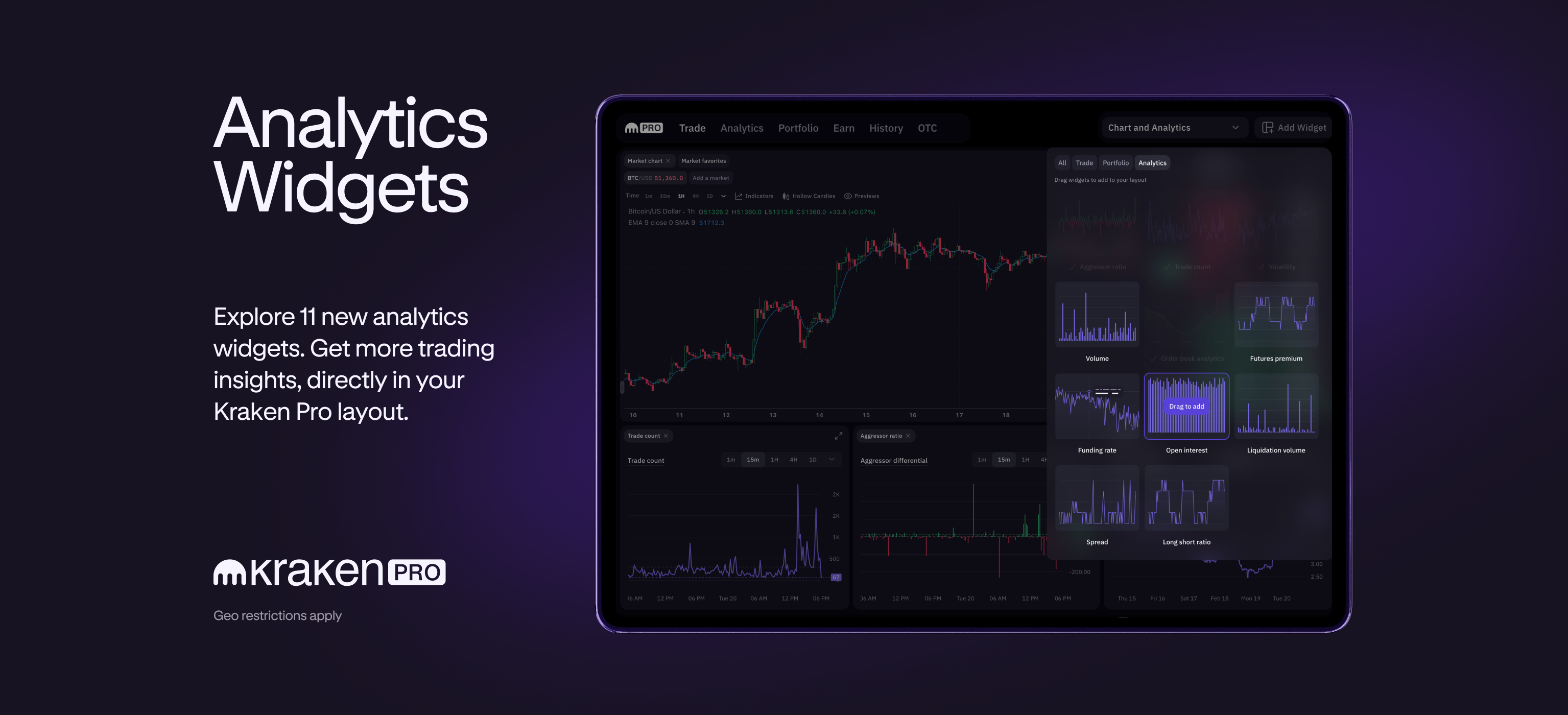

Kraken Pro’s New Analysis Widget: Improve Your Trading Strategy

These widgets not only provide advanced analysis of both spot and futures markets, but also integrate seamlessly with existing trading and portfolio widgets. Discover opportunities and open new paths to find alpha. Enhance your trading like never before.

Introduction to advanced analytics for spot and futures markets

Our dedication to your trading experience gives you a suite of widgets to meet a variety of analysis needs. Whether you want to gauge market sentiment with Aggressor Ratio, monitor market activity with Trade Count, or make informed investment decisions with Volatility and Volume, our latest additions offer Comprehensive market data is at your fingertips.

Spot and futures market insights

- Attacker Rate: Take a closer look at the taker buying and taker selling imbalance in your chosen market.

- Number of transactions: Check the number of transactions within the selected period.

- volatility: Measure market volatility with the rolling volatility metric.

- Volume: Assess market liquidity with detailed trading volume

- Order book analysis: Analyze bid/ask quantity imbalances and explore potential slippage scenarios

futures market monopoly

- Funding Rate: Get hourly updates on expected funding rates to stay ahead.

- Open Interest: Monitor the total number of contracts in the market.

- Futures Premium: Future-Based Research for Strategic Insights

- diffusion: Watch the top of the book spread for optimal bid and ask prices.

- Long/Short Ratio: Gain market positioning insight with long/short ratios

- Liquidation amount: Track liquidations to understand market dynamics and risks.

Real-time updates and customizable views

Customize your analysis view to suit your trading strategy using custom real-time update widgets. With the flexibility of drag-and-drop and resizing, along with a time period selector from 1 minute to 1 week, this widget integrates seamlessly into custom trading layouts. It updates dynamically based on your selected market, ensuring data relevance and timeliness.

Examples of custom layouts for different trading strategies

day trading

It combines volume and volatility widgets with market charts, order books, and order forms for a layout that provides quick insight into market trends. Add trade counts to monitor intraday high-frequency trading activity levels.

swing trading

For those focusing on medium-term strategies, integrating the Aggressor Ratio and Futures Premium widgets with depth charts and price alerts can provide a deeper understanding of market sentiment and potential price breakouts.

arbitrage

Traders looking for arbitrage opportunities will find the layout, which combines spreads (for futures markets), order book analysis and volume widgets, very useful. This can be used in conjunction with market charts and order forms to quickly identify price discrepancies in the market or between pairs and take action.

risk manager

Integrating liquidation volume and long/short ratio widgets with funding ratio and open interest helps clients assess market risk and leverage positions more effectively. Combine this with price alerts and order books to keep a close eye on your trading and market conditions.

Discover new strategies through integrated analysis

By integrating the new analytics widget with Kraken Pro’s customizable layout tools, clients can utilize a variety of trading strategies tailored to both spot and futures markets. This cohesive approach will not only enrich your trading experience, but also give you the insight you need to navigate the cryptocurrency markets with confidence and accuracy.

Explore new possibilities, customize your interface, and leverage these powerful tools to enhance your trading strategy!

These materials are provided for general information purposes only and are not investment advice or a recommendation or solicitation to buy, sell, stake or hold any cryptocurrency or to engage in any particular trading strategy. Kraken makes no effort to increase the value of the cryptocurrency you purchase. Some cryptocurrency products and markets are unregulated and you may not be protected by government compensation and/or regulatory protection schemes. The unpredictable nature of the cryptocurrency market may result in loss of funds. Taxes may be payable on the appreciation and/or reporting of your cryptocurrency assets and you should seek independent advice on your tax position. Geographic restrictions may apply.