JinkoSolar: Demand is high, but module prices are a headwind (NYSE:JKS)

creation

Jinko Solar Holding Co., Ltd.New York Stock Exchange: JKS) (also known as JinkoSolar) is one of the world’s leading Chinese solar module manufacturers.

In nine months of 2023, the company shipped more than 52 GW of solar modules, ranking first in the industry. Most of the company’s solar modules are produced in China.

In terms of guidance, JinkoSolar expects module shipments to exceed 70-75GW in 2023 and overseas integrated capacity (outside of China) to reach more than 12GW by the end of 2023.

Making solar modules in China is 50% cheaper than making them in Europe and 65% cheaper than making them in the United States, taking into account China’s manufacturing capabilities and other factors.

JinkoSolar is quite competitive because it has economies of scale compared to many of its competitors, but tariffs make the company’s products better. It is expensive in certain markets such as the US.

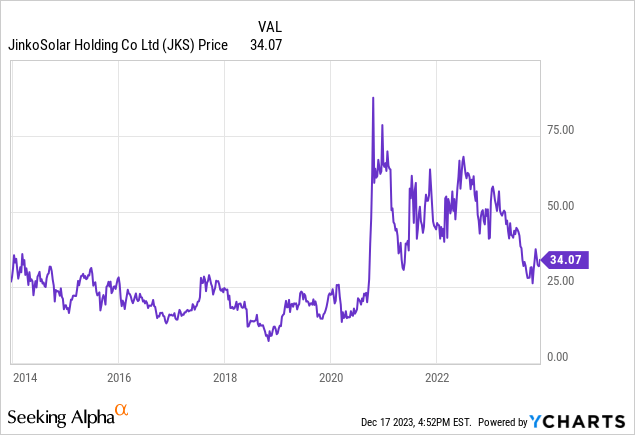

While JinkoSolar’s demand has increased due to stronger solar power competitiveness, JinkoSolar is facing headwinds due to falling solar module prices. As a result, JinkoSolar stock hasn’t performed very well over the past few years.

Demand for solar power has increased, but module prices have fallen

Declining solar production costs have made utility-scale solar PV the most affordable option for new electricity generation in many parts of the world.

As competitiveness increased, the solar energy market also expanded.

In 2022, solar power generation increased by 270 TWh, an increase of 26% compared to the previous year.

In the first half of 2023, PV installations increased significantly by 153% in China and 102% in Germany. In the United States, PV installations increased 34% year over year.

Solar power is expected to increase in demand in the future to reduce carbon emissions.

According to IEA projections, the installed power capacity of solar power could surpass coal to become the world’s largest energy source by 2027. At the time, the IEA predicted that solar energy could account for more than 20% of total power generation capacity.

Although demand for solar power has increased, solar module prices have fallen.

According to the SEIA/Wood Mackenzie Power & Renewables U.S. Solar Market Insights Report published on December 7, 2023, the global average price of solar modules decreased by 30-40% from the first quarter to the third quarter of 2023.

More supplies will be available online in the future. Wood Mackenzie estimates that more than one terawatt of water, cell and module capacity will come online by 2024.

Some are concerned that increased supply will eventually lead to oversupply.

Oversupply has been a problem in the past, and could become a problem again at some point in the future if demand cannot absorb the supply coming online.

3rd quarter 2023

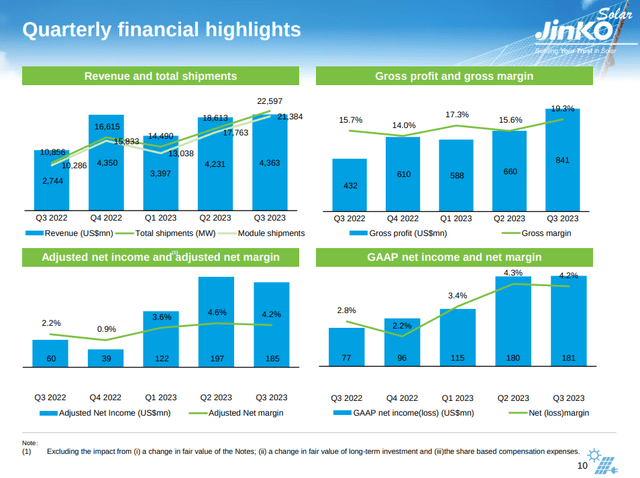

In the third quarter, Jinko Solar benefited from strong demand for solar power this year, with quarterly shipments reaching 22,597MW, including 21,384MW for solar modules and 1,213MW for cells and wafers. Shipments increased 108.2% year-on-year.

Sales were $4.36 billion, up 63.1% from the previous year.

Although module prices fell significantly in the third quarter, JinkoSolar was able to achieve relatively good performance in terms of margins. Gross margin was 19.3%, up from 15.6% in the second quarter of 2023 and 15.7% in the third quarter of 2022.

Jinko Solar Energy Investor Briefing Session

During the quarter, the company had adjusted net income attributable to common shareholders of $184.6 million, an increase of 215.1% year-over-year. EBITDA was $607.4 million, an increase of 145.9% year over year.

In terms of guidance, management said that they expect module prices to decline in the fourth quarter, but that “module prices will be relatively stable” next year.

Module prices are negatively affected by oversupply, but some estimates suggest that market oversupply may have a greater impact on older production lines producing less efficient products.

By the end of the third quarter, JinkoSolar’s N-type cell volume production efficiency reached 25.6%, which is quite competitive and allows the company to capture more value than potentially less efficient cells.

In the nine months of 2023, Type N module shipments accounted for approximately 57%, and Type N premiums continued to exceed the market average.

Management expects N-type products to account for 60% of total module shipments by 2023.

In terms of outlook, management expects fourth-quarter gross margins could decline quarter-over-quarter, given the company’s greater exposure to the Chinese market.

Regionally, China accounted for about 40% of the company’s shipments this quarter.

Inflation reduction measures should help increase demand in the United States, even though inventories remain relatively high in Europe. The company is also optimistic about growing solar demand in Saudi Arabia and the Middle East.

Management has guidance for the fourth quarter of 2023 for module shipments of approximately 23 GW.

interest rate

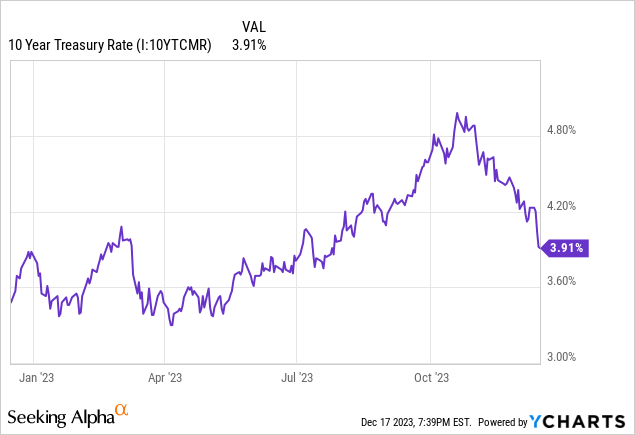

In the past, rising interest rates have made some solar projects more expensive to develop, which has been problematic.

The good news is that many economists expect interest rates to fall next year, although it is unclear how much they will fall.

Given that the 10-year U.S. Treasury bond largely reflects average interest rate expectations over the life of the bond, interest rate expectations for the future appear to be lower.

I think the interest rate cut will be a tailwind for JinkoSolar.

Lower interest rates can increase demand for solar panels, with financing often accounting for a significant portion of overall solar costs.

evaluation

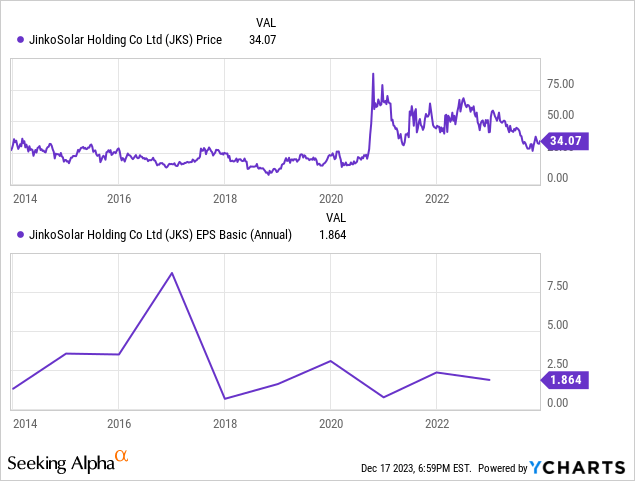

JinkoSolar has a low forward P/E valuation of 2.8 as of December 17, but the company has debt that is not reflected in forward price-to-earnings estimates.

Adding in net debt of $2.29 billion at the end of the third quarter, JinkoSolar’s forward EV/EBITDA ratio is 6.53, which is not as cheap as the company’s forward P/E multiple indicates.

JinkoSolar ultimately makes a pretty marketable product and doesn’t really have much of a moat as a result. Without a large moat, it’s hard to see a company trading for a premium valuation. The possibility of lower interest rates next year is a tailwind, but the solar industry nonetheless faces a potential oversupply.

However, I see upside potential for JinkoSolar.

One way is for a company to return capital to shareholders through buybacks that significantly reduce the number of shares outstanding, rather than simply announcing buybacks.

Given that the Chinese government likely wants as much solar power as possible to reduce carbon emissions, this scenario seems unlikely as we think management will use a significant portion of the profits for more capital investments.

JinkoSolar is already returning capital through dividends, announcing a dividend of $1.50 per American depositary share for the first time in the company’s history last September. It is not yet known whether management will maintain, increase, or reduce the dividend.

Another way for management to create value is to grow and succeed in its PV+Energy Storage business. JinkoSolar is already a well-known brand in the solar industry, and many utilities that purchase solar also require energy storage. Nonetheless, the energy storage business is relatively new, and it remains to be seen how well JinkoSolar can do.

The fact that JinkoSolar stock hasn’t actually traded on earnings is interesting because it suggests other factors have more of an impact on the stock.

One reason for the disconnect may be tensions between China and the United States. Escalating tensions could eventually result in higher tariffs on Chinese solar panels.

Another reason could be the possibility of oversupply, which could reduce margins.

From a fundamental perspective, I’d say JinkoSolar is trading at a fairly attractive valuation, but I think there’s too much uncertainty at the moment.

As a result, I consider the stock a ‘hold’ or ‘sideline’.

Given the tensions between China and the US, I’d say it would be better to ‘stand on the sidelines’ or ideally own JinkoSolar as part of a diversified stock portfolio that includes many ‘Magnificent Seven’ stocks.