Investors await CPI and bank earnings: Will this spark investor optimism? | chart watcher

key

gist

- Broader stock market indices are seeing a lot of choppy activity.

- December CPI and bank earnings are confirmed and could move markets.

- The banking sector, which is sensitive to interest rates, is affected by CPI and bank performance.

The producer price index (PPI) in December was lower than expected as stocks rose early in trading but then rebounded after selling.

The producer price index (PPI) in December was lower than expected as stocks rose early in trading but then rebounded after selling.

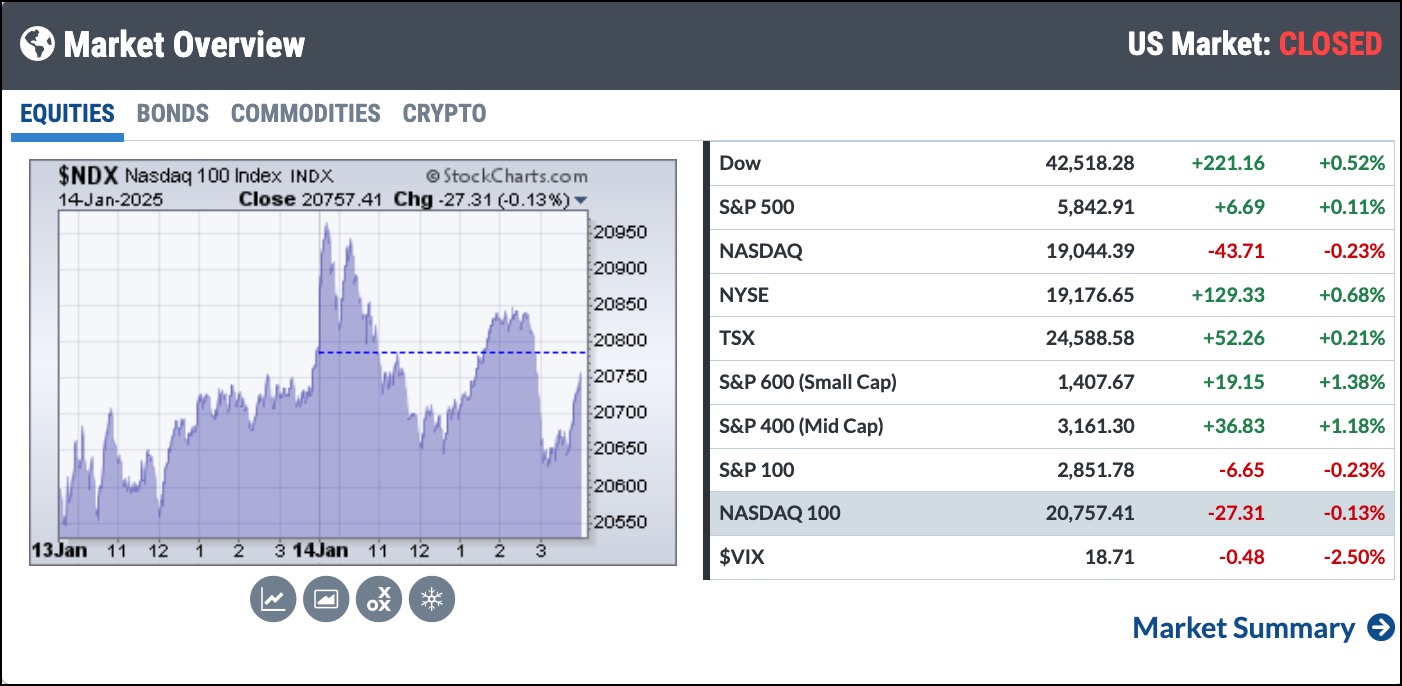

that Dow Jones Industrial Average ($indu), S&P 500 ($SPX), S&P 400 Mid Cap Index ($MID) and S&P 600 Small Cap Index ($SML) closed higher. that Nasdaq Composite ($COMPQ) and Nasdaq 100 Index ($NDX) closed lower. There are concerns that the stock market is overheating.

Will Wednesday’s December CPI and bank results stimulate markets and make investors more optimistic? Let’s dive in.

Figure 1. Stock chart market overview panel. In this panel you can see the big picture of the entire stock market. Image source: StockCharts.com. For educational purposes.

Explore markets by sector

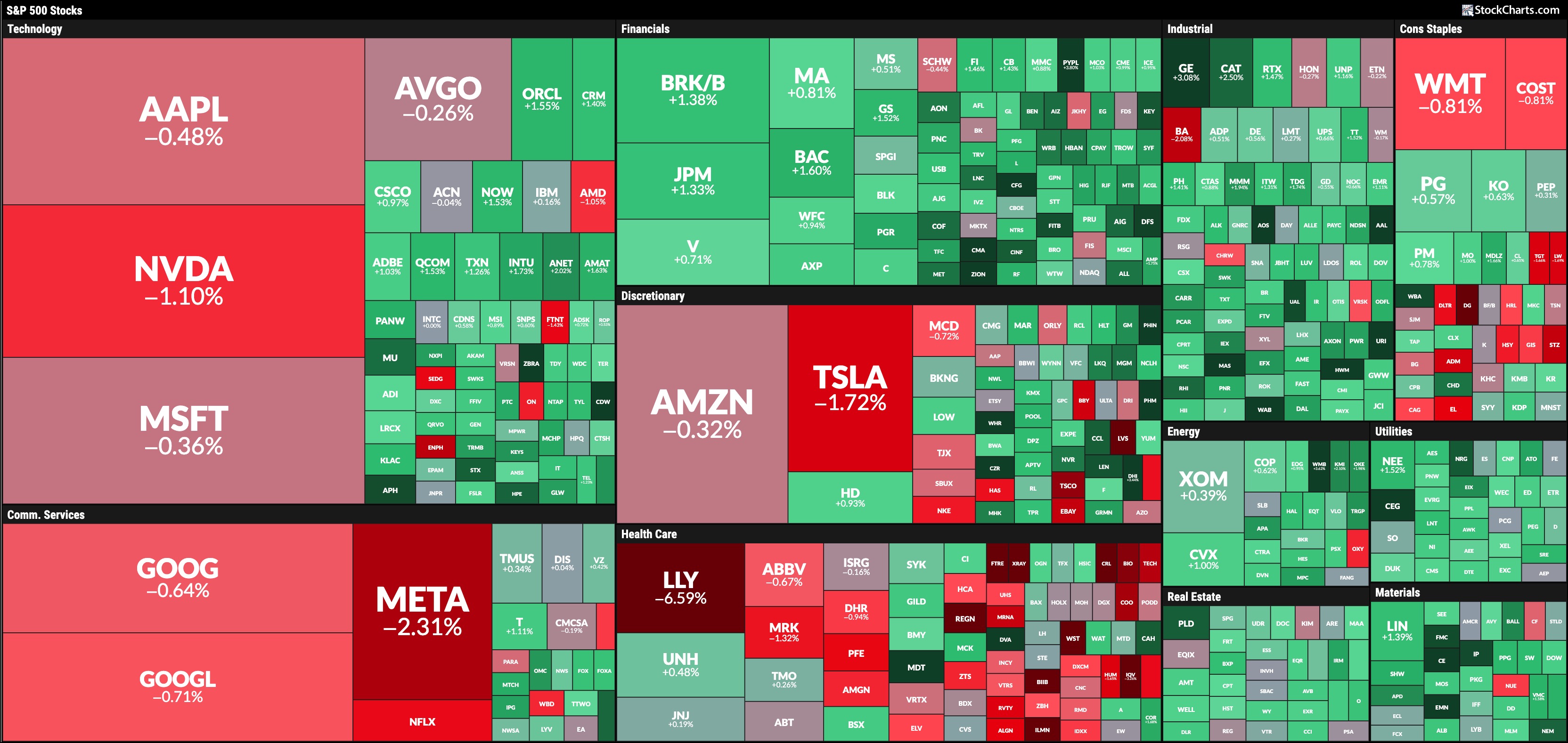

Utilities, Financials, Materials and Industrials were the best performing sectors, followed by Energy and Real Estate. The StockCharts market carpet below shows Tuesday’s stock market performance at a glance.

Figure 2. STOCKCHARTS MARKETCARPET for Tuesday, January 14. Utilities, Financials, and Industrials were the top three performing sectors.Image source: StockCharts.com. For educational purposes.

Although the technology sector was not the worst performing sector (up 0.26%), its largest market capitalization stocks were in the red. This was a similar scenario in the communications services and consumer discretionary sectors.

The Healthcare sector was the worst performer on Tuesday, led by Eli Lilly’s loss of 6.59%.

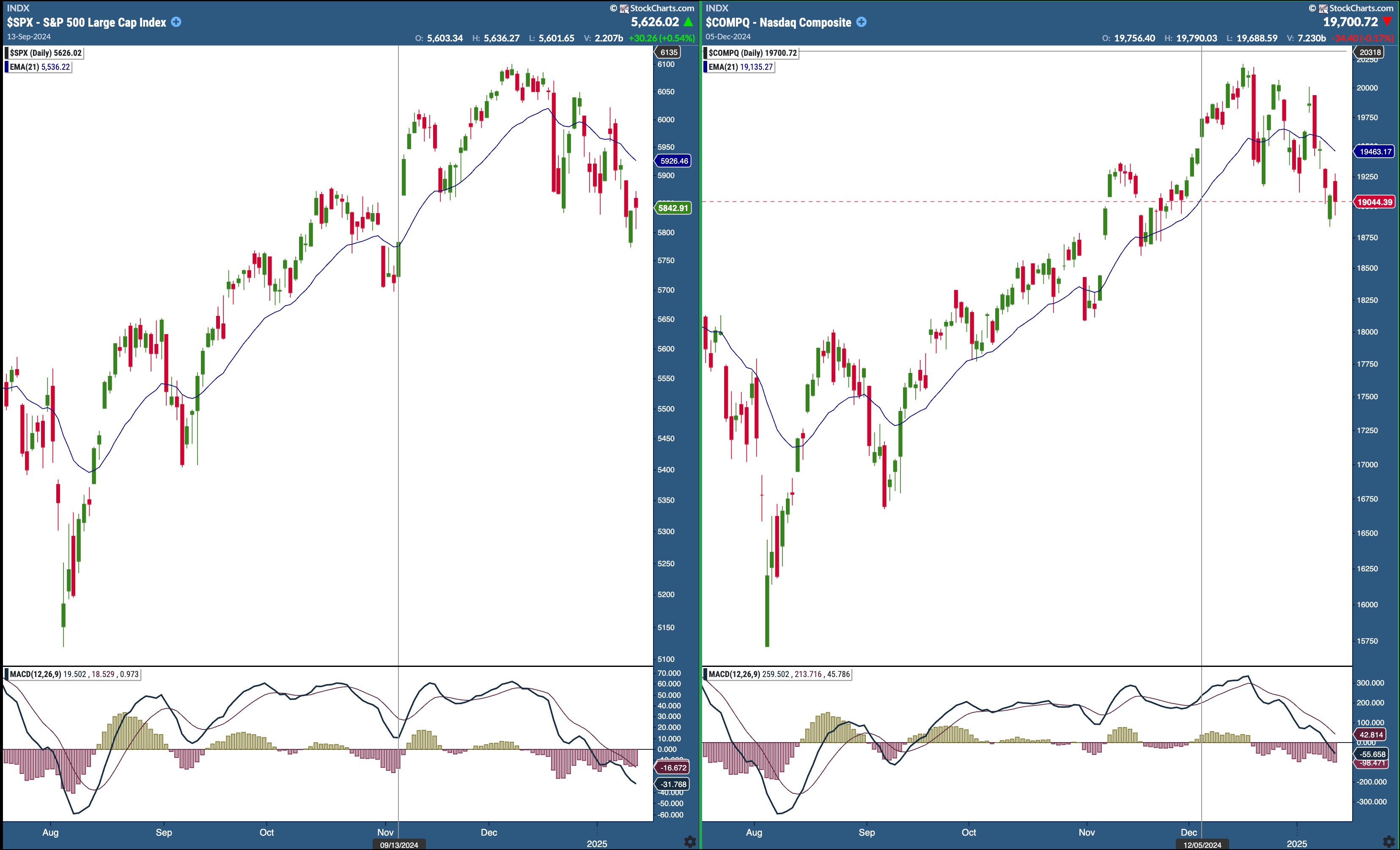

Stock indexes are plummeting. More upward movement is needed to confirm further strength.

The S&P 500 and Nasdaq are trading below their 21-day exponential moving average (EMA) and are trending downward. The moving average convergence/divergence (MACD) of both indices is decreasing (see chart below).

Figure 3. S&P 500 Index and NASDAQ Composite Index. To confirm a reversal, the 21-day EMA and MACD must reverse and rise.Chart source: StockChartsACP. For educational purposes.

To confirm a reversal, the MACD line must turn upward and cross above the signal line. As of Tuesday’s close, the stock market can move on a dime, although it appears it will be a while before that happens.

All attention is focused on the bank

The December consumer price index (CPI) is expected to be released on Wednesday, but investors will be keeping their eyes and ears on bank performance. Citigroup (aspirate), JP Morgan Chase (JPM), wells fargo (WFC) and Goldman Sachs Group (GS) woke up first. Bank earnings set the stage for earnings season, and strong reports from big banks could spark investor optimism that the stock market desperately needs. However, banks are an interest rate-sensitive industry, and if CPI is higher than expected, performance may slow down. A rollback of interest rate cuts this year is the most important issue on investors’ minds.

that SPDR S&P Bank ETF (KBE) is trading just below the 21-day EMA and the S&P Financial Sector Bullish Percent Index (BPI) is at 44.44 (see chart below). This is still not optimistic. It should move above 50 and the EMA should rise.

Figure 4. Daily chart of SPDR S&P BANK ETF. Things haven’t looked rosy for banks since late November. What will it take to shake up this interest rate sensitive stock group?Chart source: StockCharts.com. For educational purposes.

conclusion: Higher-than-expected CPI and tepid earnings from banks could push the overall index lower. Investors seem to be a bit nervous, so it’s not surprising to see the broader indices moving sideways. Add to this the possibility of just one interest rate cut in 2025 and the uncertainty surrounding the incoming administration, and you have a situation where inflation numbers need to be low and bank earnings to be spectacularly good to see positive price action. You won’t want to miss Wednesday’s stock market action.

disclaimer: This blog is for educational purposes only and should not be construed as financial advice. You should not use any of our ideas and strategies without first evaluating your personal and financial situation or consulting with a financial professional.

Jayanthi Gopalakrishnan is the Director of Site Content at StockCharts.com. She spends her time creating content strategies, providing content to educate traders and investors, and finding ways to make technical analysis fun. Jayanthi was the Editor-in-Chief of T3 Custom, a content marketing agency for financial brands. Previously, he served as editor-in-chief of Stocks and Commodities Technical Analysis magazine for more than 15 years. Learn more