Justin Sun transfers $100 million to Binance, stacking Ethereum?

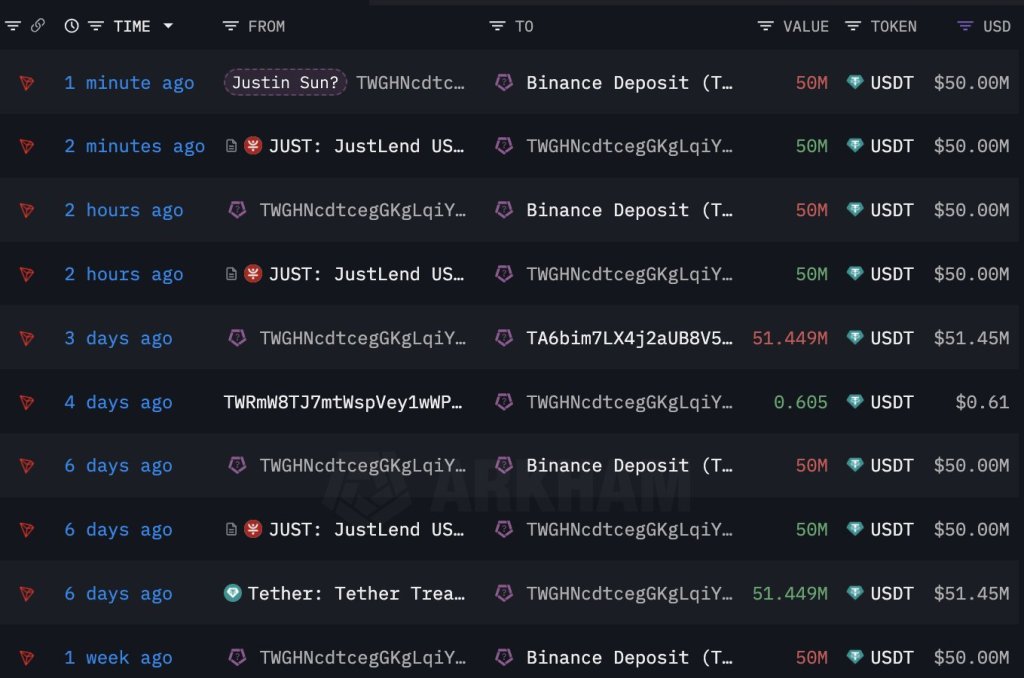

Justin Sun, co-founder of Tron, a smart contract platform for deploying decentralized applications (dapps), is once again moving and shuffling millions of dollars. According to Lookonchain data Sun reportedly transferred 100 million USDT to Binance on February 29, just days after transferring the massive sum earlier this week.

Justin Sun Has Millions of ETH: Will Co-Founder Buy More?

From February 12 to 24, wallets associated with Sun acquired 168,369 ETH at an average price of $2,894. The purchase, valued at approximately $580.5 million, currently holds unrealized profits of approximately $95 million. Considering the recent surge in demand for cryptocurrencies, especially top coins like Bitcoin and Ethereum, this could become profitable.

Looking at the Ethereum price chart, we can see that ETH is in a clear upward trend, rising from around $2,200 in early February to over $3,450 at the time of writing. Considering this pace and institutional interest in powerful crypto assets, including ETH, it is very likely that the second most valuable coin will rise.

As Bitcoin approaches $70,000, the odds of Ethereum moving higher toward its all-time high of around $5,000 also increase.

Since ETH already has a large amount of coins, there is speculation that the co-founders will purchase twice as many coins. The cryptocurrency community will continue to watch the address until this happens and there is solid on-chain data to support the purchase.

Spot Ethereum ETF and Dencun upgrades are major updates.

So far, optimism is high, especially among the broader altcoin community. As Bitcoin races to hit new all-time highs backed by billions of dollars from the agency, eyes will be on the U.S. Securities and Exchange Commission (SEC). There are several applications for spot Ethereum exchange-traded funds (ETFs).

The agency did not provide a definitive timeline for approving or rejecting derivative products. There is regulatory uncertainty about the status of ETH, which is a significant headwind that could delay or even prevent timely approval of this product.

Nonetheless, the community is looking forward to the next communication in May. If the spot Ethereum ETF is successful, the coin is likely to hit an all-time high following Bitcoin.

But before that, attention is focused on Denkun’s expected implementation. The upgrade addresses issues facing Ethereum, including scalability. With Dencun, Ethereum developers hope to lay the foundation for further improvements in throughput in the coming years.

Higher throughput means lower transaction fees and a plethora of user experiences. This upgrade could go a long way in solidifying Ethereum’s role in cryptocurrencies, fending off stiff competition from others including Solana and BNB Chain.

Featured image by DALLE, chart by TradingView

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.