Korean Stock Recommendations (September 2024)

I’m expanding and simplifying us. Korean stock recommendations Posts – Substack’s auto-generated posts table of contents (on the left side of desktop-only browsers) also helps make long Substack posts easier to read (although it seems like you have to publish and then unpublish a post.

But what only I know is amazing asset securities (KRX: 006800 /KRX: 520003), As the largest investment banking and stock brokerage firm in Korea by market capitalization, they consistently provide free Korean stock research (they didn’t release too much in September).

Therefore, I added the title of last month’s post (usually low-following Korean stocks) that I covered in Monday’s post, along with a brief description. Japan, Korea, Taiwan stock indices; Wikipedia link (🇼) items and tags (🏷️); Latest price/book value, forward P/E, forward dividend yield; Long term technical chart.

Stocks Covered:

Samsung Engineering, Geumyang Co., Ltd., Korea Zinc, Youngpoong Precision Co., Ltd. (Korea Zinc affiliate), KEPCO Plant Service Engineering Co., Ltd., LIG Nex1 Co., Ltd., Samyang Food Co., Ltd., SK Biopharm, SK Hynix, Meritz Financial Group, Celltrion, SK Telecom, Gravity Co., Ltd., Shift Up Co., Ltd., Nexon Games, Hanwha Galleria, Gangwon Land, Cheonbo Co., Ltd., Samsung C&T Co., Ltd., SK Co., Ltd., Hojeon Co., Ltd., Eco Pro HN, Hanmi Pharmaceutical & Samsung Securities

On the other hand, it is worth noting that a flock of foreign investors chasing China’s stimulus rally appear to have pulled some of their money out of the country to finance their purchases.

📰 Foreign investors sell off Korean stocks in largest volume since August 2021 (October 2024) Korea Times

As global economic uncertainty accelerated the withdrawal of overseas investors, foreign investors sold more than 7 trillion won in Korean stocks last month.

And a quick value boost update:

Bank and telecommunication stocks are falling due to the exclusion of the value up index. (Hankook Ilbo) September 2024

And as always, this post Provided for informational purposes only (And to make your life easier…). This does not constitute investment advice and/or recommendations…

🔬 Research analysis (including articles/blog posts by fund managers, etc.) 🎥 video; 🎙️ podcast; 🎬 Webinars; 📰 Newspaper/Magazine Articles; 📯 press release; 💻 Substack/Blog/Website Articles; ✅ Our own posting; 🗃️ Archived article; ⏰ Upcoming webinar or event ⚠️ Public or limited access, for example based on your location, investor status, etc. 🇼 Wikipedia page.

🔬 Samsung E&A (028050/Buy) – There is ample room for share price appreciation despite the decline. (Mire Asset Securities) 2024.09.30 ⚠️

-

🌐 Samsung Engineering (KRX: 028050) – We are an EPC specialist company. Plant industry (oil and gas processing, refining, petrochemical, industrial, environmental, BIO and green solutions sectors). 🇼 🏷️

-

Price/Book (most recent quarter): 1.01

-

Trailing P/E: 5.47 (no forward P/E) / Annual Dividend Yield: Not applicable (yahoo! financial resources)

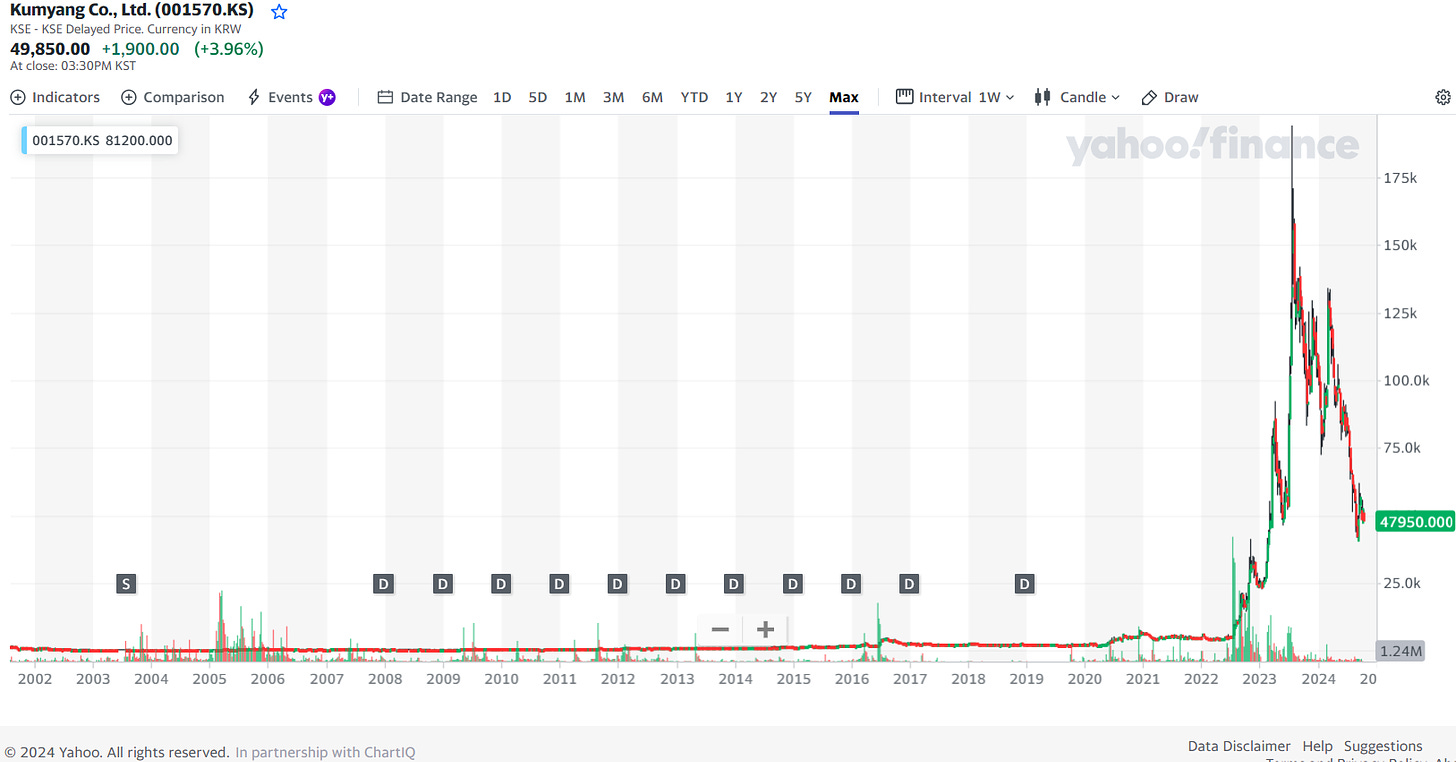

💻 Geumyang Capital Raise Drop: Breaking the Arbitrage Play (Smartkarma) September 28, 2024 $

💻 Geumyang: Paid-in capital increase of KRW 450 billion (Douglas Research Insights) September 28, 2024 $

-

🌐 Geumyang Co., Ltd. (KRX: 001570) – Chemical materials (cylindrical secondary battery cells, chemical foaming agents, etc.) 🏷️

-

Price/Book (most recent quarter): 17.41

-

Trailing P/E: 162.61 (no forward P/E) / Annual Dividend Yield: Not applicable (yahoo! financial resources)

memo: Bain joins race for control of world’s largest zinc smelter (feet) $ 🗃️ – A large commodities group whose founding families compete and watch the results. Korea Zinc (KRX: 010130)

💻 MBK raises Korea Zinc’s tender offer price by 13.6% to 750,000 won (Douglas Research Insights) September 26, 2024 $

💻 What do local residents say about those who may ally with the Choi family in the fight for Korea Zinc? (Douglas Research Insights) September 24, 2024 $

💻 MBK’s four major points of interest regarding Korea Zinc’s management (Douglas Research Insights) September 21, 2024 $

💻 Korea Investment & Securities becomes a white knight for the Choi family of Korea Zinc (Douglas Research Insights) September 20, 2024 $

💻 MBK Partners and the Jang family secure management rights to Korea Zinc + tender offer for 14.6% of shares in Korea Zinc (Douglas Research Insights) September 13, 2024 $

-

🌐 Korea Zinc (KRX: 010130) – Overseas resource exploration and discovery of new rare metals + smelting-related industries and resource recycling business 🇼🏷️

-

Price/Book (most recent quarter): 1.72

-

Trailing P/E: 30.27 (no forward P/E) / Annual Dividend Yield: 1.85% (yahoo! financial resources)

💻 Youngpoong Precision’s NAV evaluation and future domestic tender offer case study (Douglas Research Insights) September 18, 2024 $

💻 Youngpoong’s NAV analysis and three potential scenarios for the Choi family’s counterattack strategy (Douglas Research Insights) September 14, 2024 $

💻 MBK tender offer for 43.4% stake in Youngpoong Precision (Douglas Research Insights) September 13, 2024 $

🔬 KEPCO KPS (051600KS/Buy) – At the forefront of nuclear power revival (Mire Asset Securities) 2024.09.25 ⚠️

-

🌐 KEPCO Plant Service Engineering Co., Ltd. (KRX: 051600) – Plant total solution (plant equipment diagnosis and performance improvement, O&M, new EPC, industrial equipment and transmission substation) 🇼 🏷️

-

Price/Book (most recent quarter): 1.60

-

Trailing P/E: 11.26 (no forward P/E) / Annual Dividend Yield: 4.82% (yahoo! financial resources)