Investor’s Guide to DeFi

Key Takeaways

- DeFi has high potential returns, but it also has high risks.

- Avoid “yield farming” by continuously moving funds between protocols.

- Instead, invest in the native tokens of protocols you believe will grow.

- Think of DeFi tokens like shares of the companies they represent.

- Invest in what you understand. Try using DeFi services that you have actually used.

- Don’t keep track of too many projects. Follow the 20 slot rule.

- Allocate a small portion of your portfolio (2.5%-10%) to blockchain investments. DeFi includes a smaller part of that.

- Maintain quality DeFi investments for the long term to minimize fees and taxes.

Cryptocurrency investors often participate in decentralized finance (DeFi) with the promise of easy wealth.

They hear about DeFi platforms offering 10,000% APY (no exaggeration). All you have to do is place some cryptocurrency into your digital wallet, connect your wallet to a DeFi website, and press a button.

Alternatively, you can make more money by stacking multiple DeFi protocols like this:

Most DeFi investment strategies are a way to move funds between protocols and platforms. This is called yield farming. It’s about constantly moving tokens wherever they can get the most attention.

Reject this approach.

To use an analogy, imagine that you are constantly moving money between banks, opening and closing savings accounts, and chasing those with the best interest rates every day. You call it “yield farming” and you will be wasting your time.

Most of us don’t have time or money to waste. In ~ Bitcoin Market JournalOur philosophy is to find Long-term investment in cryptocurrency companies that will create long-term value. So instead, find DeFi products that people are using and invest in them.

This guide explains some simple principles of DeFi investing. read.

DeFi Principle 1: Invest in Protocols, Not Platforms

This is counterintuitive. In fact, this is the exact opposite of everything you will hear about DeFi.

Think of buying DeFi tokens like buying company stock.

Buying UNI tokens is different from buying shares of a Uniswap company (since it is a cryptocurrency, there is no Uniswap company). But even if not technically stocks, we can think about them Like stocks. In fact, everyone is already doing it! (Learn more about cryptocurrency and the company here.)

Our approach to DeFi is to avoid yield farming entirely. Avoid “locking” your assets in protocols like Compound or Balancer. Instead, consider investing directly in COMP and BAL.

Rather than investing platformWe are investing in: company.

Putting money in the bank buy a bank.

DeFi Principle 2: Measuring Metrics

The more people who use your product, the more valuable your company becomes.

This is especially true in cryptocurrency. More users = more value.

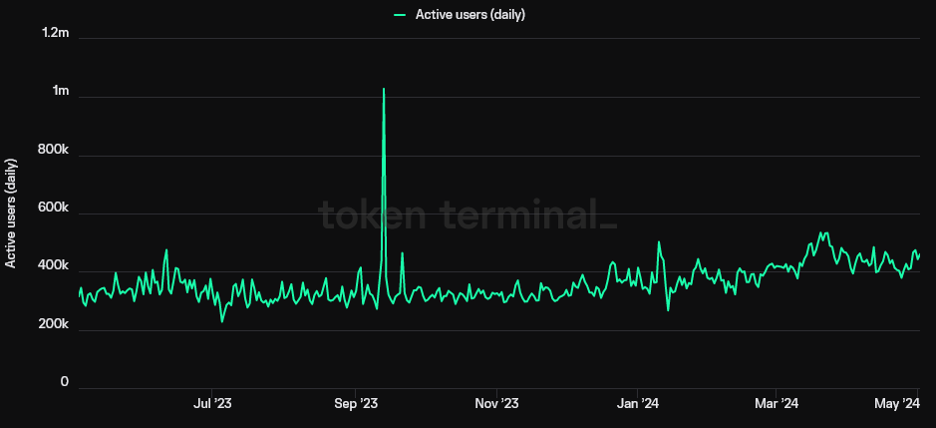

Our standard for investing in any cryptocurrency company is Daily Active Users (DAU). Think of this like a customer at a traditional company.

For cryptocurrency companies, this value is further strengthened because they are built on blockchain and blockchain has network effects. Like network companies (Facebook, Twitter), the more people who participate in a blockchain network, the higher the value of the network.

However, unlike network companies, blockchain users can see it in real time. Real-time user reporting is a cryptocurrency investor’s secret weapon. This is not like investing in Facebook, where you have to wait for quarterly earnings reports when Facebook’s user data is already stale and outdated.

For blockchain projects (at least those on Ethereum, on which most DeFi projects are built), tools like Etherscan.io (raw data) or Token Terminal (user-friendly reports) provide real-time reporting.

We are focusing on the fundamentals, a fundamentally different approach to DeFi. we measure a metric, the mother of all indicators is DAU. (For more information on metrics, see here.)

DeFi Principle 3: Keep It Simple

Warren Buffett is famous for investing in companies he actually understands. That’s why his company often buys “boring” stocks like candy, railroads and furniture.

The world of DeFi is complex, so try to understand it before investing. Can explain the features of Uniswap. This allows you to easily change one blockchain token to another. What’s better is that I’ve used the product and I know it works. (Warren Buffett invested in Dairy Queen because he loved ice cream.)

The principle of keeping it simple also applies to: number of the investments you make. Again, we’re trying to move our money where it can deliver the best results. Don’t chase every project you think might pay off. Remember the 20 slot rule.

Try the product before investing in a cryptocurrency company. Is it easy for the average user to use and understand? Does it solve a real problem? Do you feel trustworthy and safe? If the answer is no, stay away.

(Our Blockchain Investor Scorecard can help you answer these questions, and our premium membership provides 1-5 ratings for all the best DeFi projects.)

KISS: Keep it simple, idiot.

DeFi Principle 4: Piece of the Pie

Our principle is to keep cryptocurrencies as part of the overall investment pie. Between 2.5%-10% of your total investment depending on your risk tolerance.

This means that the majority of investments (over 90%) are in well-diversified stocks and bonds, with only a small portion of the “crazy money” being invested in cryptocurrencies.

DeFi is that.

Let’s say you hold 10% of your total cryptocurrency investments. Think of your DeFi investments as 10% of your total assets. that. In other words, cryptocurrencies are one piece of the pie and DeFi is one piece of the pie. piece of that piece.

for example:

- Most investments (over 90%) are invested in traditional stocks, bonds, and real estate.

- Blockchain investment less than 10%

- Over 50% of blockchain investments in BTC

- Over 25% of blockchain investments in ETH

- The rest of DeFi (if you choose)

if all DeFi market If you suddenly crash and burn, your loss is only 2.5% at most (or 25% of 10%). And if the whole cryptocurrency market Only 10% of the portfolio was lost due to crashes and burns.

As with any investment, decide how much risk you are willing to take. Your stomach will thank you.

DeFi Principle 5: Beware of Fees and Taxes

Fees are a silent killer.

This is expressed as a “gas fee”, which is like a service fee for using the Ethereum network (the platform that runs most DeFi projects). If you buy $1,000 of tokens and pay a $50 fee, you have lost 5%. Swish!

Gas prices are highest when the most people use the network. This is doubly bad. First, you are paying more to perform the same transaction. Second, it’s a big sign that you’re following the crowd.

High Ethereum gas fees are like Uber’s “surge pricing” when everyone leaves a football game. Because you’re competing with everyone else, you end up paying more for the same service. You are literally following the crowd.

It’s easy to ignore fees because many DeFi services don’t express their fees in dollars but in ETH. So your fees are real, but they don’t seem real because they make no reference to your daily life (quick: how many eggs can you buy with .005 ETH?).

Avoid investing when fees are high and avoid FOMO and FUD. And if you hold on to it long term, you can avoid fees and taxes until you sell. (Learn more about fee avoidance.)

Investor Implications

Our approach to DeFi investing is different from the mainstream.

Focus on projects with real users. Invest in tokens. And hold on to it for the long term.

Long-term investments in DeFi are of great benefit to the world as they help build a better financial system. This is the real fun of DeFi.