Is Ethereum overvalued like a ‘Shiba Inu-like meme coin’?

Crypto investor Fred Krueger believes Ethereum is overvalued at spot rates. Kruger mentions X Added that Ethereum supporters are “out of touch with reality” after the base currency, ETH, recently surpassed $3,000.

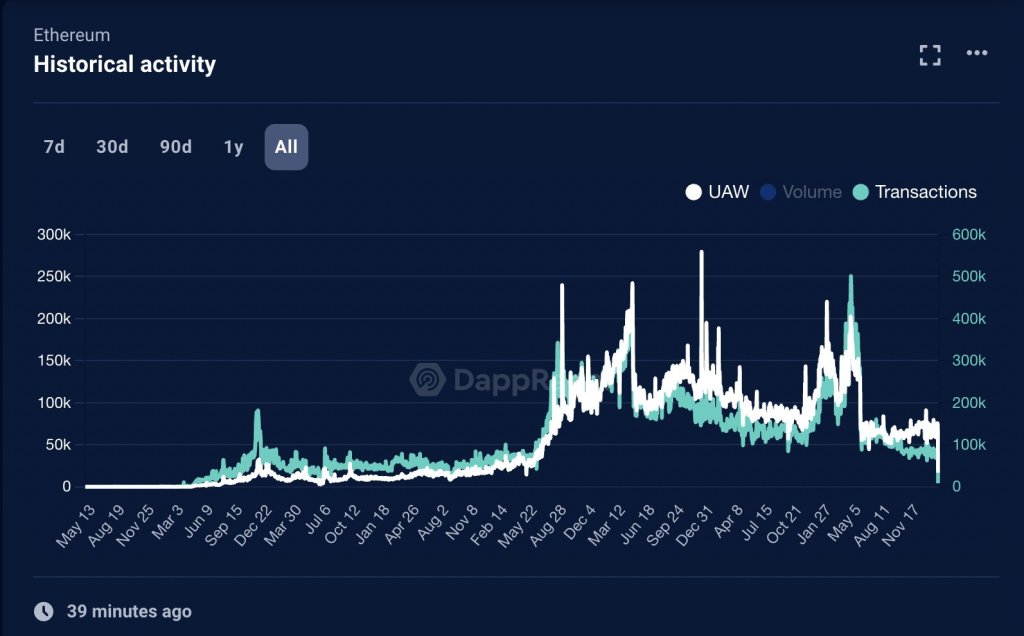

Investors pointed to an overall decline in on-chain activity, fierce competition from alternatives such as Solana and Avalanche, and regulatory uncertainty that makes holding the coin risky.

Ethereum is slow and usage is decreasing

Kruger argues that on-chain transactions on Ethereum could be faster and cheaper. In the current environment presented as a scalable, low-fee alternative built on top of Ethereum or existing as an independent chain, the chain’s problems no longer justify trading ETH at a spot rate of around $3,000.

In addition to scalability and throughput issues, investors also cite a sharp decline in daily active users (DAU) on the mainnet. Since 2021, Ethereum and altcoin prices have peaked, and active DAU has decreased from about 120,000 in February 2024 to about 66,000.

Supporters of the network say there have been developments such as layer 2 platforms like Arbitrum pinning security to Ethereum, but Krueger points out that even the most active and largest protocols by total value locked (TVL) have experienced a loss of users.

For example, Uniswap V3, the third version of Uniswap, one of Ethereum’s largest decentralized exchanges, currently has approximately 16,000 daily active users, a significant decrease from previous years.

Alternatives like Solana offer a better proposition: Is ETH expensive?

Investors argue that the decline in DAU, which points to active usage, stands in sharp contrast to Ethereum’s market capitalization and rising spot rates. In Krueger’s opinion, this new situation is the reason why Ethereum has become a “Shiba Inu-like meme coin”, inflated considering its high market capitalization.

Faster, cheaper alternatives like Solana, Avalanche, and Near Protocol offer better value for specific use cases such as decentralized finance (DeFi) and gaming, according to investor ratings.

Kruger also raised concerns about the lack of regulatory clarity on Ethereum. The U.S. Securities and Exchange Commission (SEC) recently approved the first batch of Bitcoin exchange-traded funds (ETFs). Primarily, this is because SEC officials view Bitcoin as a commodity.

Gary Gensler and the SEC failed to classify ETH in the same category as BTC. So while the broader cryptocurrency community is optimistic about the final approval of a spot Ethereum ETF, Krueger thinks that is unlikely.

However, time will tell how Ethereum and its market value will evolve in the coming months. Despite the criticism, proponents are optimistic that increased adoption and ETH’s deflationary nature will push the price to its 2021 high of $5,000.

Featured image by DALLE, chart by TradingView

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.