JD Sports: Building a Global Giant with Hibbett (JDSPY)

Philip Open Show

Headquartered in the United Kingdom, JD Sports Fashion plc (OTCPK:JDSPY) retails sports-focused clothing, footwear, and accessories. The company has built a brand portfolio that currently includes names such as JD, Size?, Footpatrol, Sport Zone, Aktiesport, Tessuti and Mainline. JD Sports is also looking to add Hibbett. Portfolio of companies, including proposed acquisitions announced in April.

JD Sports’ stock price has had a bad year over the past year, with the stock falling in January after a trading update announcing sales results for the end of 2023 came in below expectations. Stocks initially reacted positively to the Hibbett acquisition, but the stock subsequently fell. Over the long term, this stock has performed incredibly well on the London Stock Exchange, with a 10-year CAGR of 23.7%.

1 Year Stock Chart (Alpha Exploration)

The global giant Created by JD Sports

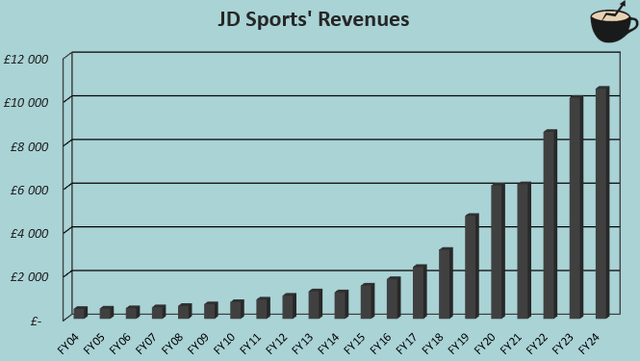

JD Sports has aggressively grown revenues through organic investment, including capital expenditure of £500 million in FY2024 and a record number of acquisitions.

Acquisitions have accelerated in recent years. In 2018, JD Sports announced the acquisition of The Finish Line for $558 million, and in 2021, it announced the acquisition of DLTR for $495 million in cash, following several smaller acquisitions during and after 2021. In total, JD Sports has generated £18.71m in cash acquisitions over the past 10 years.

As a result of extensive investment, JD Sports has grown from a relatively small retailer in the early 2000s to a globally prominent retailer with sales of £10.54 billion in fiscal 2024. Growth was achieved at a very high CAGR of 17.0% and did not result in significant dilution, with total dilution of only 6.5% in FY2015. A return on equity of 23.6% makes JD Sports’ growth very worthwhile. Generated great shareholder returns.

Author’s calculations using TIKR data

The company is also reporting healthy earnings, with an operating margin of 8.9% for fiscal 2024, similar to recent years. The revenue generated cash flow that JD Sports could use to capitalize on past acquisitions without taking on significant debt.

Announcement of product supplementation through acquisition of Hibbett

Following its cumulative acquisition performance, JD Sports announced an offer to acquire Hibbett (HIBB) on April 23 for $87.5 per share. This is JD Sports’ largest single acquisition to date. The acquisition price is 20.7% higher than Hibbett’s stock price the day before the announcement.

I previously wrote an article about the argument from Hibbett’s perspective. In the article, I expressed that the acquisition of JD Sports is quite expensive given the financials Hibbett expects, as the combined valuation of the $1.1 billion enterprise value provides great value to Hibbett’s shareholders. I estimated Hibbett’s fair stock value to be $74.78. 15% less than the given acquisition price.

However, I do not think this acquisition is a bad move by JD Sports. Hibet has a deep relationship with Nike (NKE), a key brand in the sports footwear and apparel field, and JD Sports and Hibet will be able to mutually benefit from this relationship. Additionally, the integration of the acquisition is expected to generate $25 million in synergies over the medium term, and at a revenue multiple of 10x, synergies will already account for nearly a quarter of the value of the acquisition.

The acquisition is still subject to Hibbett’s shareholder approval and U.S. antitrust approval. Although there is some pushback from Hibbett shareholders regarding Wohl & Fruchter LLP, a law firm that investigates price-related transactions, I expect the acquisition to proceed successfully. Hibbett’s shares also price the deal, trading at $86.05, a few percent below the acquisition price.

Additional acquisitions needed for upside

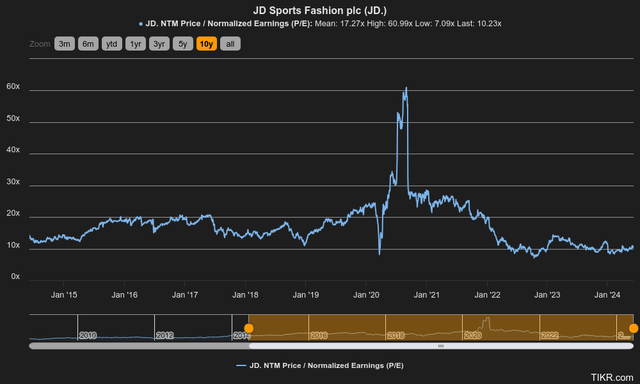

Shares of JD Sports are currently trading at a forward P/E of 10.2, well below its 10-year average of 17.3. On the surface, the current ratio doesn’t seem to reflect much growth, considering JD Sports’ strong balance sheet, which allowed it to finance the Hibbett acquisition with virtually no net debt other than lease liabilities.

Forward P/E(TIKR)

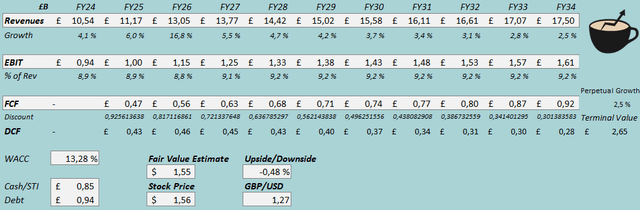

We built a discounted cash flow model (DCF model) to estimate the fair value of the stock. The model takes into account Hibbett’s successful acquisition, but no further acquisitions. I expect JD Sports to see 6% organic growth in FY2025, following 9.0% organic growth in FY2024. After that, a gradual organic growth slowdown is estimated to lead to permanent growth of 2.5%. I estimate that the Hibbett acquisition will begin contributing to earnings in FY2026, resulting in 16.8% earnings growth for the fiscal year.

Due to Hibbett’s lower margins, its EBIT margin is estimated to be 0.1 percentage point lower than the 8.9% level achieved in FY2025. After that, we estimate that synergies will lead to margin leverage of 9.2% EBIT margin, still relatively stable.

The company’s expected growth requires capital investment, which slightly worsens its cash flow translation. We also include the lease interest in the cash flow and subtract the minority interest. I subtracted £300 million in cash and added £809 million in debt for the Hibbett acquisition.

DCF model (author calculations)

Estimates place JD Sports’ fair value estimate at $1.55, one cent below the stock price. In my estimation, there appears to be no near-term upside despite the fairly attractive forward P/E. But faster organic investment could create an upside that isn’t currently expected. It is also possible that new free acquisitions may result in some synergies that are not accounted for in the DCF model. Although there is no upside on the surface, the stock can still be an attractive long-term investment.

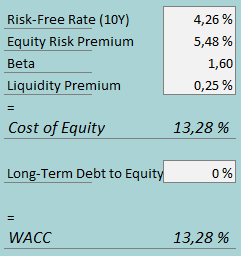

The DCF model uses a weighted average cost of capital of 13.28%. The WACC used is derived from the Capital Asset Pricing Model.

CAPM (author calculation)

Although debt will be used to finance the Hibbett acquisition, along with a $1 billion expansion of the group’s banking facilities, JD Sports’ long-term performance does not show debt as a key part of the company’s financing. Therefore, the DCF model assumes that there will be no debt in the long term and lease-related interest expenses are subtracted from cash flow. To estimate the cost of equity capital, we use the UK 10-year gold bond yield of 4.26% as the risk-free rate. An equity risk premium of 5.48% is the latest estimate for the UK, updated on January 5 by Professor Aswath Damodaran. Yahoo Finance estimates the beta for JD Sports’ UK primary listing to be 1.60. Finally, we add a liquidity premium of 0.25%, creating a cost of equity and WACC of 13.28%.

take out

JD Sports has a long history of successfully investing in growing its store network through organic initiatives and large acquisitions. The company recently announced its proposed acquisition of Hibbett, making it the company’s largest single acquisition, and believes the acquisition could be good due to synergies, despite the price we previously estimated to be a slight overestimate of Hibbett’s current earnings trajectory. The valuation doesn’t appear to have room for near-term upside, unless organic growth continues with higher-than-expected investments or the company continues to make incremental acquisitions after Hibbett. While the long-term investment case may still be compelling, we start JD Sports as a Hold due to its current fair valuation.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.