JB Hunt Transport Services: Volume Performance Suggests Normal Recovery (NASDAQ:JBHT)

Fries/E+ via Getty Images

summary

Following our coverage of JB Hunt Transport Services (NASDAQ:JBHT), we recommended a Buy investment opinion as JBHT’s downcycle is likely to end and trading volume is expected to be positive. Ahead of growth, this post is intended to provide an update on my thoughts on the business and the stock. We remain positive on JBHT’s recovery trajectory, as evidenced by its Intermodal (IM) segment volume performance. As volume increases, positive price growth should follow, which should overall drive acceleration in IM revenue growth and margins (as operating leverage kicks in). As we expect JBHT to show restorative growth, we expect the market to value JBHT at a premium compared to its historical average.

investment thesis

JBHT reported total revenue of $3.3 billion (down 10%) in 4Q23, resulting in a 13% year-over-year decline. It matches my expectations. However, JBHT reported Q4 2023 EBIT of $203 million, ending the year with an EBIT of $993 million, which resulted in lower-than-expected net income of $728 million. So FCF was also lower than I expected ($144.4% vs. $234 million in FY23). Overall, I would say JBHT’s performance is decent as its key segments IM and Dedicated have shown early signs of recovery, although International Capacity Solutions (ICS) is still holding back.

While sales were down 7% year-over-year, starting with IM, JBHT’s largest segment, we believe the sequential improvement is very indicative of the underlying demand that JBHT is seeing. Sales growth improved from -19% in 2Q23 to -15% in 3Q23 and -7% in 4Q23. In particular, management has observed improving monthly volume trends over the past nine months. Volumes increased by 6% in October, 6% in November, and 8% in December 2023. We believe this means that JBHT has already passed the bottom of its inventory clearance cycle, and volume growth from here will continue to be positive. In terms of price, the calculated revenue per load (downside ~13%) indicates that price is still negative (~6%). However, price is usually a lagging indicator. The fact that volume is improving sequentially is a positive indicator for future price growth. We believe the reason is that increased volumes mean increased underlying demand for logistics services, and customers will need to take these “volume improvement conditions” into account in the upcoming bidding period. They are likely to bid more aggressively to secure more capacity to meet higher volume demands.

That said, I think it’s important to reiterate that volume has historically been a leading indicator, while price is typically a lagging indicator with uncertainty about the timing of a potential inflection.

yes. Brian, I might add: Brad Hicks. Similar to what Darren said, it’s still too early in the bidding cycle to see what’s in front of us. But at least from our perspective, from the truckers’ perspective, the rates need to go up, and I can’t do that. 4Q23 earnings call

However, patience is required in this case as the positive price impact will not be seen in the P&L in the near future as the bids made in the previous period will still be held. Although the bidding season has just begun, we are optimistic about the company’s prospects and ability to increase market share thanks to the excellent service it provides through its rail partners, new products such as Quantum, and services outside of Mexico. GMXT providing customers with more options and addressing cross-border requirements.

The next largest segment, Dedicated, is also worth discussing. Although growth is still negative, we thought topline performance was not as bad as we thought. Despite the challenging freight transport environment, demand for dedicated services remains resilient. Objectively, there was a sequential improvement of 100 bps, with about 300 trucks sold in the fourth quarter, compared to 1,150 trucks sold in FY23. Additionally, the segment’s operating ratio also improved compared to the third quarter of ’23 after adjusting for special insurance losses and divestiture losses. Factoring in approximately $20 million in insurance-related costs and a net $8.1 million increase in equipment sales losses, DCS operating income should be approximately $114 million (or an 87.1% operating ratio, a 140 bps improvement over 3Q23).

To summarize my thoughts up to this point, I believe JBHT continues to move in the right direction as pressure from IM clearly eases on this front and overall freight demand as imports remain strong through the end of 2023. Coupled with these positive factors, the Logistics Managers Index (LMI) shows that inventory depletion is nearing its end. This would bode well if retailers and other shippers decide to restock in response to increased consumer demand and/or JBHT needs to restock shelves as schools head into the back-to-school or peak season next year. JBHT’s dedicated segment has also demonstrated sequential improvement (both revenue growth and EBIT margin) and resilience in the current challenging environment, which is expected to further improve in 2024 as the macro environment improves compared to 2023.

evaluation

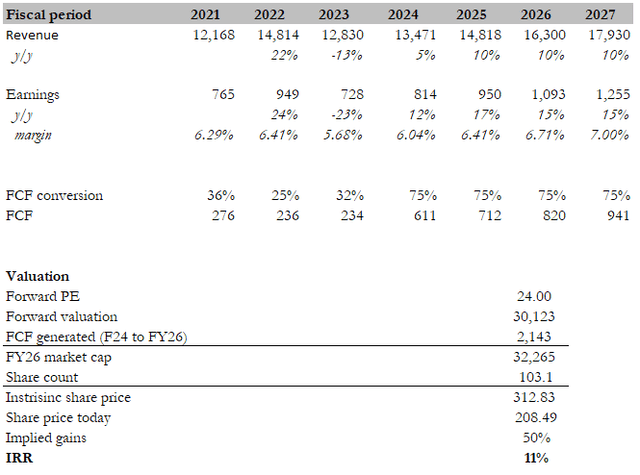

self calculation

Based on my model, the revised JBHT price target is ~$313. This target price is slightly lower than the previous price target as we adjusted our expectations for FY24 slightly lower to reflect a more conservative stance on the timing of the recovery. We have therefore halved our FY24 growth expectations to bring them in line with consensus estimates. We have taken similar action on our FY24 margin expectations due to headwinds in JBHT insurance coverage. For background, JBHT purchases insurance coverage for a portion of the costs associated with motor vehicle collisions and accidents, including the level of self-insured (deductible) coverage applicable to each claim and, by specific coverage tier, a combined reimbursement limit for the amount of covered excess. I did. opinion. For the second year in a row, the number of claims has exceeded existing coverage as settlement costs continue to rise. This insurance impact is expected to persist in FY24, delaying the margin improvement trajectory. To account for these changes in the model, I now assume two-stage growth. JBHT should recover to its highest 2022 margins in recent years by FY25 (coverage headwinds should have eased by then). JBHT will reach the peak of this cycle over the next four years, returning to its previous high margin of 7% (FY15). However, given that the market has started pricing in JBHT and IM has shown positive early signs of a recovery in growth, we have made a positive adjustment to the valuation at which JBHT should trade as we expect a recovery in the medium term. I assumed that JBHT was trading at 24 times forward earnings and 1 standard deviation above the mean.

danger

Given the improved but still uncertain economic outlook, it is really difficult to pinpoint a period of growth these days. Last week, the Federal Reserve decided to delay cutting interest rates because inflation remains tight and the labor market remains hot. If this situation continues, the Federal Reserve will maybe not Just lower the interest rate. This could delay the recovery as it weighs on consumer spending.

conclusion

We believe JBHT is on a positive recovery trajectory, as evidenced by improving volume performance, particularly in the IM segment. Despite a 10% decline in revenue in FY23, continued improvement in IM revenue growth signals a shift in the inventory clearance cycle, with monthly volume trends continuing to increase. Prices are still negative, but are expected to improve as volume increases. The dedicated segment demonstrates resilience and sequential improvement and demonstrates favorable operating ratios.