury yields exceeded 4.0%, and at one point slightly exceeded 2.80%. Inflation expectations therefore spiked with the compounded rate close to 2.6%, but have now settled back down to a figure closer to 2.0%.

inflation expectations

Looking at the bond markets, one could argue that the Fed appears to be achieving its original goals. In other words, the Fed is succeeding in lowering inflation to the Fed’s target of about 2.0%.

You could argue that we still have a long way to go, but what I believe is important is that the Fed has brought the actual inflation rate down to a level where investors believe the Fed can actually achieve its goal.

Real inflation decreased to 3.1% year-on-year. Inflation expectations were lowered to 2.3%. And the Federal Reserve has been implementing quantitative tightening for 23 months.

The goal appears to be within realistic achievability.

Federal Reserve Chairman Jerome Powell and the Fed appear intent on achieving this goal. And with stock markets rising, it looks like there is a real possibility that the Fed will achieve this goal.

What more could investors ask for?