Is gold rising or stalling?! – Analysis and Forecast – December 17, 2023

If we open the Global Gold Ounces chart and look at the daily time frame, we can see that it opened around $1975 last week, which could act as strong support for gold. The 50-day moving average has been around for a long time. On Tuesday the market rose slightly, then fell back to around $1977 due to bearish pressure.

Gold could rise above the $2000 level and into the crucial $2050 level during Wednesday and Thursday due to weak economic reports and dovish decisions by Federal Reserve officials.

Gold-related events in the foreign exchange market last week:

Last Monday, December 11, 2023, global gold ounces, which started the day and week at $2004, fell to the crucial $1975 level. The biggest reason for this decline was the very important Nonfarm Payroll (NFP) report released on the same day.

The latest report from the Bureau of Labor Statistics (BLS) shows that U.S. nonfarm payrolls increased by 199,000 jobs in November. This figure exceeds both the 150,000 reported last month and the expected 180,000. According to the report, the unemployment rate during this period decreased from 3.9% to 3.7%, and the annual wage growth rate, as measured by the change in average hourly income, was consistently maintained at around 4%.

Lastly, the labor force participation rate increased from 62.7% to 62.8%, and the U.S. dollar index strengthened immediately after the release of this report, outperforming its competitors. Accordingly, global gold prices began to decline and moved in the opposite direction to the dollar’s upward trend.

And then comes Tuesday, when markets await an important report on the US Consumer Price Index (CPI). As you know, CPI is one of the most important drivers affecting the market and financial assets such as gold and dollar. Federal Reserve officials always take this into account when making decisions.

The U.S. Bureau of Labor Statistics reported that the U.S. inflation rate, which is determined by changes in consumer prices, fell 3.1% in November. It’s worth noting that this figure follows October’s 3.2% figure, which was exactly in line with analysts’ forecasts.

In addition, the annual net inflation rate (core CPI) excluding food and energy was also announced at 4%.

The monthly inflation rate and monthly net inflation rate were also announced as 0.1% and 0.3%, respectively.

Then came Wednesday. On a day when the market was waiting for an important CPI, the forecast announced a figure of 0.2, but the same previous figure was announced as 0.

In addition, the monthly producer price index was -0.4, which was declared 0 as expected.

It is important to note that the dollar and gold did not react to this report, as the entire market was awaiting a meeting of US central bank officials.

An important factor that led to the surge in gold prices was the dovish comments of Federal Reserve officials regarding the start of the interest rate reduction process. Not only did policymakers signal an end to tightening or rate hikes, they also announced that the Fed plans to cut interest rates three times, or by 75 basis points, in 2024.

Federal Reserve Chairman Jerome Powell announced that he and his colleagues have successfully achieved their goal of achieving a 2% inflation rate and will do so without causing a recession. This statement and decision by Federal Reserve officials caused the yield on the 10-year Treasury note to fall from 4.21% to 3.94%, which pushed the value of the U.S. dollar index to around 102.43, its lowest level in four months. Powell said his colleagues are discussing and considering when to start cutting interest rates, adding that the most important thing for us is not to make the mistake of keeping interest rates high for too long.

On Thursday, markets were eagerly awaiting key central bank meetings in Switzerland, the UK and Europe, but as expected, no major changes or events occurred and interest rates remained unchanged. The biggest difference between the Bank of England and the Federal Reserve was the tone of the governors. Unlike Federal Reserve Chairman Andrew Bailey, Bank of England Governor Mark Carney said interest rates were likely to remain high for an extended period of time due to persistent inflation. Carney’s tone was perceived by the market as hawkish, causing the pound to strengthen against the dollar.

Gold continued its upward trend towards the important $2050 level after important decisions by the Swiss, British and European Central Banks. On Thursday, markets were awaiting U.S. retail sales and weekly jobless claims reports. All of these reports were better than economists predicted and caused the dollar to strengthen in the market. For example, US net retail sales were expected to fall from zero to minus 1%, but surprisingly rose by 2%. The number of weekly unemployment claims, which had been expected to drop from 221 to 219, surprisingly decreased by 202,000.

The last working day of the week finally arrived, and the only important report for the dollar and gold was the Purchasing Managers’ Index (PMI) for Services and Production, which did better for the former and worse for the latter than market forecasts.

There will be no significant news for the dollar or gold on Monday December 18th. The only significant news on Tuesday is the release of the Canadian Consumer Price Index (CPI). On Wednesday, markets await the UK CPI report and the US Conference Board Consumer Confidence Index. Thursday brings important news for the United States, including the final gross domestic product (GDP) report and the weekly unemployment claims report. Finally, on the last business day of the week, markets will be awaiting the important US Personal Consumption Expenditures (PCE) report. It’s expected to be a quiet week with little volatility.

Weekly technical analysis of gold:

Looking at the daily gold chart, we see that the lowest price over the past week was $1,973 and the highest price was $2,047. Global gold ounces rose about 0.75% last week, delighting market strength.

The RSI indicator on daily time frame is currently trending downwards towards the key level of 50 and is showing a value of 53. This means that gold has lost upward momentum and a further correction is not unexpected.

Important support levels for gold:

If gold starts to fall, the first important support level will be at $2,010. If the market declines below this level, the next important support level would be $1,990. Finally, if gold falls below this level, the next important support level will be at $1,970.

Important resistance levels for gold:

If gold rises in value, the first important resistance level will be $2,040. If the market gains above this level, the next important resistance level would be $2,060. Finally, if gold also exceeds this level, the next critical resistance level will be $2,080.

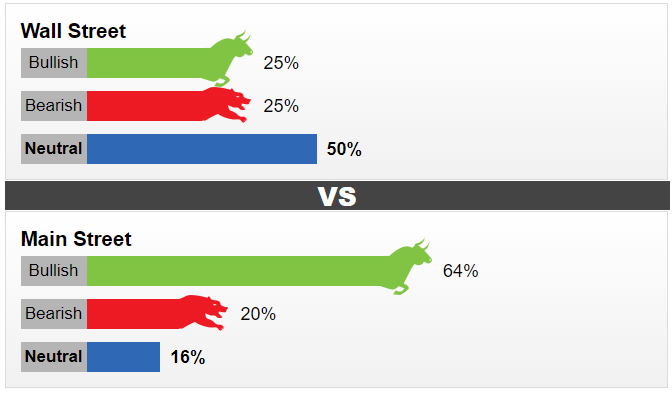

Finally, here are some statistics from Wall Street analysts.

This week, 12 analysts took part in a survey on gold. Three analysts (25%) predict gold prices will rise next week, while another three analysts (25%) predict prices will fall. The remaining six analysts (50%) are neutral on gold this week.

Market analysts have varying opinions on the gold price outlook for next week, but overall there are balanced indicators of a potential price rise.

Reasons for optimism:

1. Falling dollar and falling bond yields: These two factors have traditionally contributed to rising gold prices.

2. Seasonal Demand: From Christmas to Valentine’s Day, demand for physical gold is high, which can help push prices up.

3. Central bank purchases: Central banks continue to purchase gold, which can have a positive impact on the price of gold.

4. Market Expectations: Many market participants expect the Federal Reserve to lower interest rates in the near future, which could also benefit gold.

Reasons to be careful:

1. Conflicting statements from the Federal Reserve: Some Fed officials have made conflicting statements about monetary policy, which may cause uncertainty in the market.

2. Potential for dollar strength: In the near term, the US dollar index may strengthen, which could put pressure on gold prices.

3. Short-term correction: The recent upward trend in gold prices may undergo a short-term correction.

conclusion: