Injective ($INJ): Blockchain built for finance?

Injective ($INJ) aims to create a financial system that is truly free and inclusive through decentralization. With the fastest blockchain built for finance and plug-and-play Web3 modules, Injective’s ecosystem is reshaping a broken financial system with dApps that are highly interoperable, scalable, and truly decentralized.

Although Injective is a decentralized platform, it moves away from the stereotype definitions of such platforms to bring a new era of DeFi with better functionality. For example, it provides the liquidity that matches that of CEXs. To understand how it achieves this and more, let’s take a more in-depth look into the platform.

Check out our interview with Co-founder and CEO Eric Chen!

Background

Injective was founded in 2018 and incubated by Binance Labs. They are developed by a team with a vast experience in blockchain technology and other closely related technologies. Its Co-founder and CEO, Eric Chen, is a protocol researcher at Investing Capital, while its CTO, Albert Chon, is a software developer at Amazon.

Others include full-stack developers, Solidity developers, and Golang developers. Moreover, the Injective team comprises members experienced in ASIC design and computer science.

Apart from the core team members, Injective is supported by notable names in the industry, such as Binance, Pantera, Jump and Mark Cuban.

What is Injective?

Injective brings the features of centralized exchanges onto DEXs. The network brings speed, security, and liquidity into DEXs unlike most of the top projects at the moment, and thus, aiding DeFi adoption. The system achieves this through a layered design and the employment of various technological advancements.

3 Main Features of Injective

Inter-chain Trading

By interfacing with other blockchain-based networks, Injective can support many trading pairs. Consequently, traders can choose between trading pairs considering their profit margin. Ethereum, INJ, MKR, and DAI are the cryptocurrencies tradable on the Injective platform.

A Combination of DeFi and Derivatives

Injective has its eyes set on the DeFi space. For this reason, it includes features that enable the interaction between DeFi networks and the digital currency derivatives space, which culminates with an innovative trading offering.

Distributed Futures and Margin Trading

This is among the differentiating factors in the Injective ecosystem. It allows traders to trade futures and derivatives while enjoying the fruits of decentralization.

What’s in it for Users?

Through its features, it is evident that the platform is focused on end-users. Among the immediate benefits are security, low entry barrier, flexibility, convenience, speed, trust, and liquidity.

5 Primary Layers of Injective

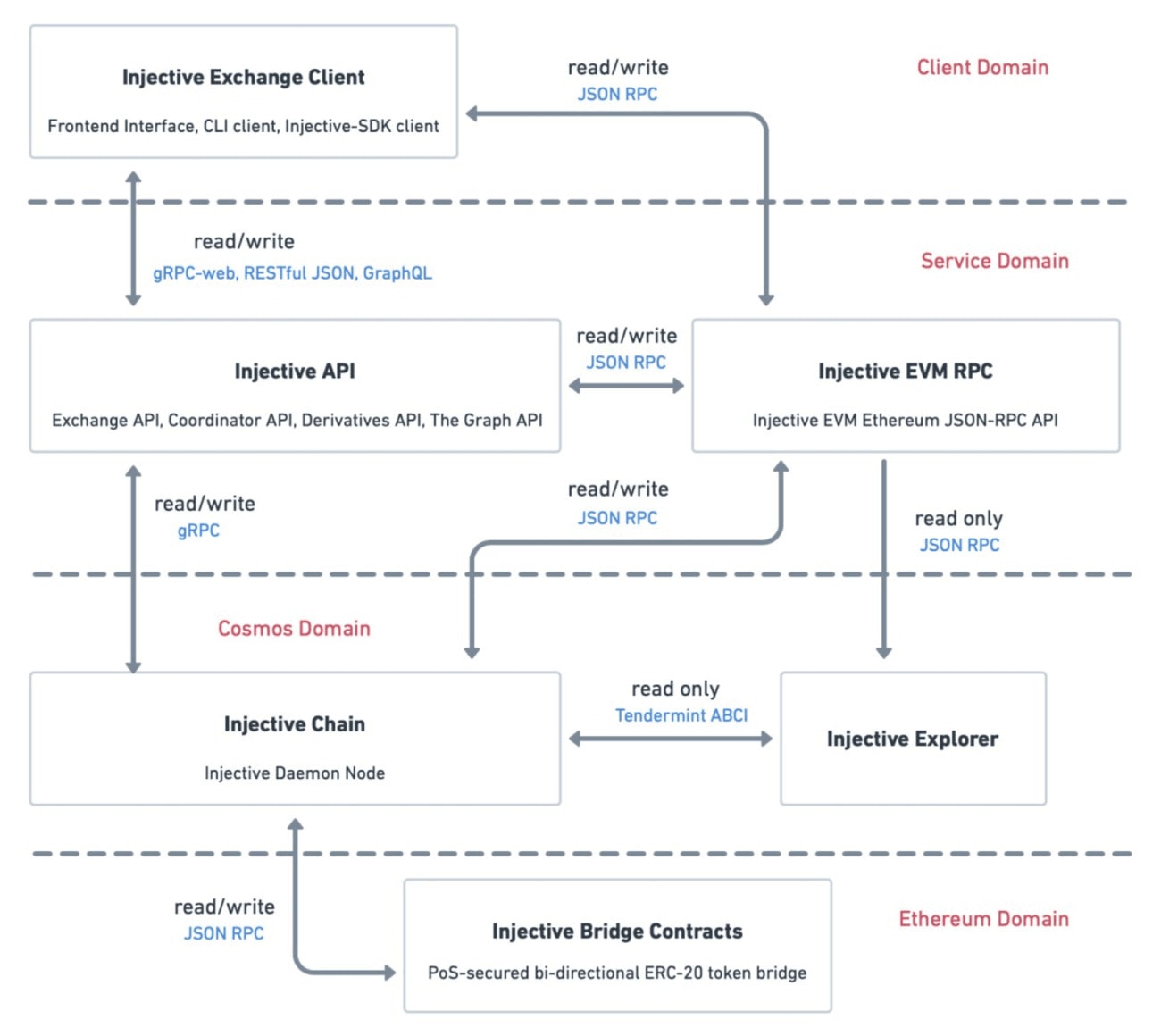

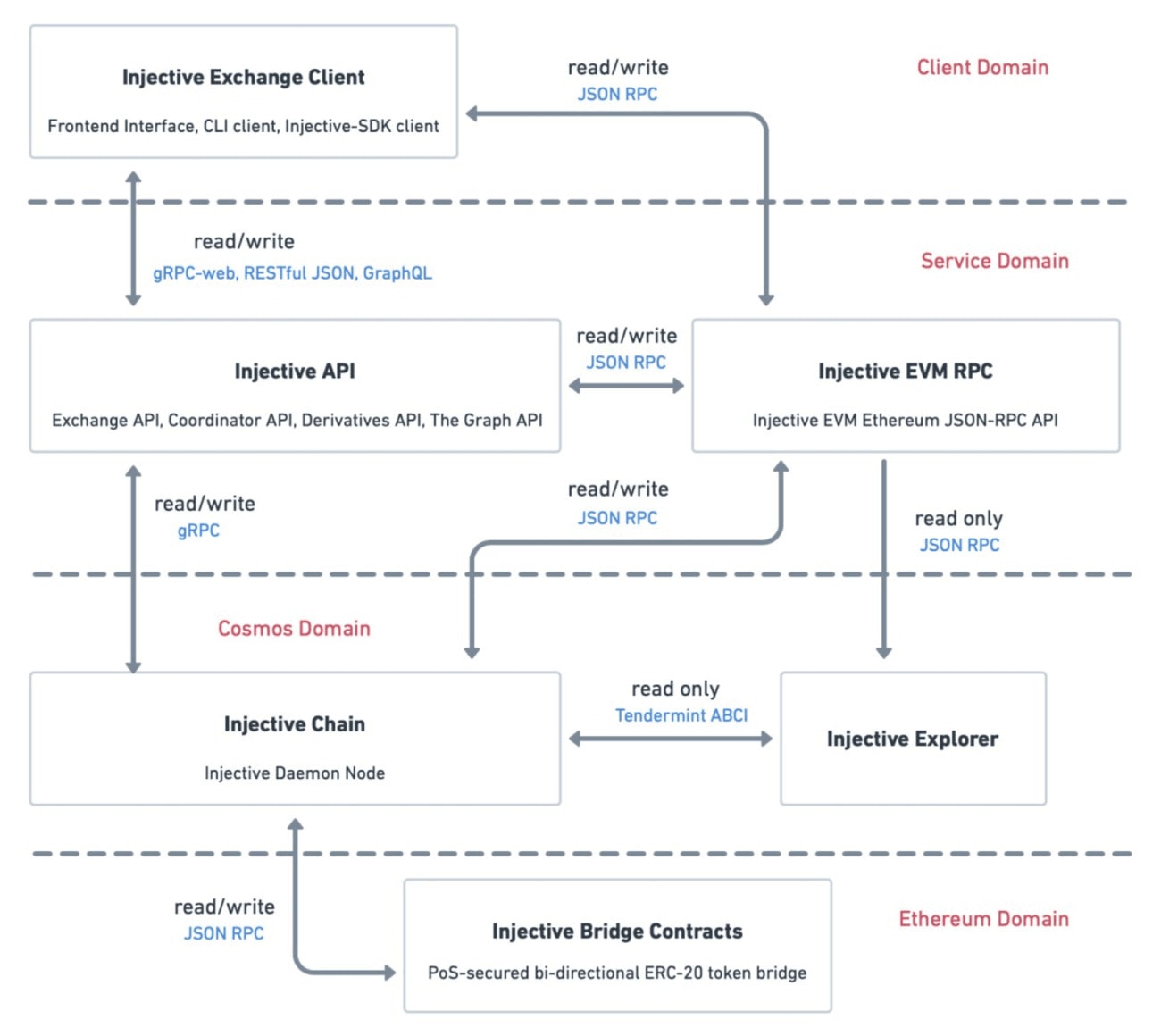

The 5 primary layers of Injective are interlinked. Below is its technical architecture.

Let’s take a look at each of the layers in detail.

Injective Chain

The Injective chain forms the network’s core and powers decentralized trading. However, instead of being a full chain per se, it is actually a sidechain that is connected to the Ethereum blockchain. Notably, Ethereum is the home of the vast majority of the DeFi platforms.

Moreover, the chain, through a connection to the Cosmos IBC, provides cross-chain functionalities. This layer acts as a derivatives platform and holds the exchange’s distributed order book.

In addition, the Injective chain comprises a system that coordinates the platform’s trades, an execution space for the Ethereum virtual machine (EVM), and a bridge that makes it easier to interact with Ethereum-based tokens on Injective. Note that EVM handles the execution of smart contracts allowing for the creation of decentralized applications (Dapps).

Other features domiciled in the Injective chain include, but are not limited to, DEX contracts, derivatives contracts, 0x V3 exchange contracts, and the staking contract.

Exchange Client

The client allows permissionless participation on the network by supporting an open-source front-end. For ease of use, it has a professionally designed graphical user interface that appeals to both novice and experienced users.

API Provider

Application programming interface (API) providers form a key part of the Injective ecosystem by interacting with transactions and acting as a data layer.

An API node can either provide a transaction relay service or be a data layer. As a transaction relay service, it provides mechanisms for users to interact with the system.

On the other hand, API providers acting as a data layer provide data and analytic capabilities to external users.

EVM RPC Provider

This aspect of Injective deals with the interconnection between Injective and Ethereum.

Ethereum Bridge

The bridge provides an interface for exchanging tokens built using the Ethereum standard (ERC-20). Also, it creates a peg-zone where the exchange takes place.

Injective Token (INJ) and its Use Cases

Injective has a native token called INJ. It has a maximum circulating supply of 100 million tokens. Though only around 15.2 million tokens are in circulation, it is projected to increase due to inflation, which happens at roughly 7%. Luckily, the platform has instituted measures to reduce inflation to around 2% over time.

The token was first made available to the public via Binance Launchpad, the exchange’s Initial Exchange Offering (IEO) platform. INJ is currently listed on Binance and on Uniswap.

INJ Token’s Uses on the Injective Platform

- Offering discounts on transaction fees – Traders on the platform are charged less when paying their transaction fees using the network’s native currency.

- Rewarding stakers – Since the platform supports staking, rewards to stakers are paid using INJ.

- Governance rights – Being a decentralized community-focused platform, governance-related issues are decided by the Injective community. However, to participate, members have to hold INJ.

The more the tokens held, the stronger the voice on the governance table since INJ is required when submitting a proposal and when voting.

- Providing passive income – Apart from paying staking rewards in the native token, INJ can be locked in a wallet to attract tips.

- Incentivizing market makers – Market makers or liquidity providers are key roles. Therefore, to attract more liquidity, the platform uses its native token to incentivize liquidity providers.

Injective CosmWasm Upgrade

On 5th July 2022, Injective’s Injective CosmWasm Mainnet upgrade has gone live. As a part of this upgrade, Injective will have, among others, the following updates:

- Smart contract support with CosmWasm;

- Automatic smart contract execution;

- Support for negative maker fees; and

- Support for binary options markets.

Smart Contract Support with CosmWasm

As a result of the latest upgrade, Injective now supports smart contracts by CosmWasm. The name “CosmWasm” comes from the combination of 2 things- Cosmos, and WebAssembly. CosmWasm is a smart contract platform built for the Cosmos ecosystem, its unique feature is that it allows developers to build multi-chain smart contracts using the InterBlockchain Communication (IBC) Protocol. Furthermore, this update will allow developers to build applications on Injective whilst at the same time making use of the existing core modules provided by Injective. For example, developers can use Injective’s decentralized order book module to create other decentralized apps (dApps) such as exchanges, prediction markets, lending protocols etc.

Automatic Smart Contract Execution

The latest mainnet upgrade also allows smart contracts to be executed automatically at every block. This is unique because generally, smart contracts require an external agent such as a user to manually invoke the contract and trigger the logic associated with the contract. Now, with the CosmWasm platform, smart contracts can be triggered individually and block by block, meaning that developers can create truly decentralized and permissionless applications.

Negative Maker Fees

In cryptocurrency trading, exchanges usually charge trading fees on a maker/taker structure, with maker fees being charged when the user places an order that goes onto the order book (whether fully or partially) i.e. “making” the market or providing liquidity.

Injective charging negative maker fees mean that instead of users paying, users will receive a percentage of their trade as a rebate. The community will be invited to submit governance proposals for which trading markets they would like to implement negative maker fees, so the decision is left in the community’s hands.

The overall benefit to the Injective community would be that it would encourage more users, thereby increasing liquidity for more orders and trading options.

Binary Options Support

Binary options are a type of financial contract, where there are 2 options based upon the outcome of an underlying asset or question. And when the correct answer occurs, there will be a payoff. Having binary options support on Injective means that new and diverse types of apps can be built on the platform, for example, those involving prediction markets.

What is the Injective Volan upgrade?

December 2023 is set to be an exciting time for Injective as it is set to release its Volan upgrade. This upgrade is expected to be the largest mainnet update in the project’s history. The Volan upgrade comes as the result of months of research and development and will involve a hard fork of the Injective network. Here are some key features that will be introduced in the Volan upgrade:

- Sub-second block times: Injective will achieve near-instant finality with sub-second block times, enabling fast and seamless transactions for users and developers. This will also reduce the risk of front-running and MEV attacks, which are prevalent on other blockchains.

- IBC integration: Injective will become fully interoperable with the Cosmos ecosystem and other IBC-enabled chains, allowing users to transfer assets and data across different networks. This will open up new possibilities for cross-chain composability and innovation, as well as access to a vast pool of liquidity and users.

- CosmWasm and EVM smart contracts:Injective will support CosmWasm, a smart contract framework for the Cosmos ecosystem that allows developers to write smart contracts in any programming language that compiles to WebAssembly. Injective will also maintain its compatibility with the Ethereum Virtual Machine (EVM), allowing developers to deploy existing Ethereum smart contracts on Injective with minimal changes. This will enable developers to create diverse and complex applications on Injective, such as decentralized exchanges, lending protocols, prediction markets, NFT platforms, and more.

Conclusion

By providing the required liquidity to power an active trading experience on a decentralized platform, Injective can siphon users from CEXs to DEXs. Consequently, cryptocurrency users and traders are hedged away from potential risks.

In addition, enabling cross-chain interaction opens the platform to DeFi enthusiasts. Additionally, providing support for ERC-20 tokens increases interaction with DeFi tokens and protocols.

Decentralised Finance (DeFi) series: tutorials, guides and more

With content for both beginners and more advanced users, check out our YouTube DeFi series containing tutorials on the ESSENTIAL TOOLS you need for trading in the DeFi space e.g. MetaMask and Uniswap. As well as a deep dive into popular DeFi topics such as decentralized exchanges, borrowing-lending platforms and NFT marketplaces

The DeFi series on this website also covers topics not explored on YouTube. For an introduction on what is DeFi, check out Decentralized Finance (DeFi) Overview: A guide to the HOTTEST trend in cryptocurrency

Tutorials and guides for the ESSENTIAL DEFI TOOLS:

More videos and articles are coming soon as part of our DeFi series, so be sure to SUBSCRIBE to our Youtube channel so you can be notified as soon as they come out!

Disclaimer: Cryptocurrency trading involves significant risks and may result in the loss of your capital. You should carefully consider whether trading cryptocurrencies is right for you in light of your financial condition and ability to bear financial risks. Cryptocurrency prices are highly volatile and can fluctuate widely in a short period of time. As such, trading cryptocurrencies may not be suitable for everyone. Additionally, storing cryptocurrencies on a centralized exchange carries inherent risks, including the potential for loss due to hacking, exchange collapse, or other security breaches. We strongly advise that you seek independent professional advice before engaging in any cryptocurrency trading activities and carefully consider the security measures in place when choosing or storing your cryptocurrencies on a cryptocurrency exchange.