Kraken takes aim at Coinbase’s Bitcoin storage dominance and launches institutional service

Nine new spot Bitcoin exchange-traded funds have amassed more than 300,000 Bitcoin as assets under management in less than two months. And so far, US-based Coinbase has been the primary cryptocurrency exchange mandated to act as custodian for issuers offering these new investment products.

But now Kraken, a California-based rival of Coinbase, appears to want to challenge the status quo.

Kraken announced its new institutional brand on Tuesday, saying it wanted to mitigate the risk of relying on one company to provide most of the custodial services for identifying Bitcoin ETF issuers.

“The approval and subsequent launch of the Bitcoin ETF has only highlighted the need for a broader range of custody solutions,” Tim Ogilvie, head of institutions at Kraken, told The Block. “The upcoming launch of Kraken Custody is timely to overcome potential concentration risks with multi-party custody and diversify the risks of an ecosystem that relies on a single custodian.”

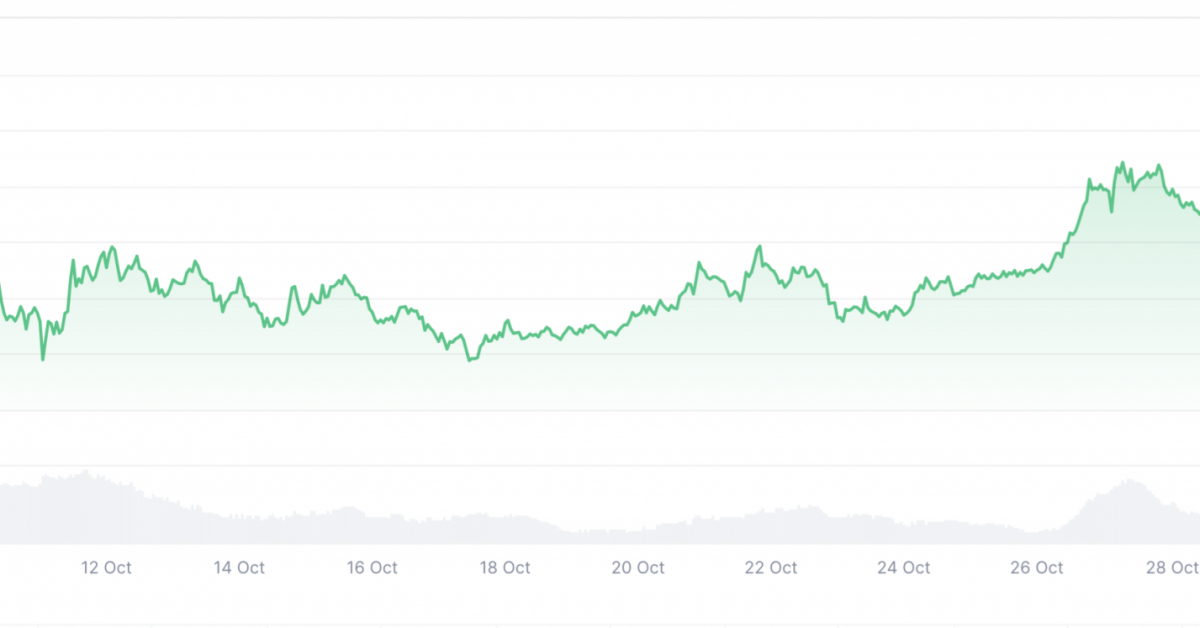

Custodians play a key role in the emerging Bitcoin ETF market as they safeguard the billions of dollars worth of Bitcoin owned by the ETFs. Earlier this month, Coinbase CEO Brian Armstrong told analysts during an earnings call: “We finished eighth out of 11. Bitcoin  BTC

BTC

+4.35%

“Custody has been delegated by the issuer, and as a result, Coinbase Custody now holds approximately 90% of the $36 billion in Bitcoin ETF assets.”

Disrupting Coinbase’s dominance.

In an effort to usurp Coinbase as the “single custodian” that Ogilvie referred to, Kraken launches Kraken Institutional. The company said the new brand will serve the biggest names in finance, including institutions, asset managers, hedge funds and high-net-worth individuals.

“Institutional adoption of cryptocurrencies is growing rapidly,” Ogilvie said in a statement Tuesday. “The recent ETF approval further broadens institutional demand. Together with Kraken Institutional, Kraken is consolidating its products and services to meet the needs of institutional clients.”

As of the end of last week, spot Bitcoin ETFs had nearly $40 billion in assets under management, according to CoinShares. Daily trading volume for nine new ETFs hit a new record on Monday, surpassing buying and selling activity on the first day the products began trading.

Attracting ‘new entrants’ to institutional cryptocurrency

Ogilvie emphasized the benefits of not falling victim to a market controlled by a single custodian, while also teasing that Kraken’s strategy is driven by a desire to attract institutional clients that have not yet entered the market.

“The diversification of the institutional market to include more types of asset managers makes this a timely development, especially as institutional adoption of cryptocurrencies is expected to grow rapidly,” Ogilvie told The Block. “So this is more about preparing the ground for new entrants starting to participate in the digital asset class than it is about capturing existing market share.”

Disclaimer: The Block is an independent media outlet delivering news, research and data. As of November 2023, Foresight Ventures is a majority investor in The Block. Foresight Ventures invests in other companies in the cryptocurrency space. Cryptocurrency exchange Bitget is an anchor LP of Foresight Ventures. The Block continues to operate independently to provide objective, impactful and timely information about the cryptocurrency industry. Below are our current financial disclosures.

© 2023 The Block. All rights reserved. This article is provided for informational purposes only. It is not provided or intended to be used as legal, tax, investment, financial or other advice.