Intermediate-term participation levels are highly overbought and long-term weak | decision point

when we discuss Participation We are referring to a more specific and accurate assessment of the available breadth through the Golden Cross and Silver Cross indices. The famous and widely known Golden Cross is when the 50-day moving average of a price index crosses the 200-day moving average, indicating a transition from long-term weakness to long-term strength in the price index. (Note: We use exponential moving averages (EMA).)

Taking this one step further, we developed the Golden Cross Index, which represents the percentage of stocks in a particular index that have a Golden Cross. The chart below shows ETFs for the S&P 500 Large-Cap, S&P 400 Mid-Cap, and S&P 600 Small-Cap indices and their respective Golden Cross Indexes (GCI). The GCIs are all well above the bull market level of 50%, but well below the 2021 bull market level of 90% despite price indexes being at or near all-time highs. While this may continue to improve, it should be taken as a negative sign that long-term engagement is too low.

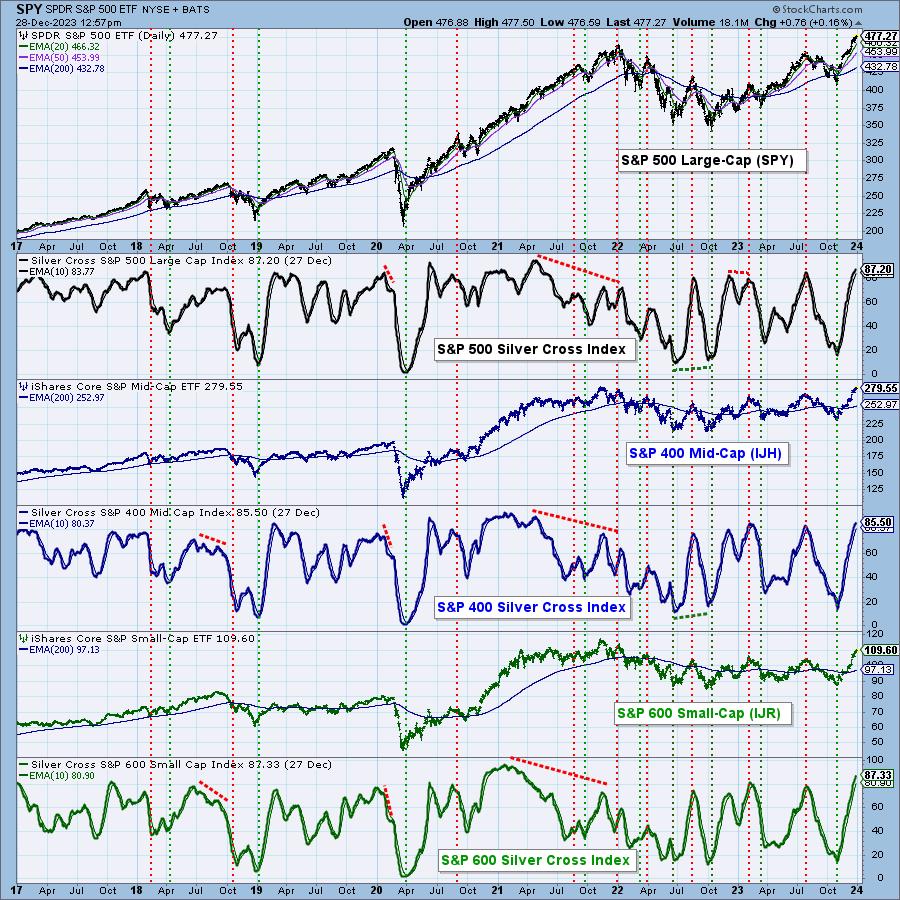

Because it is a long-term indicator, GCI’s slower, more cautious pace does not apply well to shorter time frames. To help with this, we developed the Silver Cross Index (SCI), which is the percentage of stocks in a particular index whose 20-day moving average exceeds its 50-day moving average (known as a silver cross). SCI shows medium-term levels of engagement.

Below is a chart showing the three S&P indices and their respective SCIs. We see that all SCIs are in the mid to high 80s, which is near the upper end of their range and overbought levels for the past three years. Typically, SCI does not stay at these levels and is expected to decline soon. You can see that prices don’t always follow SCI, but it’s dangerous to assume otherwise.

conclusion: In the long term, participation is weak and in the medium term it is overbought. We believe the market is vulnerable to a correction.

Learn more about DecisionPoint.com:

Watch the latest episodes decision point On StockCharts TV’s YouTube channel here!

Try it for 2 weeks with a trial subscription!

Use coupon code DPTRIAL2 at checkout!

Technical analysis is a windbreaker, not a crystal ball. –Carl Swenlin

(c) Copyright 2023 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. You should not use any of our ideas and strategies without first evaluating your personal and financial situation or consulting a financial professional. All opinions expressed herein are solely those of the author and do not in any way represent the views or opinions of any other person or entity.

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletter, blog or website materials should not be construed as a recommendation or solicitation to buy or sell any security or to take any particular action.

Useful DecisionPoint links:

DecisionPoint Alert Chart List

DecisionPoint Golden Cross/Silver Cross Index Chart List

DecisionPoint Sector Chart List

DecisionPoint Chart Gallery

trend model

Price Momentum Oscillator (PMO)

balance volume

Swenlin Trading Oscillators (STO-B and STO-V)

ITBM and ITVM

SCTR Ranking

Bear market rules

Carl Swenlin is a veteran technology analyst who has been actively involved in market analysis since 1981. A pioneer in creating online technical resources, he was the president and founder of DecisionPoint.com, one of the leading market timing and technical analysis websites. knitting. DecisionPoint specializes in creating stock market indicators and charts. Since DecisionPoint merged with StockCharts.com in 2013, Carl has been a consulting technology analyst and blog contributor. Learn more