iShares MSCI Israel ETF: Strong Recovery Play (NYSEARCA:EIS)

rarrarorro/iStock (Courtesy of Getty Images)

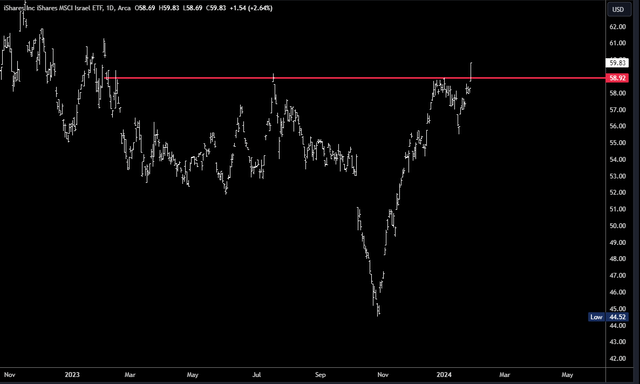

iShares MSCI Israel ETF (NYSEARCA:EIS) rallied +2.64% on Monday to surpass the July 2023 high. It has now rebounded more than +34% from its October low and is within +2.4% of its 2023 high.

Relative strength like this is always worth noting, especially when outperformance occurs against a backdrop of negative sentiment. The conflict in the Middle East makes investing in Israel seem risky, but it’s clear that someone is buying into that fear and doing very well. Should I follow along?

Black Swan

The Hamas attack on Israel on October 7 was a black swan for the markets. That prompted a general reaction. Sell now, ask questions later. In the case of EIS, a large gap occurred on Monday 9th and the price fell sharply into capitulation. Bottom on October 26th.

A large decline is logical given the severity of the situation, but a ‘V-shaped’ reversal into a strong rally is less likely. By the end of November, the entire fall had recovered.

EIS Reversal (Tradingview)

The reasons for the recovery and rebound can only be guessed. Israel’s ground offensive began on October 28 and could have helped sentiment. But I don’t think one specific event triggered the turnaround. The market appears to have gradually realized that Israeli companies may not be as negatively affected as initially feared, and buying rather than selling was a better approach.

EIS Exposure Risk

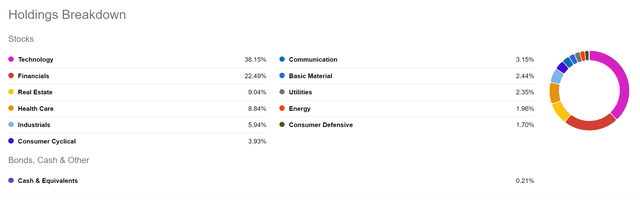

The Middle East conflict will impact many sectors in different ways. Travel, recreation and tourism will face headwinds. It can be of great help in security and defense. In many other sectors, you may not see any effect at all. Looking at the exposure of the EIS, we see that it is unlikely that most of our holdings will be directly affected.

EIS Exposure (Alpha Exploration)

Tech companies dominate. Many of them have a global presence and offices in the United States and other countries. EIS’ largest holding, Check Point Software Technologies (CHKP), provides cybersecurity solutions globally and is listed on Nasdaq. It has performed well since the October 7 attacks and is trading at record highs. Companies like this should not be negatively affected.

The financial sector also has a significant impact on EIS exposure, with real estate being the third largest sector. I’m not sure this will avoid all side effects so it requires closer investigation. The fund’s top 10 holdings are:

EIS Top 10 Holdings (Alpha Exploration)

Of the fund’s 116 holdings, 52.5% are concentrated in the top 10. Local banks account for three positions and five of the top 20, so it is important for them to perform well in the current climate.

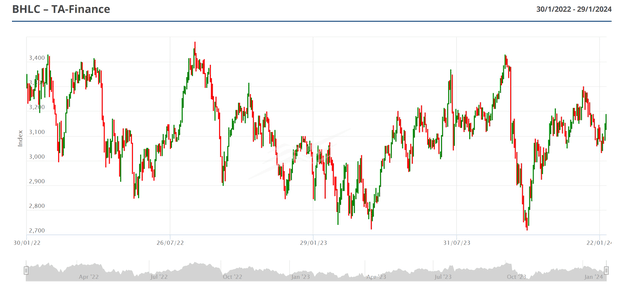

Unfortunately, the bank is the only holding in the top 10 that is not listed on the NYSE, so information is not easy to access. However, they are listed on the Tel Aviv Stock Exchange and are among the top holdings in the financial sector. The financial departments in Tel Aviv are:

Finance (Tel Aviv Stock Exchange)

The sector is trading in the upper half of its large two-year range. There are no real signs of stress, and if there are major long-term risks due to conflict, this is likely to be reflected in your chart. That said, it has yet to trade above its early October 2023 highs, and given that stock markets in many other countries are trading at all-time highs, this represents relative weakness. We will become more comfortable once the chart breaks the 2023 high and consolidates above.

Other companies in the top 10 include the well-known Teva Pharmaceutical (TEVA), a global generic drug manufacturer. We have manufacturing plants in several countries and a large plant in Jerusalem, Israel, which was not affected by the war.

In conclusion, the fund’s holdings include numerous global companies, which will protect EIS from any downturn in activity in Israel.

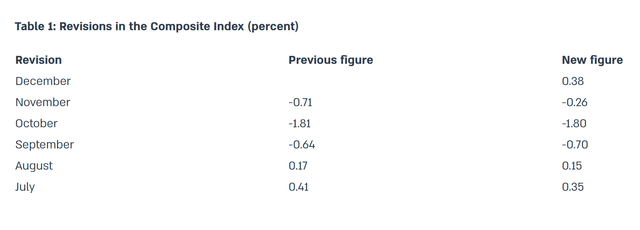

Moreover, the impact of the conflict on the Israeli economy as a whole has decreased overall. Data from the Bank of Israel shows a return to growth after contraction in October and November.

Economic Conditions Index (Bank of Israel)

Below is the bank’s commentary:

The economic composite index increased 0.4% in December, reflecting the economy’s gradual recovery from the effects of the Iron Sword War. The war continued in December, but its impact on activity continued to wane.

Industrial production index, retail trade profit index (November), consumer goods imports, product exports, employment rate, and increase in credit card purchases (December) had a positive impact on the index. On the other hand, exports of services, employee positions (October), and imports of production inputs (December) decreased, which had a negative impact on the index.

EIS – Other Considerations

EIS is a passively managed ETF from BlackRock. According to the prospectus:

The Fund seeks to track the investment results of the MSCI Israel Capped Investable Market Index (IMI) (the “Underlying Index”). This index is a free-float market capitalization weighted index designed to measure the performance of large companies. Small and mid-cap sector of the Israeli stock market. The Underlying Index is rebalanced quarterly using an optimization process that aims to minimize the differences in component weights between the Underlying Index and the MSCI Israel Index (the “Parent Index”).

EIS pays a small distribution with a yield of 1.35% (TTM). The expense ratio of 0.59% is reasonable but on the high side. My concerns lie more with liquidity, with daily dollar volume trading at $1.84M. This is a small fund with AUM of just $137.

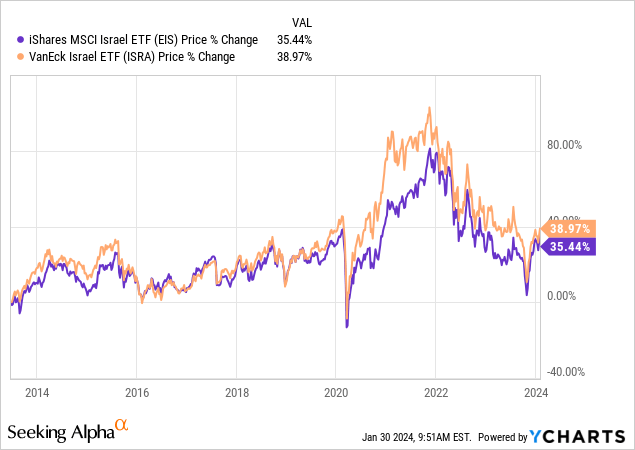

EIS’ only real peer is the VanEck Vector Israel ETF (ISRA), which has performed slightly but is more volatile. The reason I haven’t looked at ISRA more closely is because it has only $60 million in AUM and average daily dollar volume of only $144,000.

In terms of providing broad exposure to Israeli companies, EIS is the most liquid ETF.

danger

A sudden drop of -17% can occur, as we saw in October. The conflict in the Middle East is likely to escalate and there is a risk of further attacks. I think the decline should bounce back, but short-term losses may be difficult.

There is a risk that Israel and the EIS will underperform in the long term. The EIS has been much weaker than the US index for most of 2023, which obviously has nothing to do with the October attacks. Now that the snapback rally is well underway, EIS may underperform again.

conclusion

EIS has made a strong recovery from the decline following the October 7 attacks. The fact that the fund’s majority is international and technology-based means it has limited impact on its holdings. Moreover, the economic impact of the war is waning, with Israel’s composite economic index rising 0.4% in December. With Israeli financials up 34% and underperforming, I’m not sure I’d rush to buy. But if it plummets again, EIS could be an interesting recovery strategy.