La-Z-Boy Incorporated: Optimism Amid Housing Shortage Crisis (NYSE:LZB)

ionic

outline

La-Z-Boy Corporation (New York Stock Exchange: LZB) is a leading global manufacturer of reclining chairs and the second largest furniture distributor in the United States. According to a KeyBanc consumer survey, it is also the brand with the highest interest in purchasing new furniture. But the outlook is The furniture industry showed a somewhat sluggish performance due to the housing shortage and continued inflation. Despite the turmoil in the housing market, LZB is focusing on solidifying its business by expanding its market share and strengthening its operating profit margin. Additionally, my relative valuation gives me a target price of $36.98 and an upside of 12%. Therefore, we recommend a Buy rating.

historical financial analysis

author chart

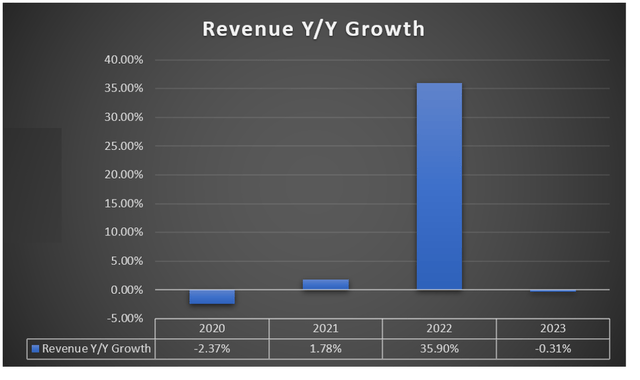

In FY22, the year-on-year revenue growth rate increased significantly at 35.90%. Revenues increased by $622.6 million over FY21. As retail and manufacturing businesses reopen post-pandemic, LZB will see significant Increased orders. Pent-up demand during the lockdown led to a surge in orders, indicating a significant surge in consumer interest in the product once restrictions were lifted. Increased demand due to the impact of the pandemic has led to a relative decline in delivery volumes. FY23So there is a ~0.3% reduction.

author chart

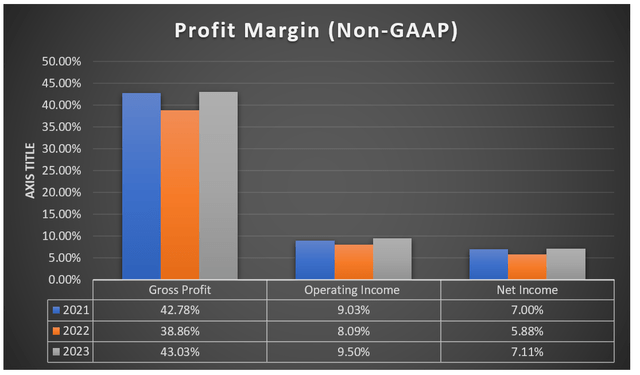

Moving to margins, LZB’s annual margins increase slightly overall. Gross margin improved ~4.1% due to increased sales volume in the retail segment, which has higher gross margins than the wholesale segment. Pricing and surcharge actions implemented in previous years to address inflationary cost pressures were realized in FY23, resulting in improved gross margins.

These inflationary pressures on raw material and freight costs have been driven by pandemic-related challenges in global supply chains. LZB has therefore taken action on pricing and surcharges to counter rising costs. Despite cost reductions in FY23, continued global supply challenges in the first half of FY23 partially offset LZB’s robust margins. Additionally, annual SG&A expenses increased by 2.7%. This is primarily due to higher sales volumes in the retail sector, resulting in higher marketing costs to drive sales. As a result of the strong top line in FY23, non-GAAP operating margins reached an all-time high of 9.5%, up 1.4% from FY22. Net profit margin increased 1.23% overall, reaching 7.11%.

Third quarter ’23 revenue was down 13% compared to third quarter ’22 revenue, which benefited from higher backlogs related to the pandemic. This quarter’s results were significantly impacted by winter weather. This has slowed production, resulting in delayed deliveries, temporary closures of production facilities, and slowed store traffic. LZB has maintained a strong balance sheet and financial position with $333 million in cash and no external debt.

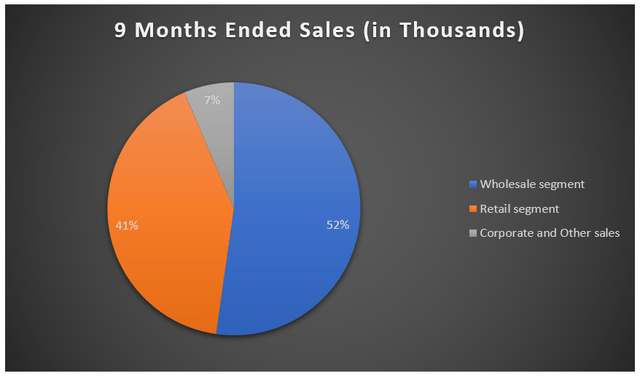

profit sector

LZB’s business can be divided into three sectors: wholesale, retail, corporate and other sectors. The wholesale segment can be further separated into three segments: La-Z-Boy, its largest operating segment, its UK subsidiary, and its case goods brands (American Drew, Kincaid and Hammary). The retail segment consists of 171 stores, selling furniture and case goods to end consumers.

author chart

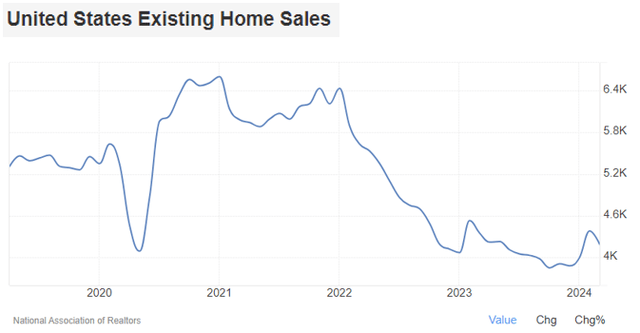

sluggish housing market

trade economics

Existing and new housing activity has a significant impact on the overall growth of this industry. Discretionary spending on home furnishings increased during the start of FY21 and FY22, driving demand. Existing home sales plummeted in 2022 and 2023 as the Federal Reserve began raising interest rates in 2022 to stem inflation, which in turn weighed on the housing market.

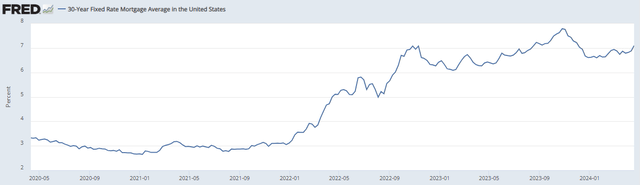

The Federal Reserve’s inaction on interest rates has caused existing home sales in the U.S. to stagnate for some time. Since then, the Federal Reserve has kept interest rates stable due to lack of confidence in controlling inflation. The 30-year fixed mortgage interest rate currently remains high, averaging around 6%. In addition to lower mortgage rates, increased housing inventory will moderate housing price increases.

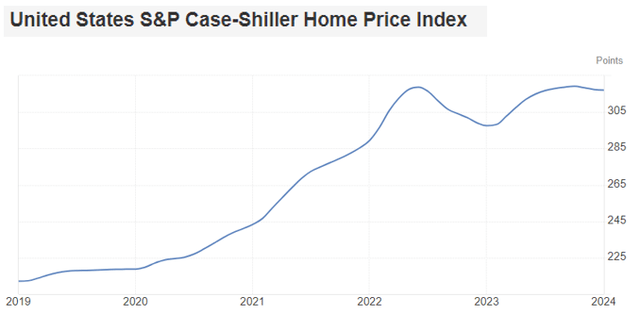

According to the S&P Case-Shiller Home Price Index, prices fell slightly in early 2024 despite having generally been rising for quite some time. Existing homeowners with relatively low mortgage rates may be reluctant to move because it would be expensive to refinance to current higher rates. This reluctance reduces the number of homes available for sale, which results in lower housing supply and higher prices for existing and new homes. This will ultimately impact the home furnishings industry until homebuyers are more certain about where interest rates are headed.

trade economics trade economics

LZB is preparing and looking forward to the normalization of the furniture industry.

LZB management expects a return to normal household demand in the second half of FY25, driven by favorable demographics and potential interest rate easing. They see the upside in that the ongoing structural housing shortage could support long-term demand for households as housing inventory grows. Additionally, falling interest rates may allow demand to return to normalized levels.

In response to this situation, they are focusing on strengthening their business over the long term by increasing market share, increasing sales, and strengthening operating margins in line with Century Vision’s growth strategy. This included acquisitions and store openings. They have already acquired six independent stores this quarter and are adding two more independent stores in the next quarter. This brings the total to 11 store acquisitions in FY24. These independent store acquisitions are critical to LZB’s profitability, integrating them into our existing operations and optimizing our retail operations by leveraging vertical integration and wholesale-retail margins.

Additionally, having independent stores ensures a uniform brand experience across your retail network. This acquisition supports LZB’s vertically integrated model by controlling more of the retail process, which is a significant competitive advantage as it allows us to deliver furniture at a strong speed to market.

evaluation

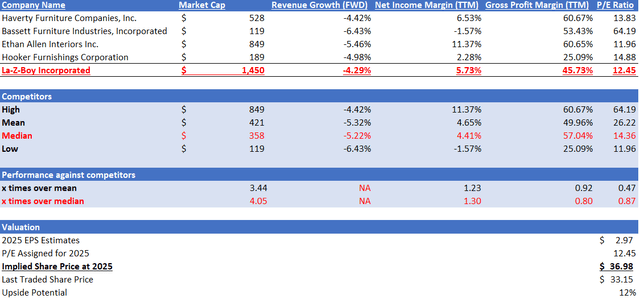

Author’s evaluation

LZB is the second-largest manufacturer in the United States and has a market capitalization of $1.45 billion, the highest among its peers. Their products are in the upper-middle price range, above budget but below luxury, and they specialize in residential furniture for living rooms, bedrooms and dining rooms. I will compare LZB to its peers in the competitive home furnishings industry.

All companies showed negative net revenue growth, indicating a slowdown in the economy. Among its peers, LZB is still performing better, with a decline forecast that is about 1% lower than the median of its peers. LZB has a slightly lower TTM gross profit margin, but has surpassed the TTM net profit margin. TTM’s gross profit margin is 45.73%, which is 0.80 times the median of 57.04% for its peers. TTM’s net profit margin of 5.73% is 1.30 times the peer median of 4.41%.

Currently, LZB’s forward P/E ratio is trading at 12.45x, slightly lower than its peers’ median of 14.36x. LZB’s 5-year average forward P/E is 13.13 times. Given LZB’s outstanding performance, we argue that it should at least trade at a P/E of its peers. However, to keep the valuation conservative given the current housing situation, we assign a lower P/E of 12.45x. The market revenue estimate for 2025 is $2.07 billion and the EPS estimate is $2.97. These estimates are reasonable considering the macro headwinds currently discussed. Applying a target P/E of 12.45x to the 2025 EPS estimate results in a 2025 target stock price of $36.98, which represents a 12% upside potential.

Risks and Conclusions

LZB expects monetary policy easing to begin and ultimately normalize demand in the furniture industry. The furniture industry is particularly sensitive to cyclical changes in the economy because LZB’s goods are considered discretionary purchases. Long-term inflation and high interest rates will continue to impact overall demand. High mortgage loans still make purchasing a home unaffordable, which reduces demand for home furnishings.

LZB also anticipated potential price increases for key materials, which it could respond to by passing costs on to customers. However, it may not fully mitigate the impact of inflationary pressures on costs, which could eventually impact operating profits. In response to macro headwinds, they are growing their network by opening new stores and acquiring stores to expand their brand’s reach. Additionally, my relative evaluation shows that LZB has outperformed its peers with strong net profit margins and relatively better future earnings prospects. Therefore, we recommend a Buy rating.