Is an Ethereum price crash approaching? Celsius plans to unstake $465 million

Bankrupt cryptocurrency lending company Celsius Network is preparing to unstake approximately $465 million worth of Ethereum (ETH) in an effort to compensate its creditors. This development follows the company’s bankruptcy filing in July 2022, which left creditors waiting 18 months for financial compensation.

Celsius’ decision to unstake a significant amount of ETH is seen as a necessary measure to ensure liquidity to compensate creditors. The company’s official announcement via X (formerly Twitter) highlights the strategic nature of this move.

“In preparation for asset allocation, Chelsea has begun the process of divesting and rebalancing assets to ensure sufficient liquidity. Chelsea will release its existing ETH holdings, which have provided valuable staking reward income to the property, to offset certain costs incurred during the restructuring process. “Significant unstaking activity over the next few days will result in ETH being unlocked and distributed to creditors in a timely manner.” presentation reading.

Celsius is responsible for over 86% of ETH in the exit queue?

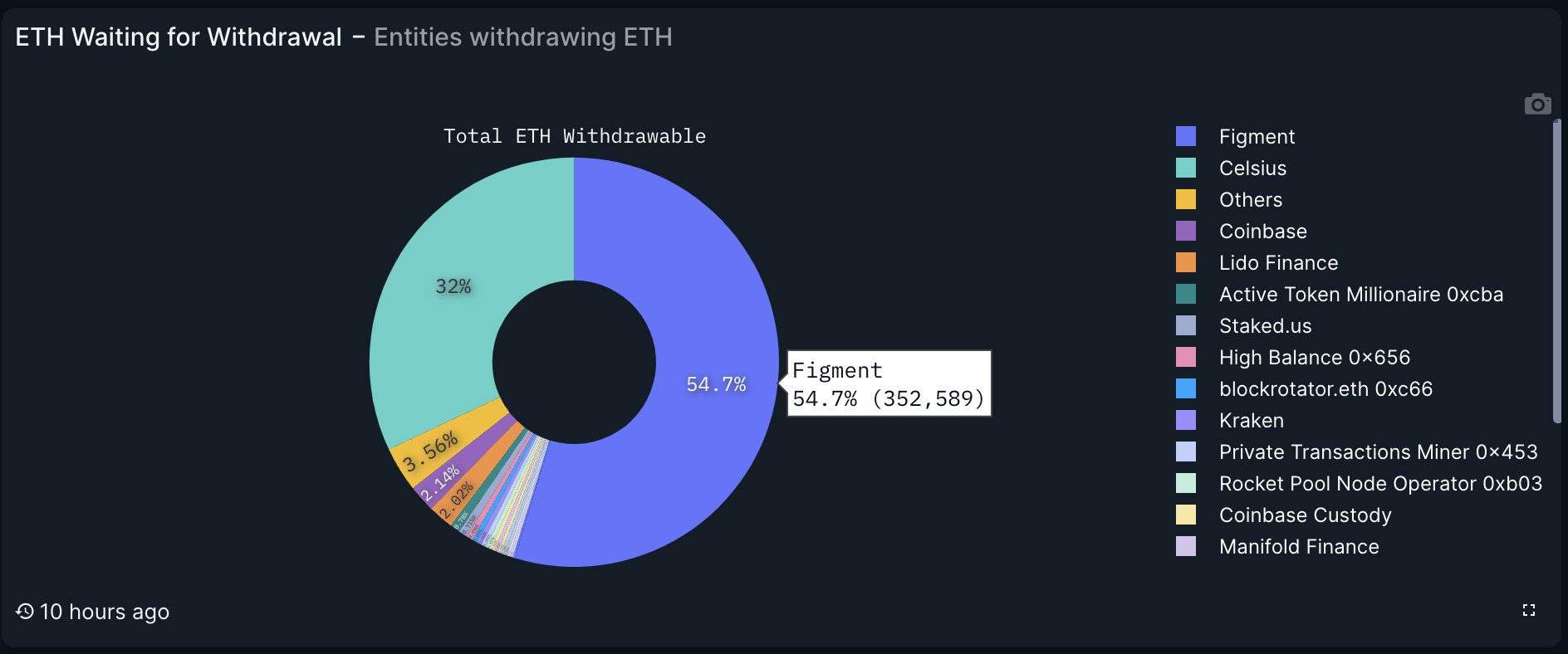

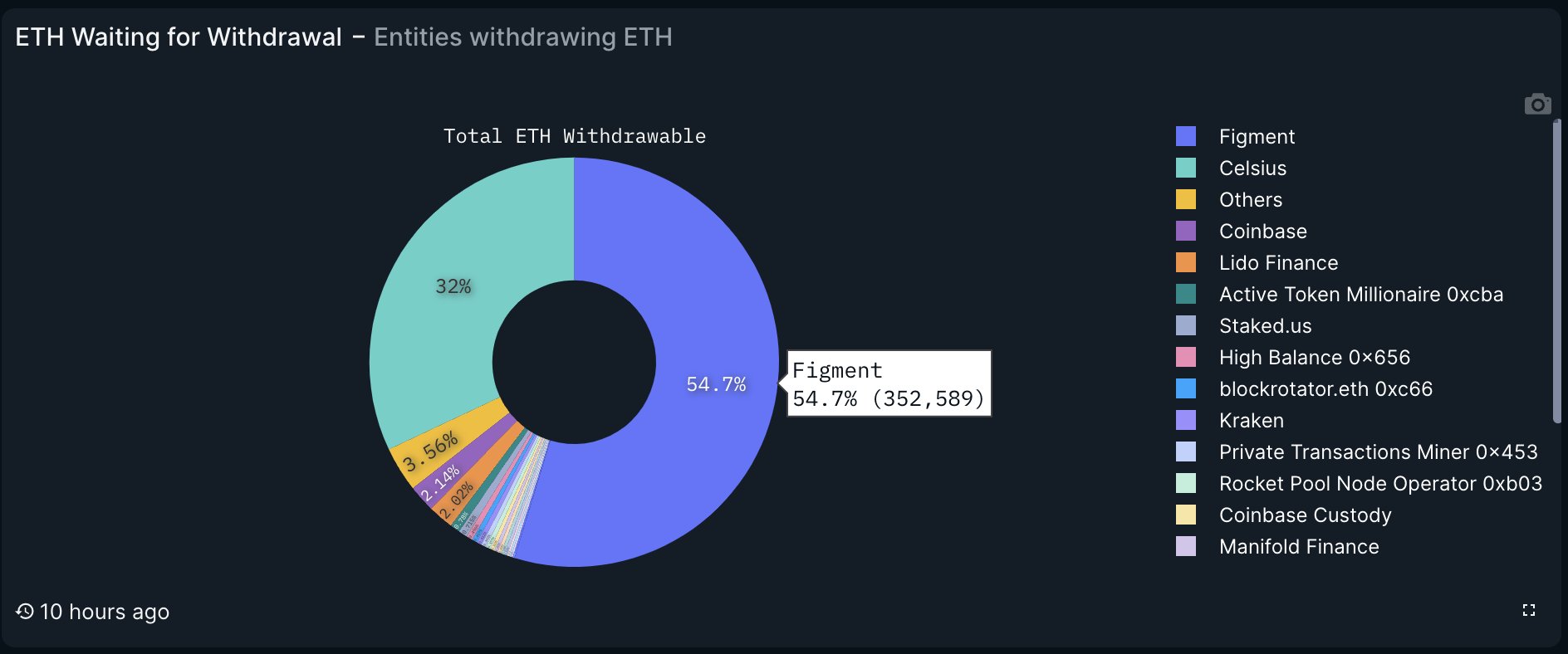

Blockchain analytics firm Nansen revealed that Celsius has about a third of all ETH in its unstaking exit queue, or a total of 206,300 ETH. This figure translates into a market value of approximately $465 million. To date, Chelsea have already withdrawn over 40,249 ETH.

Tom Wan, on-chain data analyst at 21.co (parent company of 21Shares) elaborate About the situation: “More than 540,000 staked ETH (16,670 validators) are currently being withdrawn from the Ethereum beacon chain. You have 14.5 days to fully withdraw and withdraw now.” The researcher added that 352,000 ETH (54.7%) pending withdrawal belongs to Figment and 206,000 ETH (32%) belongs to Chelsea.

“Also, Figment’s departure is likely to be owned by Chelsea. “In early June, when Chelsea redeemed 428,000 stETH from Lido, they re-staked 197,000 ETH through Figment,” he added. Chelsea may therefore be responsible for unstaking 86.7% of all ETH in the queue.

Is an Ethereum price crash approaching?

While some investors have expressed concerns that the release of such a large amount of tokens from staking could have a negative impact on the price of Ethereum, others take a more sobering outlook, believing that the market is robust enough to absorb this additional volume. Maintain.

Even if it is unlikely that all ETH in the queue will be sold, liquidity appears to be strong enough to absorb such a process, which will be gradual rather than sudden. According to Coinmarketcap, ETH trading volume currently stands at around $11.35 billion, suggesting that the market can withstand a possible sale of Celsius’ entire ETH holdings without a major ETH price crash. Therefore, inciting fear is unnecessary.

After receiving approval for the reconciliation plan, Celsius allowed eligible users to withdraw 72.5% of their cryptocurrency holdings, an option available until February 28. Court documents filed in September show that about 58,300 users held a total of $210 million. These are assets classified by the court as ‘custodial assets’.

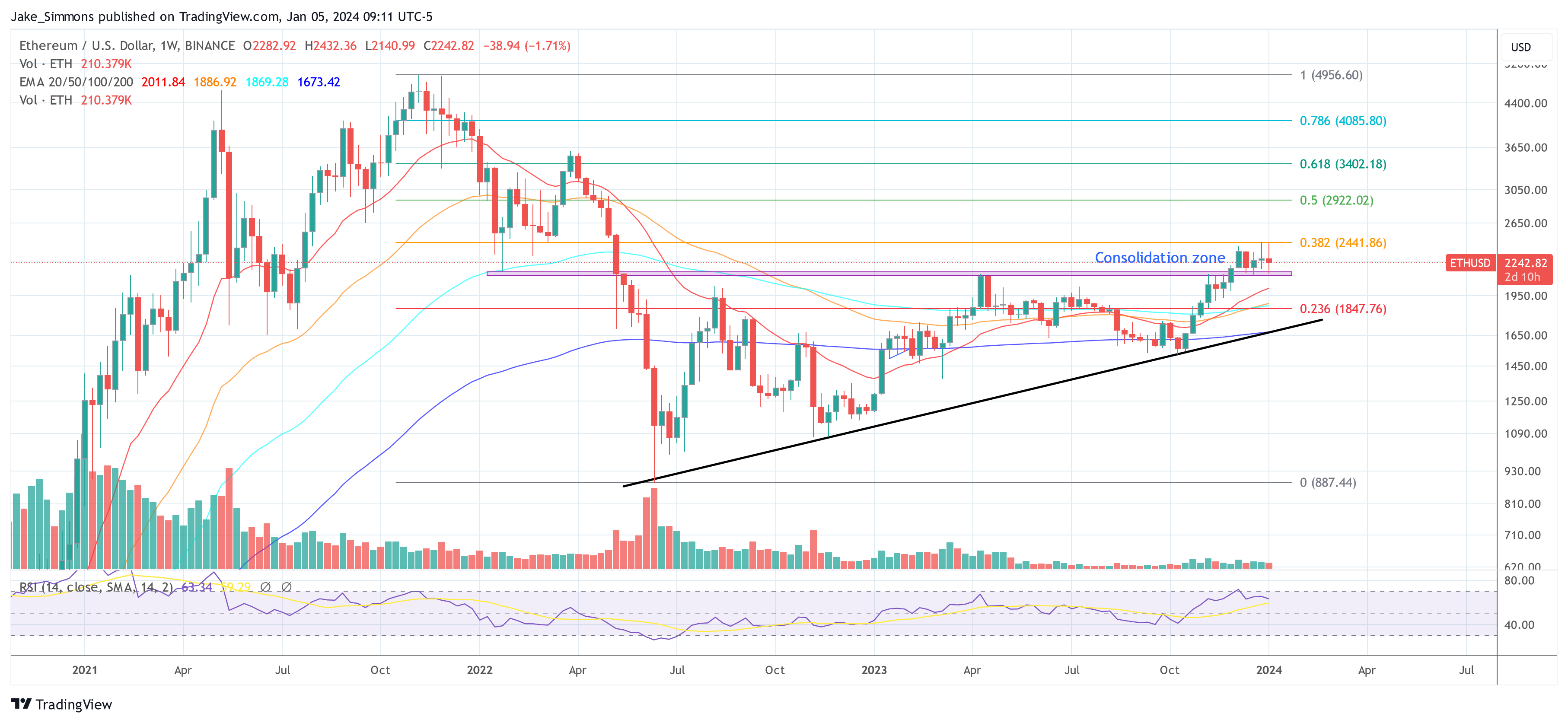

At press time, ETH was trading at $2,250. The one-week chart of ETH/USD shows that the Ethereum price has formed a consolidation range over the past five weeks. The chart defines this area with a lower limit at $2,125, indicated by the red area, and an upper limit at the 0.382 Fibonacci retracement level located at $2,441.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.