KuCoin guarantees that user funds are safe after the US imposed criminal charges.

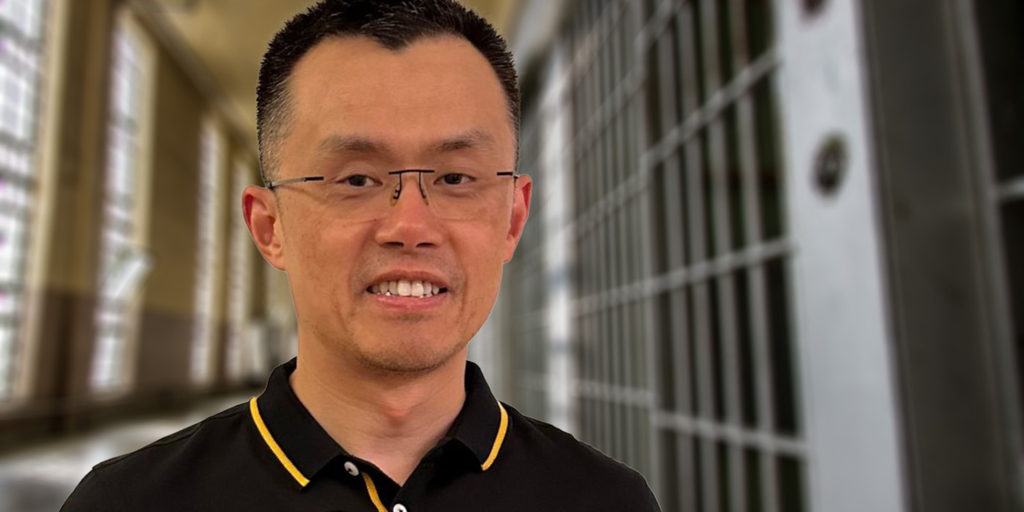

KuCoin CEO Johnny Lyu said the US criminal charges against the exchange would not affect the operational stability of the platform and assured users that their funds were there. stay safe.

Lyu made the statement on social media after the U.S. Department of Justice (DOJ) announced criminal charges against the exchange for violating anti-money laundering (AML) laws.

Liu said:

“Your assets are safe and sound with us. My team and I will provide timely updates on our progress.”

KuCoin was also created. official statement He said lawyers were looking into the details of the allegations. Likewise, the exchange assured users that their funds were “absolutely safe.”

criminal charges

The U.S. Attorney’s Office for the Southern District of New York announced that it had charged KuCoin, along with founders Chun Gan (known as Michael) and Ke Tang (known as Eric), with operating without the necessary legal permits and failing to comply. AML laws will apply from March 26.

The indictment accuses the platform and its founders of circumventing the Bank Secrecy Act and operating an unlicensed money transfer business.

Damian Williams, the U.S. attorney leading the case, outlined the charges, arguing that KuCoin and its founders avoided U.S. regulatory action despite having a significant user base in the United States.

The indictment criticizes KuCoin for failing to implement required AML policies, which allegedly allowed more than $9 billion in suspicious and illicit funds to be transferred through the exchange.

The document also points out that KuCoin was late in adopting customer identification measures that took effect in July 2023 after the federal investigation began and was not applied retroactively to existing customers, including in the United States.

The indictment also alleges that KuCoin sought to conceal the presence of U.S. customers on its platform and misrepresented this information to investors. The exchange has been criticized for promoting itself on social media as a platform where US users can trade anonymously.

Meanwhile, charges against the two exchange founders include conspiracy to operate an unlicensed money transfer business and violation of the Bank Secrecy Act, and each charge carries a maximum sentence of five years in prison.

KuCoin and related entities face multiple charges, the most serious of which is violating the Bank Secrecy Act, which carries a potential prison sentence of 10 years.

Cryptocurrency Products

The indictment states that KuCoin violated the Commodity Exchange Act (CEA) by failing to register with the CFTC despite allowing users to trade commodities on its platform.

According to the document:

“Bitcoin and other cryptocurrencies are “goods” under the CEA.

The filing did not specify any other cryptocurrencies and only Bitcoin was mentioned in connection with the CFTC complaint. However, the indictment mentions Ethereum in another section describing KuCoin’s spot trading activities.

DeFi Education Fund Board Member Jake Chervinsky famous The CFTC complaint against KuCoin specifically classifies three cryptocurrencies as commodities: Bitcoin, Ethereum, and Litecoin.

The inclusion of ETH in the CFTC complaint is significant considering recent rumors that the SEC is investigating the Ethereum Foundation for classification as a security.

Chervinsky believes this inclusion means the CFTC is directly challenging the SEC’s approach to investigating Ethereum and other digital assets. This development marks a notable departure from the generally cautious stance taken by the agency regarding jurisdictional overlap related to cryptocurrencies.

According to Cherbinsky:

“It may seem trivial, but it’s actually a pretty savage inter-agency drama by DC standards.”