Kratos Defense & Security Solutions: A Good Choice for the Defense Industry (NASDAQ:KTOS)

Sean

investment thesis

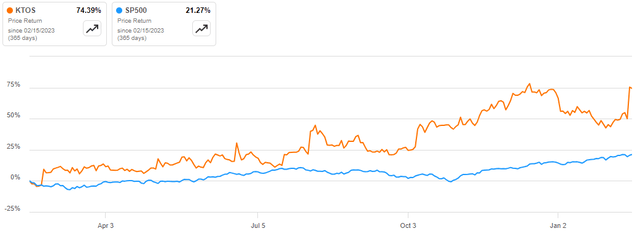

Kratos Defense & Security Solutions, Inc. (NASDAQ:KTOS) The stock has performed impressively over the past year, gaining more than 74% and outperforming the S&P 500 by more than 53%.

pursue alpha

Despite these solid achievements, I I am bullish on the stock due to its strong financial performance, competitive advantages, and diverse portfolio. From a technical perspective, the company has strong upward momentum and a target price of $32.82.

financial performance

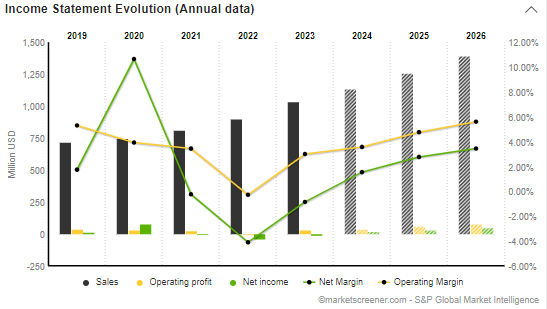

Considering how important financial strength is for all investments, KTOS has demonstrated strong performance in this area. Since 2019, the company has continued to grow its revenue from $718 million in 2019 to $1.037 billion in 2023, representing a growth of 44%. In addition, after the company’s profitability was hit hard and fell significantly due to the impact of COVID-19, it rebounded strongly in 2023 with improved operating profit. In 2022, it will decline from negative $3 million to positive $31 million. Net loss also improved from $37 million in 2022 to $9 million in 2023. The company’s financial outlook is also promising, with the company expected to turn profitable this year and maintain continued financial growth until at least 2026.

market screener

This strong performance continued at MRQ, with EPS coming in at $0.12, compared to $0.08 in the same period last year and beating estimates by $0.04. Revenues were $273.8 million, up 9.83% year-over-year and beating estimates of $19.41 million. This strong performance was the result of a number of reasons, including increased demand for high-performance unmanned systems and effective execution of a strategy to leverage core competencies.

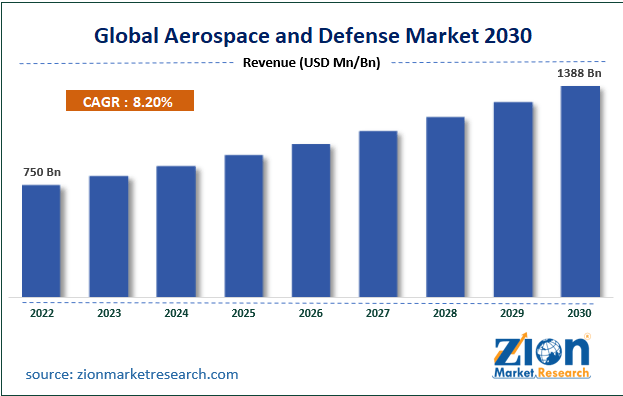

In particular, considering its competitiveness and diverse portfolio, it is expected to maintain solid performance over the long term. These two levers will further strengthen as strong market growth is expected in the aerospace and defense industry. According to Zion Market Research, the industry is expected to grow at a compound annual growth rate (CAGR) of 8.2% from 2022 to 2030.

Zion Market Research

Competitive Advantage: Why KTOS is well-positioned to capitalize on expected growth

While the market is expected to grow, we believe that only strategically positioned companies will benefit the most from this growth. Against this background, KTOS believes there is a better opportunity to leverage market trends for competitive advantage. First of all, the company sets itself apart from its competitors by offering highly innovative and very unique products. To support this claim, I will mention one of the company’s unique and latest innovations – the XQ-58 Valkyrie. It is a combat drone that can be used to carry weapons or support fighter jets using AI. It is claimed that this innovative product could play an important role in America’s military efforts to use AI in line with the advancements of other rival countries, such as China.

One of the unique features of this product is its unique design. The aircraft has a trapezoidal-shaped fuselage harmoniously integrated with swept-back main wings and a distinctive V-shaped tail with overhead air intakes.

This layout is very important because it not only improves the aerodynamics of the aircraft, but also makes it very stealthy, creating great difficulty for potential enemies to spot or track it. This product has several advantages: For example, it is low cost and highly autonomous. Producing 50 artifacts per year can be produced at a unit cost of $4 million, and increasing the annual production rate to 100 artifacts has the potential for less than $2 million.

Another advantage is that it can act as a loyal wingman for manned aircraft, providing additional firepower and electronic warfare support. It also has the ability to reach altitudes as high as 60,000 feet at high speeds of 650 miles per hour, allowing it to quickly approach and attack enemies above air defenses. These are just a few of the many unique characteristics and benefits of this technology. These outstanding products highlight the professionalism of the company and, in my opinion, make it what MOAT is.

Their innovative culture is supported by a diverse portfolio specializing in unmanned systems. In my opinion, this diversity helps the company appeal to a broader customer base and diversify its revenue streams. We also believe it helps improve customer satisfaction because there are a variety of products to choose from to meet customers’ needs. This is backed by long-term contracts with our customers, which we believe translates into high levels of satisfaction. For example, on the 14th of this month, the company received a $579 million government contract that includes an option to operate until 2032. This will be a huge boost to your bottom line and will also mean your ability to pursue new business opportunities. .

technical analysis

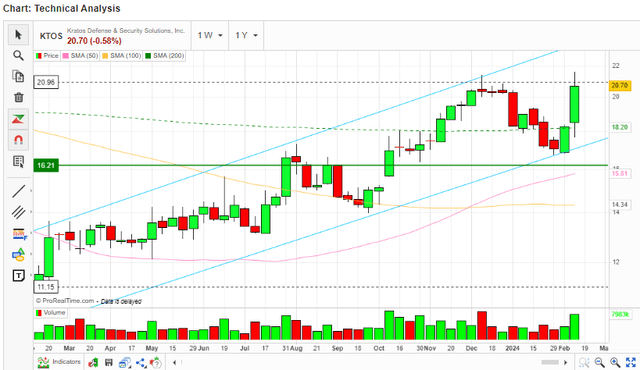

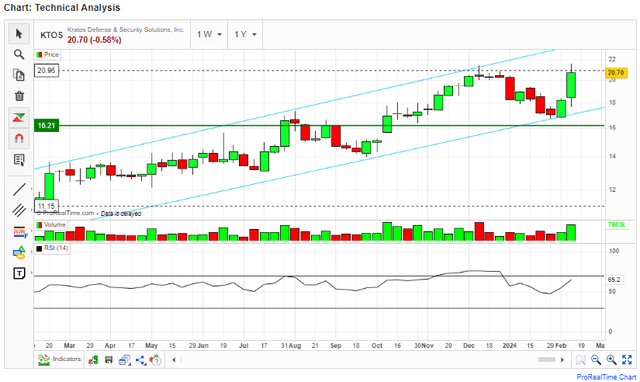

From a technical perspective, KTOS is currently on an upward trajectory, as can be seen by the blue trend line in the price chart below. Additionally, the price is above the 50-day, 100-day, and 200-day moving averages that act as support, indicating a continuation of the bullish trend. Solid upward momentum was confirmed, with the 50-day moving average and 100-day moving average crossing, suggesting that the trend is very strong.

market screener

Additionally, the RSI is 65.2, which means the stock is not yet overbought and has more room to grow before reaching the overbought zone of 70. In particular, RSI is showing an upward trend, which is a sign of a strong bullish trend.

market screener

Finally, there are two main target areas for this stock. The first area is a strong support area around $10.13 and the other area is a resistance area around $32.82. The company bounced strongly from the support zone and is now rising towards the resistance zone. Based on past price movements and patterns, we predicted the price movement indicated by the arc below, which led to our target price of $32.82.

TradingView – Author

I believe that the company’s competitive advantages and expected market growth will continue to improve its financials, pushing the stock price up to my target price. To support my bullish outlook on this stock, I will refer to the relative valuation metric where the stock has a PS ratio of 2.61, which is higher than the industry median of 1.48. In my opinion, this reflects the market’s confidence in this stock relative to its peers, and the fact that its Forward PS Ratio is 61.09% higher than the sector median reflects the market’s high expectations of the company’s future performance. I agree with this considering the competitiveness of the company. Benefits and expected market growth. Additionally, the PBR of 2.75, which is higher than the industry average of 2.72, shows that the market is willing to pay more for the company’s equity than the book value of its assets, which means that the company has high growth potential. .

danger

I am bullish on this stock, but investing in it, like any other investment, is not without risk. One of the company’s major risks is cybersecurity threats. Because KTOS has an extensive technology platform, it faces the risk of security breaches as well as cyber attacks. These risks can compromise intellectual property and customer data, resulting in legal liability, regulatory action, or even reputational damage. This can have a significant impact on our financial performance and stock price. Another potential risk is dilution. Potential investors should expect share dilution, considering shareholders have been diluted over the last year, leading to a 2.4% increase in shares outstanding.

conclusion

In conclusion, I think this stock is moving in the right direction and I recommend it to those looking for exposure to the defense industry. Innovation and diversity bode well for future success. However, potential investors should be aware of the potential risks associated with this investment, as described above.