Inflation is not hot

dragon claws

Don’t jump to conclusions based on one month’s numbers.

The final demand version of the Producer Price Index rose 0.6% in February, double market expectations.

Bloomberg headlines On Thursday morning, “bond yields surged as inflation curbed the Fed’s bets.” Worse, the full version of the PPI rose 1.4% in February. Oh my goodness!

Well, as you can see from these two charts, the reality is very different.

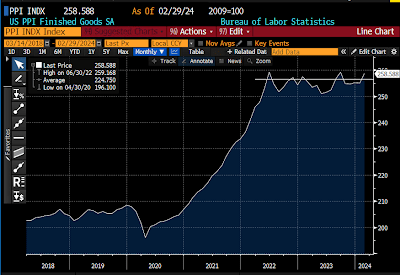

Chart #1

Chart #1 shows Producer Price Index levels. As you can see from the line at the top right, the price is unchanged From June 22.

Monthly data points fluctuate quite a bit, but on balance prices aren’t going anywhere. In fact, PPI is Under 0.2% since June 2022.

Do you want more? Prices of raw goods for intermediate demand (another subset) PPI) has plummeted 31% since June ’22.

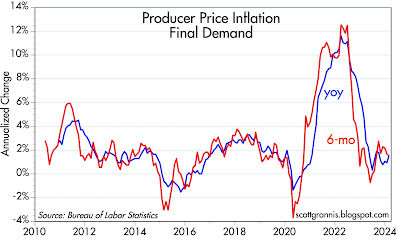

Chart #2

Chart #2 shows 6 months. Year-on-year and year-over-year change in PPI final demand version – the version given to the market at will on Thursday morning.

What do we see? The year-over-year change in this measure of inflation is 1.55% and has been less than 2% since April ’23.

Producer-level inflation has not been a concern for several months. In fact, he is dead.

If Federal Reserve experts have any understanding, they will realize that there is nothing in Thursday’s news that would argue against a rate cut in the near term.

original post

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.