iRobot and Amazon Deal Face Antipathy from European Commission (NASDAQ:IRBT)

Cyano66/iStock via Getty Images

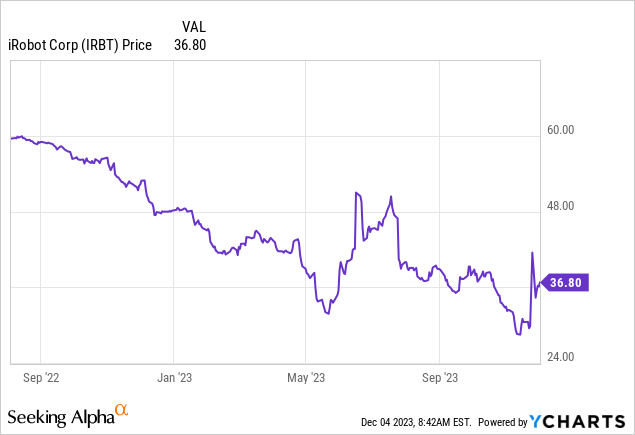

that much iRobot Co., Ltd. (NASDAQ:IRBT) Deal with Amazon.com, Inc. (NASDAQ:AMZN) It was like riding a roller coaster. The company received a second request from the FTC on September 19, 2022. The UK’s CMA approved this. The transaction took place in June 2023. The European Commission in-depth investigation The deal was reduced from $61 to $51.75. The latest drama began when Reuters reported that there would be a deal. Clear unconditionally by the European Commission. Then, a day later, word came out that the European Commission had sent a letter. counter statement To the argument.

If the stock closes at $51.75 at the current price, there is an upside potential of 40.62%. Fellow contributors Chris DeMuth and Andrew Walker briefly discussed the deal on the highly recommended YAVB podcast. One of the things they discussed was a strange transition. One day Reuters reported (via no less than three sources) that a deal had been reached in the EU, and the next day we issued a statement opposing it. Their conversation inspired me to write this article because I agree with them about how unusual it was and have some thoughts on what happened.

We got the impression Wednesday that the situation was such that EC lawyers were recommending a deal go through, with Reuters reporting the change of heart.

The commission’s legal services, unlike antitrust authorities handling the case, did not believe challenges to the deal were warranted, the people said. Without that invoice, the deal would have gone through.

…The lawyers later changed their minds and supported the antitrust agency’s decision to send a complaint outlining their concerns, the sources said, speaking on condition of anonymity and declining to provide confidential details.

I think they expected the lawyers to not see the case and dismiss it. But the boss told me to send a letter of objection anyway. Reuters included the following as a sort of explanation of how a boss can tell a lawyer to send what he likes.

Antitrust officials can override legal services objections by tailoring or narrowing their concerns to gain support, or by appealing to top officials.

The objection narrowed the sale of vacuum cleaners to certain European countries (Spain, France, etc.) and strengthened Amazon’s marketplace by breaking away from the deal.

The EC formulated Amazon’s threat to disrupt other vacuum cleaner sellers as follows (emphasized by the EC):

Amazon is This is an incentive to shut out iRobot’s competitors because it could be economically beneficial. The combined company is likely to gain more from additional sales of iRobot RVC than it loses from reduced sales of iRobot’s competitors and other related products on Amazon. These gains include benefiting from additional data collected from iRobot users.

The argument that Amazon would make more money from additional sales of iRobot RVCs than other manufacturers seems like a weak argument. In an absolute sense, that’s likely true. There is a reason why platform businesses are treated differently by EC and marketplaces (getting phenomenal multiples). Sales by third-party producers require no inventory and the marginal costs associated with these sales are limited. In fact, I think there’s a good argument for Amazon to favor sales from its competitors if it wants to maximize shareholder value (rising stock price).

What’s worse is that favoring a platform’s products is illegal (from my understanding, not a lawyer) under the Digital Markets Act, which came into effect in early 2023. By law you cannot do this transaction.

The EC tried to give more gravitas to the argument by including:

These gains include benefiting from additional data collected from iRobot users.

To me this looks like they are looking for a way to strengthen their legitimacy.

Here’s what stands out about the EC release:

The Commission worked closely with other competition authorities during the initial and in-depth investigation and will continue to do so during the remainder of the in-depth investigation.

This is not unprecedented in EC. This is also true for the Adobe (ADBE) and Figma merger. I don’t recall the deal between Activision and Microsoft (MSFT) being disclosed. I’m not sure what this actually means. Perhaps one of the regulators is the key (or bad cop) to a particular deal, or perhaps the regulators share the burden of research.

In a previous podcast, Chris and Andrew discussed the current U.S. antitrust regime, which can be seen as quite aggressive when it comes to antitrust enforcement. In my opinion, the differences in the probability of a deal crossing the finish line are only marginally different across regimes. This is likely in part because investment bankers and companies are adapting to what will fly under a particular regime. Second, budgets aren’t always that different. Regulators cannot always pursue everything they want.

However, for certain transactions it can make a big difference. I also agree with the assessment offered by Chris that there appears to be a regulatory willingness to harass, intimidate or discourage companies from trading. At every step. This applies before leaving the board and during the merger process. Antitrust regulators appear to be very energetic and cooperative these days. Widening spreads are generally expected to favor merger arbitrage, but this remains to be seen.

Reuters also reported that this case mirrors that of Alphabet (GOOG, GOOGL) acquiring Fitbit. I wrote about that deal here. The market was skeptical that the EC would be liquidated, but it was eventually liquidated. In this case, Alphabet had to agree to limit the use of its customers’ health-related data. This issue is now also included in DMA. The Fitbit transaction was completed before this regulation went into effect. From the Reuters article:

Some of the problems with the Amazon deal are addressed in new tech rules called the Digital Markets Act, which spell out a list of things Big Tech should and shouldn’t do. One person said they were generous in their dealings.

Gatekeepers are subject to stricter laws, so it seems wise not to give them a free pass. Ultimately, the law is expected to have the opposite effect. But I don’t think the regular courts will like it if you actively prohibit trading on a law you specifically enacted.

I get the feeling from the latest developments that the EC’s lawyers want to resolve this issue unconditionally. For some reason (possibly tactical to help negotiate with regulators acting as bad cops here) the bosses interfered and they reluctantly opposed their part of the deal. They were forced into a vulnerable position. I’m not sure they’ll extract much from Amazon this way. The transaction is taking a very long time. This may be because Amazon is not willing to compromise on many issues to get a deal done.

The retail giant paid top dollar for iRobot (even after the recut) and may not want to lose out on all fronts. Once the EC or FTC approves a transaction, it is historically very rare for the other side to ultimately block it. This is why stock prices rose significantly on the news of European liquidation. The objection is terrible news, but I don’t think it’s as bad as the lack of context above.

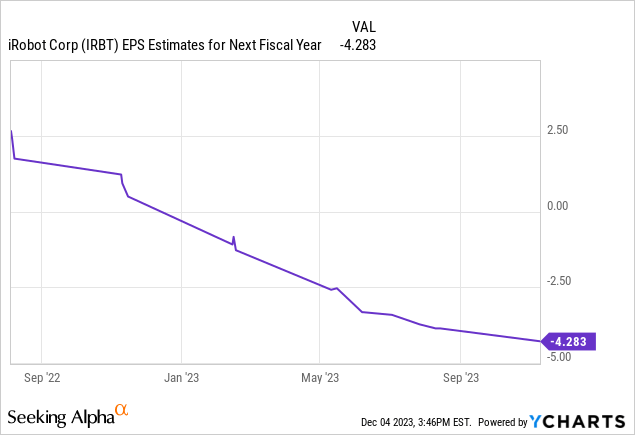

If this deal is terminated or halted, things could be bad. Analysts have consistently revised their estimates downward since the deal.

The company also surprised three quarters with declines, including a huge surprise after hitting one EPS target. This is very bad, as the company tends to beat EPS estimates.

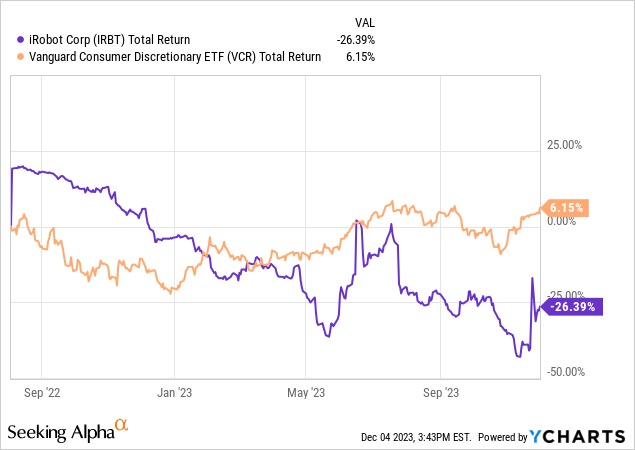

However, the stock is trading as if the merger is highly questionable, so some of that is reflected in the price. Consumer discretionary, represented by the Vanguard Consumer Discretionary Index Fund ETF Shares (VCR), has seen rapid gains.

From the options market, I believe the downside will be in the $20-$28 range. That’s a downside risk of between 24% and 46%. Meanwhile, there is a 40% upside here. Suppose Amazon made a deal with the FTC. Perhaps the EC will also be resolved (given that the counterargument is very weak). Mergers don’t fail often. They are much less likely to fail for regulatory reasons. Not surprisingly, the failure rate after an appeal and/or secondary request is much higher than average.

The merger process has already been underway for over a year. iRobot Corporation is a billion-dollar vacuum cleaner company. I don’t think it will close in December or January. I think the market is underestimating the odds that this will end somewhere after that. Although it’s not my favorite M&A event, I think iRobot Corporation stock is good enough to get some exposure.