Key trends in cryptocurrency in 2024

index

Key Takeaways

- bitcoin The value is expected to rise in 2024 due to factors such as the approval of a Bitcoin spot ETF and the upcoming Bitcoin halving event. These developments are expected to attract more investors and increase demand.

- coinbase We will continue our growth momentum and potentially double our sales by 2024. This growth is due to increased demand for Bitcoin and increased institutional adoption due to the approval of Bitcoin ETFs.

- Ethereum The upgrade (EIP-4844) can help you grow significantly by improving transaction throughput and reducing costs. Additionally, the integration of AI into the cryptocurrency industry is expected to significantly improve transaction analytics, efficiency, and security.

introduction

In 2023, we saw a strong resurgence in the cryptocurrency industry, and we expect the same energy to continue in 2024 as increased adoption, revenue growth, and new technology integration are just around the corner.

However, new tokens and assets, uncertain regulations, security concerns, and technological innovations speak to the dynamic nature of the industry. This can make it difficult to predict, let alone keep up with, future trends.

That said, we are seeing several new trends that will help fuel the excitement that 2023 will bring to the cryptocurrency industry. These trends include the surge in the value of Bitcoin, Coinbase’s revenue growth, increasing adoption of Ethereum, the growing influence of stablecoins, and the integration of advanced technologies such as AI into cryptocurrencies.

Learn more about the cryptocurrency trends that will shape the industry in 2024.

Trend 1: Bitcoin’s surge

Bitcoin rose another 150% in 2023, with the price soaring above $47,000 in early January 2024. Analysts predict that Bitcoin’s price rise will continue throughout the year and is likely to hit an all-time high and reach $80,000 before the end of the year.

Bitcoin’s price trajectory is strong. Chart via Coinmarketcap.com

Several factors support this prediction. First of all, the SEC approved a spot Bitcoin ETF. This ETF puts Bitcoin within the reach of the average investor directly within a brokerage account.

Bitcoin spot ETFs, traded on stock exchanges, hold Bitcoin as their primary asset and directly track the price of Bitcoin, providing investors with price exposure without directly owning the asset. This will help Bitcoin appeal to a wider range of investors, leading to increased demand and higher prices.

Another factor that could lead to a surge in Bitcoin price is the halving event scheduled to take place in April 2024. These halving events occur approximately every four years, with the last occurring in May 2020. Bitcoin halving cuts the rewards for Bitcoin mining. This means miners receive 50% less Bitcoin for confirming transactions. Historically, these halving events have been associated with price increases as the rate of new Bitcoin creation decreases, creating scarcity and ultimately increasing demand and price.

Trend 2: Coinbase’s Growth Trajectory

Coinbase is the largest U.S. cryptocurrency exchange by trading volume, and the company has been building brand authority with investors for years, giving it pricing power. In 2023, Coinbase’s stock price soared 418% and its revenue grew 14%. The company is well-positioned to continue this growth through 2024 and has the potential to double its revenues.

Coinbase stock price even surpassed Bitcoin.

The Bitcoin ETF and Bitcoin halving event are the two main catalysts for Coinbase’s expected growth. This is because both events will lead to increased demand for Bitcoin, which accounts for the majority of the platform’s trading volume.

Approval of a Bitcoin ETF is likely to lead to increased institutional adoption. This is because insurance companies, pension funds, and other institutional investors who are reluctant to trade cryptocurrencies are more likely to invest in ETFs because they are regulated and provide reliable services. -Known investment structures. Coinbase is the sole custodian for all Bitcoin ETFs proposed so far. This should generate significant revenue in the form of child support.

Trend 3: Ethereum’s rise

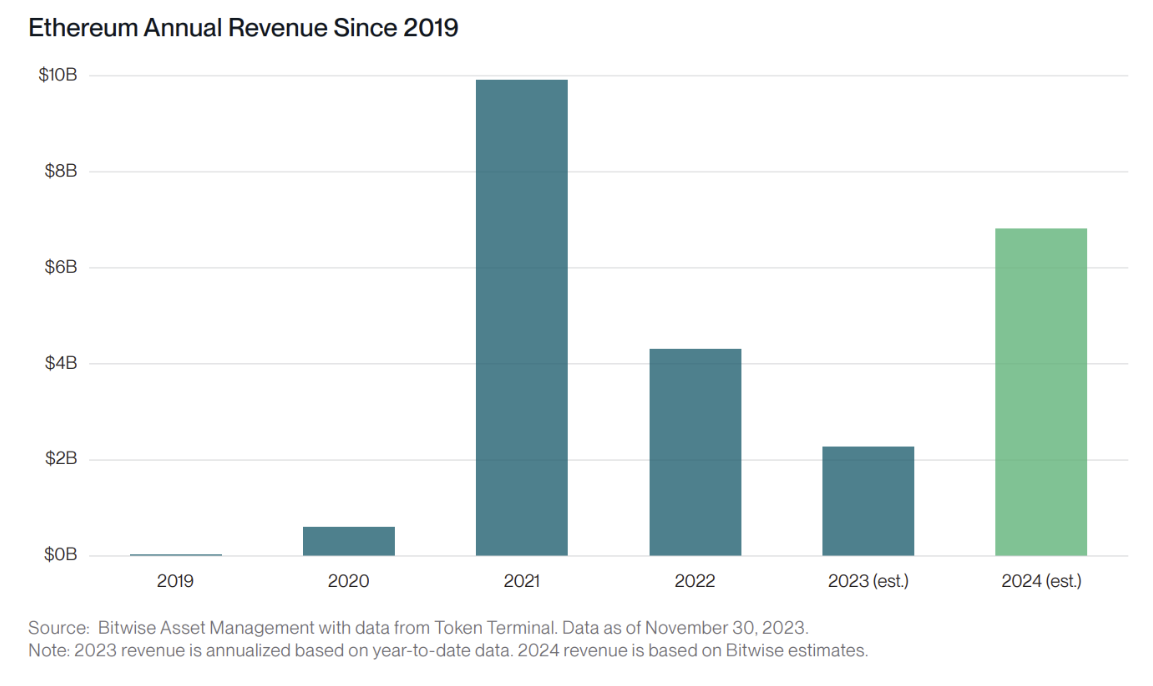

Ethereum is also expected to see rapid growth in 2024, with some analysts predicting that its revenues will double.

This is partly due to a significant upgrade known as EIP-4844, which is expected to occur in the second half of this year. The upgrade will increase throughput to 100,000 transactions per second and reduce transaction costs by 90%, making the network more accessible to mainstream users and driving adoption.

Over the years, Ethereum has made significant efforts to improve adoption of cryptocurrency projects. Ethereum provides smart contract functionality, serves as the underlying platform for the DeFi ecosystem, provides a framework for NFT tokenization and sale, and enables the creation and issuance of new tokens. Simply put, it serves as a foundation for the growth of various cryptocurrency projects, and lower transaction costs will make the platform more attractive to users.

Trend 4: Stablecoin Revolution

While most attention through 2024 is focused on Bitcoin, investors will want to keep an eye on stablecoins next year as well.

In the second half of 2023, JP Morgan announced an enhanced tokenized payments platform, PayPal launched stablecoins, and Visa expanded its stablecoin payments capabilities. These events complement the optimistic predictions made for stablecoins in 2024. Bitwise predicts that stablecoins will surpass Visa in terms of payment volume.

There has also been significant progress in stablecoin regulation in 2023. According to Cointelegraph, stablecoin regulations were implemented in 25 countries last year. The United States is likely to take action on stablecoin regulation next year. This will give the United States a mechanism to oversee adoption and ensure a central role in supervising and regulating stablecoin issuers. It will also allow the United States to serve as a home to growing companies that will be strategically important in expanding the role of USD and other stablecoins in the global economy.

Trend 5: On-chain innovation for traditional finance

Additionally, on-chain innovation is expected to increase in 2024. In 2023, JP Morgan worked with a handful of blockchain companies to demonstrate how a proof of concept could be possible for asset managers to tokenize, purchase and rebalance their funds on the blockchain of their choice. Position in tokenized assets across multiple chains.

The demonstration coincides with the traditional financial sector’s growing interest in cryptocurrency and blockchain technology. In 2024, we will see more traditional financial companies exploring on-chain innovation through partnerships and services as regulatory clarity improves.

Trend 6: AI, decentralization, cryptocurrency

Integrating AI tools into the cryptocurrency industry holds tremendous potential, and we expect some of this potential to come to fruition in 2024. More companies will use AI algorithms to speed up transactions, analyze transaction data, and improve efficiency and security.

AI trading tools will also become more sophisticated and user-friendly, making cryptocurrency trading more accessible to many investors. AI is also essential for real-time sentiment analysis, regulatory compliance, and forecasting. We are also likely to see the emergence of AI-based personal trading assistants that can learn the risk appetite and preferences of individual traders to provide tailored advice and manage trades.

The decentralized prediction market is likely to grow by 2024. Prediction markets have been around for years, but cryptocurrencies take them one step further by making them permissionless and borderless and automating functions such as issuing payouts and determining winners and losers. We expect decentralized prediction markets to become the primary venue for sports-based and event-based betting.

Finally, we can expect financial advisors to increasingly allocate to cryptocurrencies in 2024. According to a Bitwise survey, 98% of financial advisors with a cryptocurrency allocation to client accounts plan to maintain or increase that exposure in 2024.

Investor Implications

As you can see, many interesting cryptocurrency trends will emerge in 2024. Analysts predict that Bitcoin’s price and reputation will rise, Coinbase’s profits will increase, Ethereum will establish itself as a powerhouse, and stablecoin adoption will increase.

We can also expect more financial companies to explore on-chain innovation and AI to play a more important role in the cryptocurrency world. If you are currently investing in cryptocurrency, it is a good idea to look at your portfolio regularly to see how these trends may affect your investments.

Also, subscribe to Bitcoin Market Journal for the latest news for cryptocurrency investors!