Investment Strategy Innovation: Discover three game change rules | Chart watch

key

Takeout

- It is important to set some investment rules before investing in stocks or ETFs.

- Basic principles, such as knowing the long -term trend of security, and watching the short -term trend, simplify the investment process.

- If you have training to comply with the rules, you will be a smarter investor.

“Trend is your friend. Until you finish until you bend.”

“Trend is your friend. Until you finish until you bend.”

How often did you hear this proverb? How more important do you follow it?

The next stock that follows the next stock can be tempted to send a letter to high flight AI stocks, popular memes, or next hot IPO. If you are lucky, the price will move advantageously, you rejoice, and you will throw a party. Alas, the story doesn’t always end in this way. The stock market can protect you. It offers some opportunities, but unexpectedly takes them from you. This is especially true in excessive expanded markets.

Negative news headlines make investors nervous and make irrational decisions. In order not to fall into a trap of buying and selling stocks at the wrong time, take a wise approach and set some basic rules to follow.

Rule 1: Determine the long -term trend of the market

You want to trade in the direction of the long -term trend. It is sold when the trend is bent and down when the trend rises. When the overall trend decreases, purchasing stocks can be the same as catching a falling knife, and when the trend rises, it can be missing a significant movement. To determine the overall direction of the long -term trend of the stock market S & P 500 ($ SPX), dealing with at least one year ($ SPX).

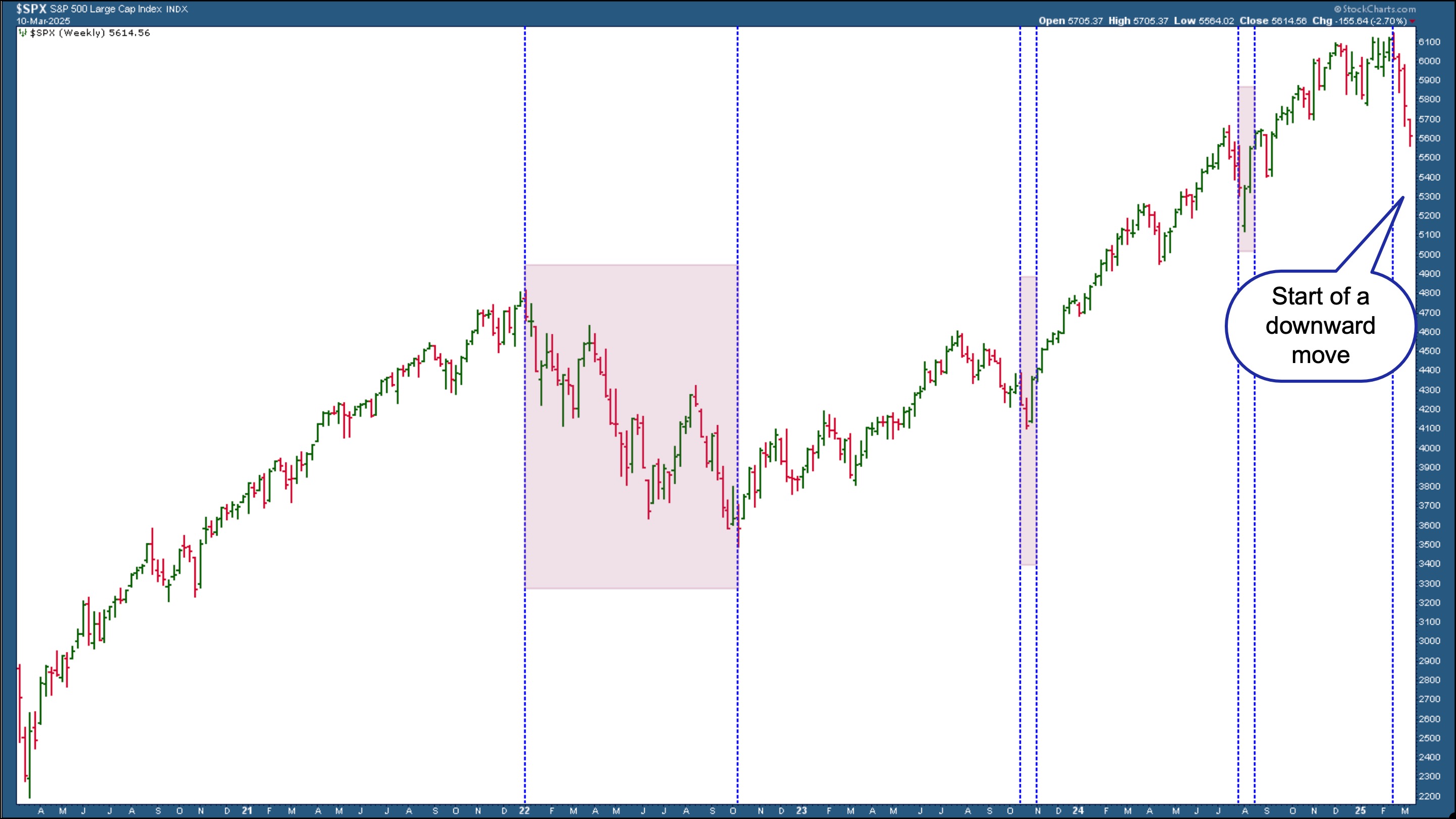

Let’s take a look at the weekly chart of S & P 500 (See below). Overall, this index has tended to be higher in the last five years, but there was a longer and longer paragraph than others (pink shades). The index is now going through a fullback, but we don’t know the size until it ends.

Figure 1. Weekly chart of S & P 500. Overall, the trend of the benchmark was strong and withdrawal, but the optimistic trend was optimistic. The index is undergoing decline.Chart Source: Stockcharts.com. For educational purposes.

From January 2022 to October 2022, the S & P 500 decreased by more than 20%. Many Wall Street analysts were expected to continue, but the S & P 500 recovered, and in 2023, 26.3% profit and 2024 gained 23.31%. There were some small full backs along the road, and some were more prominent than others (from 2023 and July to August 2024).

No one knows what the market will do, but when you see a full back formation (when one seems to be formed), you do not plan to open a long position. If you are not sure that the mayor is withdrawn, look at the Daily Chart of the S & P 500 and see if it matches the trend of the weekly chart. If both have a downward trend or two people are not sorted, they should dig deeper.

Rules 2: Is the market wider or contracted?

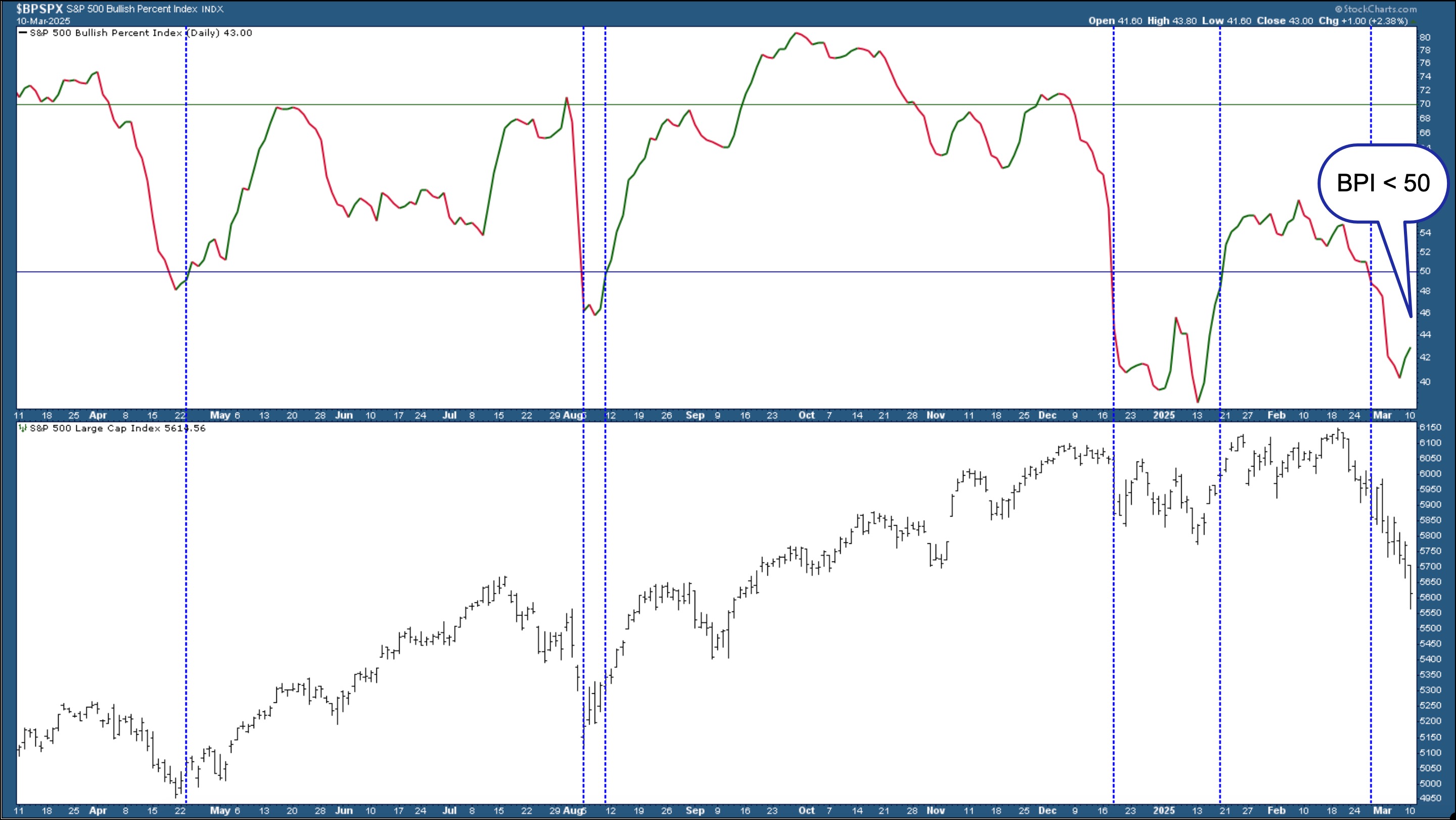

The market width is an effective way to identify the ratio of stocks participating in the rise. Optimistic (BPI) is one of the several indicators that can be used in Stockcharts and can be used for indexes, sectors and industrial groups.

The chart below In the bottom panel, the BPI of the S & P 500 of the top panel ($ bpspx) is displayed for the daily chart of the S & P 500 in the bottom panel. If the BPI is 50%or more, it indicates that there is a edge of the bull. If it is less than 50%, there is a bear’s edge.

Figure. S & P 500. The rise of S & P 500 matches BPI, which is larger than 50. The fall of the S & P 500 is consistent with the S & P 500 BPI of less than 50.Chart Source: Stockcharts.com. For educational purposes.

Last year, the bull also took an advantage in addition to the full back of the S & P 500. If you want to invest in S & P 500 stocks when the bull controls, the first task is to match the strong movement.

Rules 3: Purchased at UP Days, sold to Down Days

In the period between August 9, 2024 and December 18, 2024, we will focus on the period of the BPI, which is larger than 50, and checks the hollow candlestick chart. To Apple, Inc. (AAPL), one of the top cap weighted stocks of S & P 500.

Figure 3. Daily chart of apple stocks. The stock price is higher from August 9 to December 18, 2024, which matches the S & P 500 BPI> 50, with a series of hollow green candles on the front and tail of the period.Chart Source: Stockcharts.com. For educational purposes.

The Heavy Candlestick Chart has the advantage of visually interesting and quickly identifying trends. The upward movement began a few days before August 9, when there was a significant difference in the price of AAPL. Although it was a low day, the bar was empty, which means that it was higher than the opening.

Looking at all three charts, August 9th presented an appropriate purchase signal. It matched the long -term trends of strong BPI and daytime and daily charts.

If you opened a long place, you were able to end your position when the BPI turned on December 18 and made a decent return. It was possible to keep it for a few days, but the stock was sold quickly, so the exit depends on how well the order is filled.

Nevertheless, you must terminate the position during a series of downs that started on December 27. If you haven’t closed your status and still hold onto it, you would have been caught in a downward spiral that started when the S & P 500 BPI fell below 50 on February 27.

Stockcharts tip

Stockcharts tip

The hollow candlestick chart is different from the traditional filled candlestick chart. To apply the hollow candle chart, click the hollow candle button under the chart properties..

conclusion

Considering the irregular characteristics of the stock market, especially excessively expanded, the wise approach to investment is necessary according to a series of rules. There is no need to be complicated.

It is a simple approach to identify the long -term trend, check the market width, and adjust the trend of stocks to be purchased with the entire market, but it is necessary to practice successfully in real time. Practice to apply the rules using the simulated account. There is no better teacher than you.

disclaimer: This blog is used only for educational purposes and should not be interpreted as fiscal advice. You should not use ideas and strategies without evaluating your personal and financial situations first or consulting financial experts.