LanzaTech Stock: Growth with Valuation (NASDAQ:LNZA)

beam

Lanza Tech (NASDAQ:LNZA) is a clean technology company operating at the intersection of carbon capture and synthetic biology. I previously wrote about the company in early 2023, detailing its business and technology. Since then, the stock price has been highly volatile, but It’s currently near where it started.

Although LanzaTech’s stock price has had a difficult time since going public, business has been progressing steadily. Although questions remain about market size, competitive positioning, and margins to scale, performance to date has been solid given the challenging macro environment. Although LanzaTech’s stock price is still relatively high compared to the early stages of the business, the company’s valuation is increasing.

pipeline

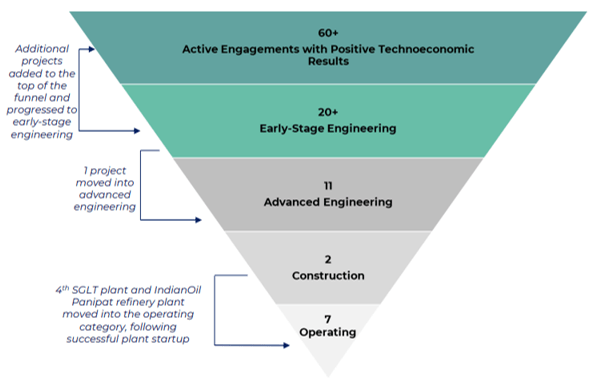

LanzaTech’s growth is driven by an expanding project pipeline through a steady stream of new feasibility studies and progress to operational status for existing projects.

LanzaTech We have advanced two joint development projects with Brookfield through various early-stage engineering milestones and hope to advance one of these projects into advanced engineering in early 2024. The basic engineering package was also recently completed. Nextchem 64,000 tons Annual plant in Italy.

Figure 1: LanzaTech active customer biorefinery project pipeline (Source: LanzaTech)

In May 2023, ArcelorMittal began producing ethanol samples at its €200 million facility in Belgium. Commercial-scale production is expected to ramp up next month. The plant has a production capacity of 80 million liters of ethanol per year.

LanzaTech previously had six commercial-scale facilities with a total annual nameplate capacity of approximately 300,000 tonnes. With the recent commissioning of IndianOil Corporation facility at Panipat refinery, this number has increased to seven.

Figure 2: LanzaTech commercial scale plant (Source: LanzaTech)

LanzaTech also continues to develop new strains to pursue production of additional molecules. The company is known to have achieved its target production of monoethylene glycol, a key ingredient in polyethylene terephthalate. LanzaTech is also currently developing strains to produce isopropyl alcohol, a $3 billion market by 2022.

Moving from producing ethanol to producing other molecules is a huge technological leap. If LanzaTech can do this profitably at scale, it will greatly increase its target market and further legitimize its capabilities. As of 2021, LanzaTech has designed and modeled more than 500 pathways and has been able to demonstrate that more than 100 molecules can be synthesized directly from gases. However, without knowing the production scale and potency, this metric is somewhat meaningless.

Partnership Announcement

LanzaTech has announced a steady stream of partnerships in recent months, but many of them are just feasibility studies with unclear long-term financial implications.

LanzaTech and Tadweer (Abu Dhabi Waste Management Company) have begun a study on the feasibility of producing SAF from municipal and commercial solid waste. Up to 350,000 tonnes of waste per year could be converted into 200,000 tonnes of ethanol, producing 120,000 tonnes of SAF per year.

LanzaTech also recently announced a JV with Olayan Financing Company to deploy LanzaTech’s technology in Saudi Arabia and other countries in the Middle East.

LanzaTech and ADNOC have entered into a partnership to explore opportunities to produce molecules from waste gases using LanzaTech’s technology.

LanzaTech and GAIL, India’s largest natural gas company, announced a partnership to explore ways to use LanzaTech’s technology to convert GAIL’s renewable H2 and CO2 gas streams into biorecyclable materials.

Lanzajet

LanzaJet is a sustainable aviation fuel company that LanzaTech helped launch in 2020 and still holds a 25% ownership stake. Upon achieving certain pilot facility milestones, LanzaTech will receive additional shares of LanzaJet, resulting in an ownership stake in the company. 40-57%.

LanzaJet is targeting production at its 10 million gallon per year Freedom Pines Fuels facility in Georgia in early 2024. The majority of production will be SAF and some renewable diesel will be used. This project is a collaboration with Pacific Northwest National Lab and the U.S. Department of Energy.

LanzaTech also recently announced plans to supply waste carbon to the SAF plant in Wales. A basic engineering package has recently been delivered for LanzaJet’s first UK SAF project, Project Dragon. The facility will reportedly supply around 1% of the UK’s jet fuel needs. To support this project, LanzaTech has received £25 million from the Department for Transport’s Advanced Fuels Fund. Subject to approval, construction is expected to begin in 2025, with production expected to begin in 2026/2027.

LanzaJet was recently selected by Air New Zealand and the New Zealand Ministry of Business, Innovation and Employment for Phase 2 of the SAF Feasibility Study. This study focuses on the use of forest residues to produce SAF in New Zealand.

This business has the potential to grow significantly and create shareholder value, but it is questionable how attractive it will ultimately be based on simply chemically converting ethanol to SAF. Moreover, there is already significant competition, and LanzaJet is differentiated only by LanzaTech’s feedstock.

Neste has been producing SAF for over 10 years and produces 100,000 tons per year, with plans to expand this to 1.5 million tons. Neste, a long-established oil refining and marketing company, is probably better positioned to capitalize on the SAF opportunity than LanzaJet. Neste is a public company with an EV/S multiple of only about 1.

Gevo is a renewable chemicals and advanced biofuels company that produces a variety of fuels, including SAF. The company aims to produce 55 million gallons of SAF per year. Gevo’s market capitalization is currently around $230 million.

World Energy is another large biofuel supplier in North America. The company already produces SAF commercially and aims to produce 1 billion gallons of SAF per year by 2030.

financial analysis

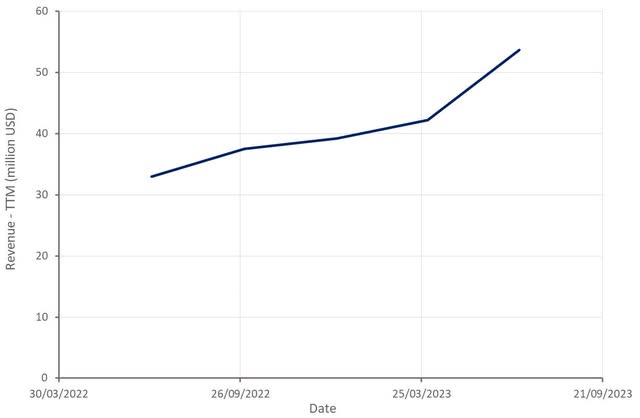

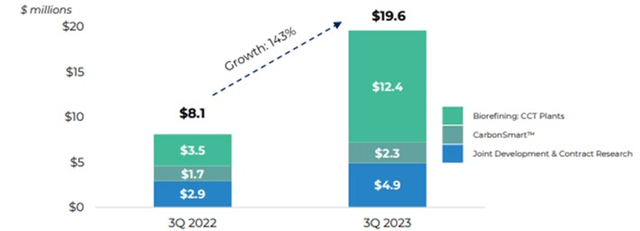

LanzaTech’s third quarter 2023 revenue was $19.6 million, up 143% year-over-year. The increase was driven by engineering and other services revenue from the company’s biorefinery business. CarbonSmart sales also increased 34% year over year, but are still a relatively small contribution.

Figure 3: LanzaTech Revenues (Source: Author using data from LanzaTech)

LanzaTech monetizes its technology through a combination of contract research, licensing (IP), royalties (ethanol sales) and sales (engineering services and materials).

Figure 4: LanzaTech Revenue Breakdown (Source: LanzaTech)

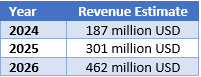

LanzaTech’s growth is expected to remain strong going forward, driven by the size of the company’s pipeline and continued ability to attract new partners. However, most of this is already priced into the stock, as it will be 2025/2026 before LanzaTech starts trading at a more reasonable earnings multiple.

Table 1: LanzaTech analyst revenue estimates (Source: Author using data from Seeking Alpha)

LanzaTech’s gross margin was higher in the third quarter, driven by changes in its revenue mix. Perhaps LanzaTech’s gross profit margins will tend to get higher over time as royalties and licensing revenue is generated and the company scales. But so far, that hasn’t really been the case.

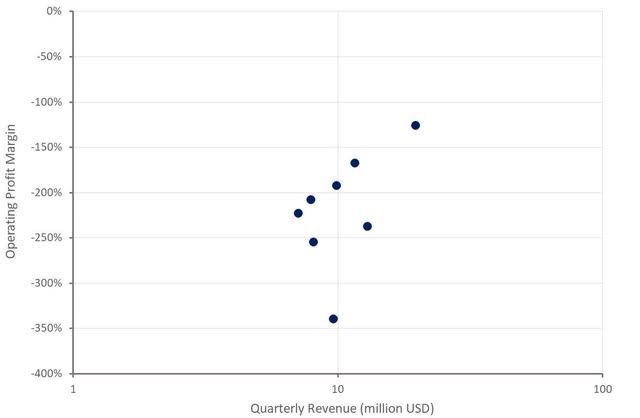

LanzaTech’s third quarter operating expenses totaled $29.8 million, driven by headcount increases to support the company’s pipeline and R&D expansion. Although LanzaTech’s losses are decreasing as the company grows in size, the amount the company is still losing is somewhat concerning.

I’m okay with companies losing a lot of money because accounting statements often don’t properly reflect the reality of the business. This really depends on the company’s ability to realize economies of scale as its upfront investments in product development and customer acquisition begin to pay off.

This is evident to some extent in the case of LanzaTech, whose upfront engineering work generates royalties, licensing and consumer product revenue. The company is also still investing in molecularizing waste through fermentation technology. Considering that most of its revenue comes from services and downstream revenue is limited, continued losses are questionable.

Assuming all goes well, breakeven will probably occur in 2026. It’s estimated that LanzaTech will need about $200 million in cash to get to this point. However, the company only has about $137 million in cash, so it will likely need to raise adequate capital. Considering LanzaTech’s market capitalization and lack of debt on its balance sheet, this isn’t a big deal.

Figure 5: LanzaTech operating margin (Source: Author using data from LanzaTech)

conclusion

LanzaTech has an interesting technology, but it competes with efficient and affordable production from mature sources. Although LanzaTech does not produce commercial chemicals itself, demand for its technology is dependent on cost equivalency with existing production methods. There is currently little clarity on production costs, but continued progress of projects through LanzaTech’s pipeline appears to suggest that a commercial plant is feasible.

LanzaTech has a variety of revenue streams that vary greatly in quality. Fees associated with R&D and engineering services are likely to be relatively low margin and non-recurring in nature. As a result, these revenue streams do not guarantee high multiples, even if they scale quickly.

Recurring revenue comes from royalties, microbial and media sales, and software licenses. Licenses and royalties are likely to have better margins and are more recurring in nature, creating more value for LanzaTech shareholders. Unfortunately, most of our revenue currently comes from engineering services. This makes us skeptical of LanzaTech’s current valuation, even taking into account the company’s cash balance and the value of its LanzaJet stake.

Figure 6: LanzaTech EV/S multiple (Source: Seeking Alpha)