JPMorgan Chase, America’s largest bank, discloses physical Bitcoin ETF holdings: SEC filing

JPMorgan Chase, the largest U.S. bank, today disclosed its exposure to a spot Bitcoin exchange-traded fund (ETF) in a new filing with the Securities and Exchange Commission (SEC).

phoenix deal

JPMorgan Chase’s SEC filing provides specific insight into the bank’s exposure to spot Bitcoin ETFs. The bank currently has exposure to spot Bitcoin ETFs issued by some of the world’s largest asset managers, including BlackRock, Fidelity, and Grayscale.

However, the amount allocated to each ETF seems a bit overwhelming considering how much other institutions are allocating to Bitcoin purchases. It is because:

“JPM, Susquehanna (which owns this ETF and was posted all over this site last week) and others are merely market makers and/or APs, other than their ownership necessarily indicates how many shares they hold in 3 It doesn’t indicate anything else, /31/24,” said Bloomberg ETF analyst James Seyffart. “If you make markets in these sectors, the number of shares you hold can fluctuate significantly from day to day. 13F data is simply a snapshot of *LONG* positions held as of March 31. 13F does not show shorts or derivatives. “We haven’t even fully looked at their actual exposure on March 31.”

Bloomberg senior ETF analyst Eric Balchunas also commented on the news, saying, “We’ll probably see a lot of the big banks reporting some of their holdings in their role as market makers/APs.” Exposure (and therefore less hypocritical for JPM).. props for capturing this, but I’m getting the file for bbg that just came out.”

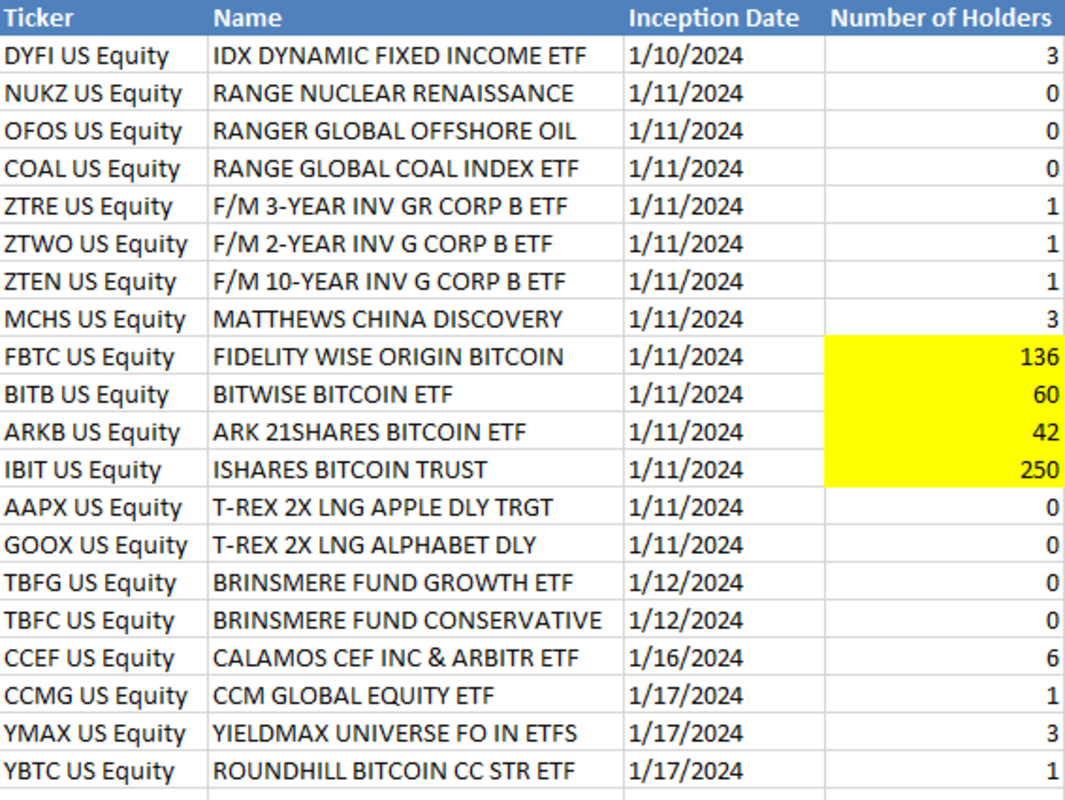

“What’s notable, IMO, is the sheer number of holders we have so far. $IBIT is up to 250, which is a huge number for the first quarter of market launch,” Balchunas said. “Here’s a comparison to other ETFs launched in the same week as BTC: There’s still about a week left in 13F.”

Eric Balchunas

JPMorgan’s disclosure comes just hours after Wells Fargo, the third-largest U.S. bank, made a similar disclosure about its spot Bitcoin ETF exposure.