Introduction to Basic DAX Trading – Crash Course – Trading Strategies – December 18, 2023

The German DAX index is traded at the institutional level through the Frankfurt Stock Exchange (XETRA) and consists of 40 major blue-chip companies in Germany. important! The entire article only refers to the DAX chart (symbols). DE40 in Trading View) and all time references are CE(S)T Time. Therefore, no matter where you live, you should set your chart time to Central European Time or the equivalent UTC time. Or better yet, just Use Berlin time on Trading View.

DAX can be traded as a futures contract via: FDAX (€25/person), FDXM (Mini DAX, €5/p) or FDXS (micro-DAX, €1/p) or as CFDs at most brokers (symbols DE30, DE40 or GER40).

institutional daily life

Few people talk about trading. hour at institutional perspective. We hear all kinds of fancy things about time and the associated key price levels, but very few people tell us the ‘why’ of timing the markets properly as a day trader. What you need to learn first is when hunting for deals when it doesn’t to. Some time intervals are much more likely to provide trade setups and actual movement than others. Of course, time is not the only factor to consider, but it is the first factor. Moreover, there are certain dates where the likelihood of a clean setup and smooth price action is usually much lower. However, this is beyond the scope of this basic course. Based on the DAX Index Institution’s trading schedule and years of development experience focused solely on this product, the following results can be drawn: roadmap Tips on when to look for trades and when to expect the possibility of a lower move. Let’s analyze the daily life of institutions trading the DAX index. And this is not just from my head, it is public data from the XETRA website. But few people know where to look or what to look for.

What is auction?

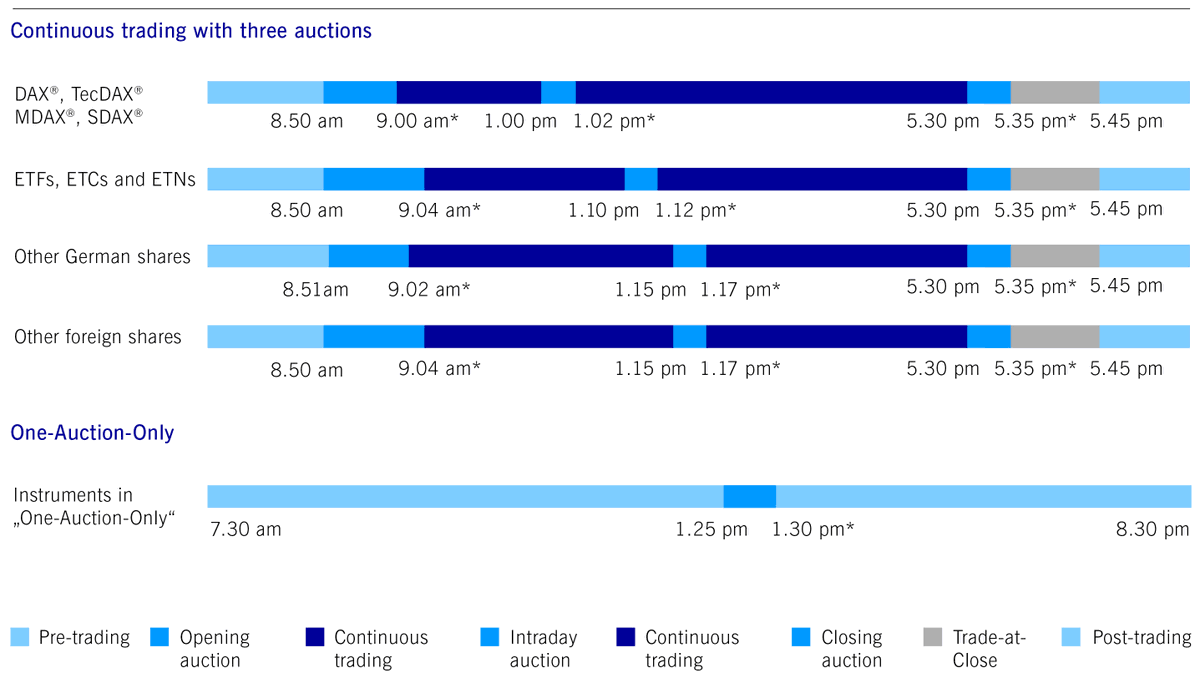

Officially, the daily trading method on XETRA is called “continuous trading through auction”. Auctions are small, well-defined time windows in which institutional traders and investors place or match orders to buy or sell DAX on the T7 trading platform. These orders can be market, limit, stop types, and other advanced types that are not very relevant to what we briefly discuss here.

These auctions are conducted electronically/algorithmically and their primary purpose is to concentrate liquidity and enable the submission of large institutional orders. This is when investment funds, pension funds, banks or other large traders focus their orders. And this is important to us too.

Times outside of this short window of time during the day are called continuous trading or regular trading hours. Now let’s briefly talk about the three daily auctions.

If you would like to try the automated DAX SPECIALIST PRO EA, you can find it here.

When is the auction time?

8:50 – 9:00 CE(S)T – Opening Auction – This auction uses an algorithmic process to determine the opening price for the day. London opening time is 9:00 CE(S)T.

13:00 – 13:02 CE(S)T – Intraday Auction (IDA) – A midday auction introduced in recent years to allow new time windows for institutions to inject liquidity into the market. This auction will also end with an algorithmic procedure lasting between 13:02:00 and 13:02:30 CE(S)T.

17:30 – 17:35 CE(S)T – Auction Close – This auction uses an algorithmic process to determine the closing/settlement price for the day. The daily settlement price is derived from the VWAP of all trade prices executed at the last moment before 17:30 CET and is the reference price for institutions to calculate short- and medium-term portfolio returns/unrealized profits/losses. .

17:35 – 17:45 CE(S)T – Trading phase at close – Immediately after the close auction, institutional traders can place their last orders of the day based on the close price.

credits

You can also trade in the pre-trade stage before 9 o’clock, but I prefer not to do that. Even after 17:45 DAX is traded in the post-trade phase until 22:00 CE(S)T, but this is not relevant to me.

important! My own analysis shows that I treat the closing auction and trading at closing phase as a single phase between 17:30 – 17:45 CE(S)T.

important! Here you can see the daily settlement price for the previous day (select the correct date and see D. Settlement in the first row).

So this is how you can properly display the actually relevant levels/zones on your chart based on institutional time and institutional price values.

The bottom line is that you need to include both PRICE and TIME in your trading strategy. One is irrelevant without the other.

Also, please believe that day trading is not everyday trading. Be very selective with your settings. You don’t need more than 4-6 trades per month to be consistently profitable.

now…

Of course, we have not covered all the details about DAX’s auctions, auction types, institutional order types, specific scenarios or corner cases, etc. It is difficult to include such extensive information in one post.

However, if you liked this mini-course and would like to dive deeper into the world of DAX trading and create more educational threads 100% free, feel free to post your DAX analysis or some of my trades and like and comment on this post. I know I have your support going forward.

If you would like to try the automated DAX SPECIALIST PRO EA, you can find it here.