Is Reliance Power on the road to revival?

Our world revolves around electricity, which drives power generation and provides light to life. The electricity industry plays a vital role in the modern world. Electricity is generated by power generation companies and distributed to homes and businesses. One of the major players in this market is Reliance Power. They oversee several power plants in India. The business uses a variety of energy sources, including renewable resources, gas, and coal. Reliance Power aims to supply the country’s growing energy needs.

With concerns over fuel availability and environmental issues becoming a hurdle for Reliance Power, the company is investing in cutting-edge technologies to improve its operations. Our research on this evolving sector primarily concerns Reliance Power’s significant involvement.

Industry Overview

The energy production market is steadily expanding and is expected to reach 28.80 trillion kWh by 2024. The energy mix is dominated by fossil fuels, but the share of renewable energy is increasing. The share of nuclear energy remains constant. The sector is expected to continue its growth and is expected to reach 32.62 trillion kWh by 2029.

This represents a CAGR of 2.52% between 2024 and 2029. Global energy companies are always investing in various sources to keep up with the growing demand. Generating clean and conventional energy has to be balanced, which presents a hurdle. Technological developments in all sectors are driving efficiency gains. Companies are prioritizing green operations while maintaining a stable supply of electricity. This vibrant sector is essential for the expansion of the global economy.

NOTE: If you want to learn candlestick and chart trading from scratch, here is the best book available on Amazon! Buy the book now!

Company Overview Reliance Power

Reliance PowerFounded in 2007, the company has emerged as a key player in India’s energy sector. It traces its roots to the Reliance Group, founded by Dhirubhai Ambani.

Reliance Power plays a significant role in the power sector in India and contributes significantly to the country’s energy security. The company operates multiple power plants across India, utilizing a variety of fuel sources. It focuses on conventional and renewable energy projects to meet the growing demand. The company is expanding its presence in the renewable energy sector, implementing cutting-edge technologies to increase efficiency and reduce environmental impact, in line with India’s clean energy goals.

Is Reliance Power on the road to revival?

Reliance Power is undergoing a remarkable turnaround, transforming its financial health and operational efficiency. Reliance Power was facing severe financial difficulties due to high debt and project delays. The company had accumulated significant loans for ambitious power projects, amounting to about Rs 800 crore. However, it has launched a robust recovery plan to address these issues.

Reliance Power has taken the following steps to become debt-free:

1. We have engaged in extensive negotiations with lenders to restructure the loans and extend the repayment terms.

2. Signing of debt settlement agreements with banks including ICICI, Axis, DBS and IDBI.

3. Sold non-core assets to raise funds to repay debt.

4. Optimized operations to improve cash flow

5. Focus on completing suspended projects to start generating revenue.

6. We sought strategic partnerships to share financial risks and attract new investments.

These efforts have paid off as Reliance Power has repaid all its outstanding debts to lending banks. The company is now independent and debt-free. With a capital base of Rs 4,016 crore and over 38 lakh retail investors, Reliance Power operates a capacity of 5,900 MW, including the 3,960 MW Sasan UMPP and the 1,200 MW Rosa Thermal Power Plant in Uttar Pradesh.

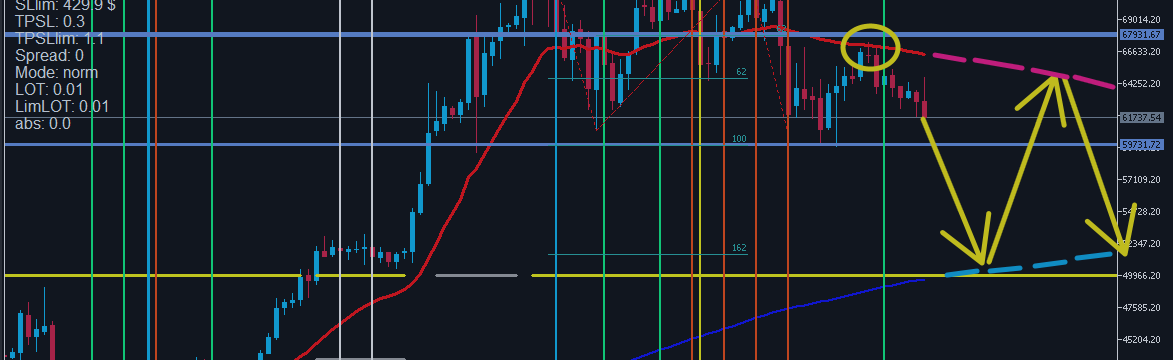

Stock price recovery

Reliance Power’s stock market journey has been turbulent since its debut on February 11, 2008. The company’s stock faced significant volatility due to market conditions and investor concerns. On the first day of trading, the stock price plunged 27% from its issue price of ₹450. To cushion investors’ losses, Reliance Power issued bonus shares on February 25, 2008.

Over the years, the stock has seen dramatic fluctuations. It fell from ₹260.78 in 2008 to a low of ₹1.13 on March 27, 2020. However, Reliance Power’s stock price has shown signs of recovery recently. The stock has risen above ₹31.15, drawing renewed interest from traders. This rebound has opened a new chapter in the company’s stock market journey.

Financial Highlights Reliance Power

Reliance Power’s financial performance has fluctuated considerably over the past five years. The company’s revenue has remained relatively stable, ranging from ₹7,503 crore to ₹7,934 crore. However, profitability has been variable. Reliance Power reported a significant loss of ₹4,271 crore in 2020, before posting a profit of ₹454 crore in 2021.

The company’s operating profit margin has steadily declined from 40% in 2020 to 15% in 2024. Similarly, the return on capital employed has declined from 6% to 1% over the same period. Earnings per share have also been inconsistent, ranging from a low of – ₹14.53 in 2020 to a high of ₹0.82 in 2021. The most recent financial year (2024) saw a net loss of ₹2,068 crores and a negative earnings per share of ₹5.15.

competitor

Adani Power: Adani Power is emerging as a major private player in the thermal power sector in India. The company is expanding its capacity through strategic acquisitions and new projects. Efficient Development and distribution technology. Adani Power is also exploring renewable energy options to diversify its portfolio.

Tata Power: Leading India’s transition to cleaner energy sources, the company is investing heavily in solar and wind power projects. It is also modernizing existing thermal power plants to reduce emissions. Tata Power is expanding its consumer business, including rooftop solar and EV charging solutions.

JSW Energy: It is expanding its presence in the thermal and renewable energy sectors. The company is focusing more on solar and wind energy projects. It is implementing advanced technologies to improve the efficiency of its power plants. JSW Energy is also exploring opportunities in the electric vehicle charging infrastructure market.

nation: (main), India’s largest power company is diversifying its energy mix. It is increasing its renewable energy capacity, especially solar power. It is modernizing its combined heat and power plants to meet stricter environmental standards. NTPC is also venturing into new areas such as hydrogen fuel and electric mobility solutions.

Also read…

Key Indicators Reliance Power

Future outlook Reliance PowerR

1. Reliance Power plans to expand its renewable energy portfolio with a focus on solar and wind projects to meet the growing demand for clean energy.

2. The company plans to upgrade existing thermoelectric power plants for higher efficiency and lower emissions in compliance with environmental regulations.

3. Reliance Power is leveraging its expertise in power generation and distribution to explore opportunities in the emerging green hydrogen segment.

4. The company plans to invest in smart grid technologies and energy storage solutions to enhance grid stability and reliability.

5. Reliance Power became a debt-free company through successful loan negotiations with banks, execution of strategic repayment plans and monetization of non-core assets.

conclusion

Reliance Power’s journey to revival has been marked by significant challenges and promising developments. The company has successfully become debt-free and its stock price is showing signs of recovery, but it still faces challenges in terms of profitability and market performance compared to its peers. Nevertheless, Reliance Power’s focus on renewable energy, plant modernization, and emerging technologies such as green hydrogen offers opportunities for future growth.

However, the company has to deal with declining operating margins and return on capital employed. Going forward, investors should closely monitor Reliance Power’s ability to execute its expansion plans and improve its financial metrics. Will Reliance Power be able to successfully capitalize on the growing renewable energy market? Will its strategic initiatives lead to sustained profitability? How will the company differentiate itself in the competitive power sector? Please leave your comments below.

Written by Dipanshu Kundu

The Trade Brains portal’s stock screener, stock heatmap, portfolio backtesting, and stock comparison tools give investors comprehensive tools to identify the best stocks, receive stock market news, and make informed investments.

Start your stock market journey today!

Want to learn how to trade and invest in the stock market? Check out FinGrad’s exclusive stock market courses, a learning initiative from Trade Brains. Get ahead in your trading career by registering for free courses and webinars from FinGrad today. Join now!!