Lennar Q4 Earnings: What to Expect Amidst a Stock Rebound (NYSE:LEN)

DNY59

introduction

home builder Renard Corporation (New York Stock Exchange: Ren, LEN.B) has rebounded significantly from October lows. LEN stock has risen nearly 40% in less than two months and has just hit a new all-time high of $140. I covered the second largest home builder (by market capitalization). The United States at the end of September comparison analysis KB Home (KBH), which explains why we largely ignore common valuation metrics when deciding when to buy homebuilding stocks and instead focus on book value.

Lennar will report its fiscal 2023 fourth quarter results on Thursday, December 14 after the bell and will hold a conference call at 11 a.m. ET on Friday. In this brief update, we explain the reasons for the sharp rebound, share what investors can expect from the homebuilder’s upcoming report and why we have become very cautious despite strong momentum leading to improved inflation numbers. Expectations for the Federal Reserve are growing. policy reversal In 2024.

Why Lennar Stock Has Rebounded Sharply From October Lows

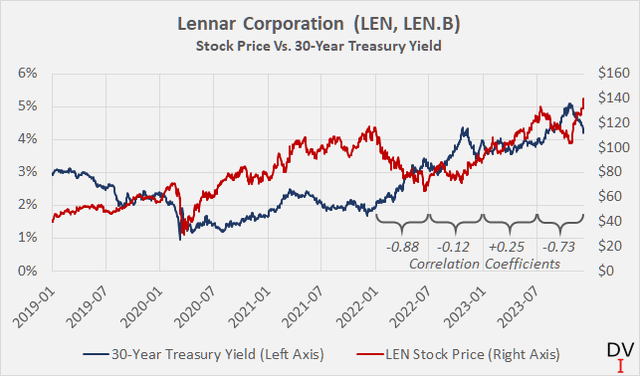

Surprisingly, Lennar stock shows a slightly positive correlation with long-term bond yields, such as 30-year Treasury bonds (r = +0.45 since January 2019). However, I think this is a good example of how correlation does not necessarily mean causation. Clearly, it is important to take a closer look (Figure 1). The Federal Reserve will begin raising interest rates in early 2022 to curb rising inflation. Somewhat shocked, the market sold off LEN stock for about six months, and the correlation was significantly reversed due to higher mortgage rates, rising unemployment, and a resulting weaker housing market. In the second half of 2022, Renard’s stock price bottomed and began to recover as long-term interest rates fell slightly.

Figure 1: Lennar Corporation (LEN, LEN.B): Stock Price and 30-Year Treasury Bond Yield. (your own work)

Finally, as the “higher the longer” environmental narrative solidified in the second half of 2023, LEN stocks again showed a strong inverse correlation with long-term interest rates and plummeted when long-term interest rates rose above 100%. 5.0% at the end of October. The bond rally that followed the yield on the 30-year Treasury note falling as much as 80 basis points in less than two months led to a massive rally in homebuilder stocks.

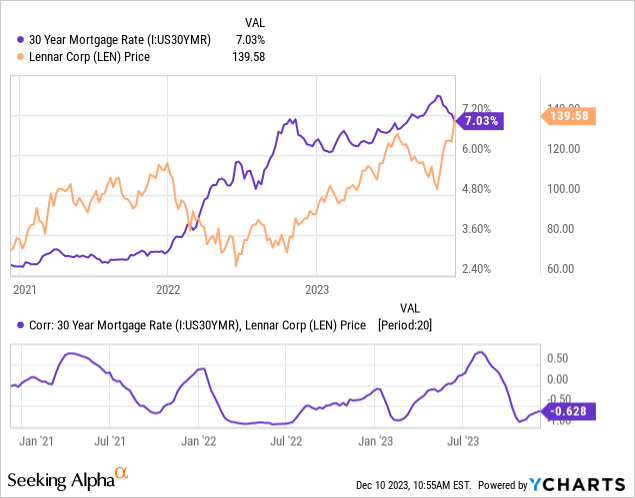

Naturally, we see the same characteristics when we graph LEN’s stock price against the 30-year mortgage rate (Figure 2). But the disproportionate rise in stock prices suggests the market now has the “higher is higher” narrative in the rearview mirror and is starting to price in cheaper mortgage rates.

Figure 2: Lennar Corporation (LEN, LEN.B): Stock Price vs. 30-Year Mortgage Rate (Y chart)

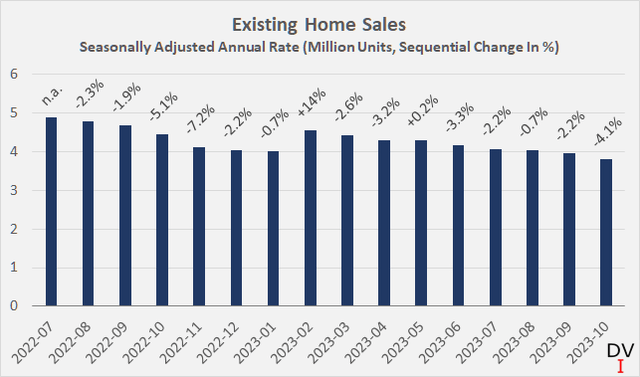

However, the second aspect to pay attention to is the sale of your existing home. The number of units sold continues to decline, with the October 2023 figure being particularly notable (down 4.1% quarter-on-quarter, Figure 3). Existing homeowners with fixed-rate mortgages (rates on adjustable-rate mortgages are very low in the United States) are reluctant to sell because they know they have secured very favorable interest rates. While this runs somewhat counter to market expectations (see above), it is clearly positive for new home providers like Lennar.

Figure 3: U.S. Existing Home Sales Since July 2022 (In-house work, based on data from the National Association of Real Estate Brokers)

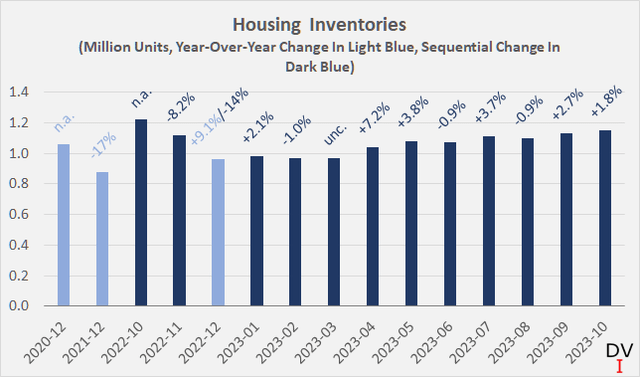

Lastly, if you look at the housing inventory registered at the end of the month, you can see that the supply situation is steadily improving (+1.8% compared to the previous month, 1.15 million units, Figure 4), but we must not forget that it is still close to the supply level. This is 6% lower than the October 2022 figure (1.22 million units). Clearly the market remains undersupplied.

Figure 4: U.S. housing inventory at month-end since October 2022 and year-end data for 2020 and 2021. (In-house work, based on data from the National Association of Real Estate Brokers)

What can we expect from Lennar’s fourth quarter earnings report?

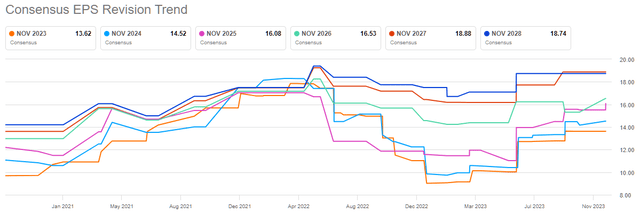

For the recently concluded fiscal year 2023 (ending November 30), analysts expect adjusted earnings per share (EPS) to be $13.6, down 24% year-over-year. Quarterly revenue is expected to be $4.60, or 8% lower than the fourth quarter of fiscal 2022. Analysts have been much more optimistic over the past six months, and expectations for fiscal 2023 are now almost back to where they were in August 2022, but still remain well below expectations for fiscal 2022. This is the beginning of this rate increase cycle (Figure 5). But Lennar’s long-term outlook remains solid and hasn’t really changed over the past two years.

Figure 5: Lennar Corporation (LEN, LEN.B): Revised Annual Earnings per Share. (Look for alpha)

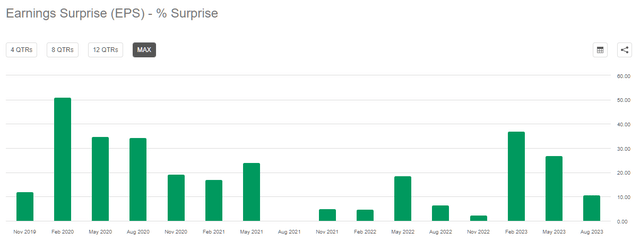

Considering the fact that Lennar has regularly exceeded earnings (mostly revenue) estimates for at least the last four years (Figure 6), it is reasonable to conclude that analysts have been too conservative with their estimates.

Figure 6: Lennar Corporation (LEN, LEN.B): Amazing quarterly earnings per share. (Look for alpha)

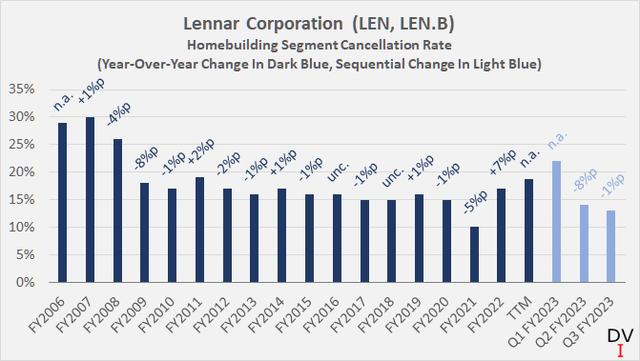

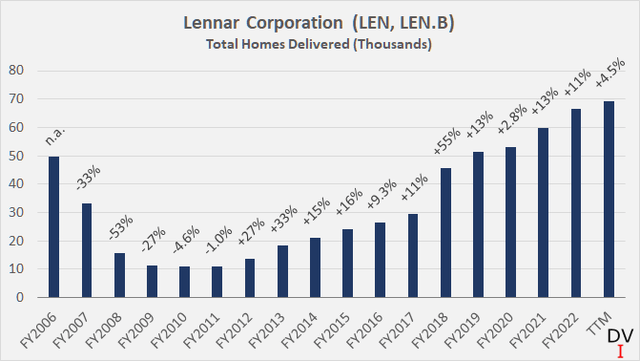

As I wrote in a previous article, the tailwinds from undersupply in the existing housing market should not be underestimated (recall Figure 4). The favorable market environment is also highlighted by Lennar’s historically low cancellation rates (Figure 7) and number of homes delivered (Figure 8).

Figure 7: Lennar Corporation (LEN, LEN.B): Homebuilding Cancellation Rate (Own work based on company documents) Figure 8: Lennar Corporation (LEN, LEN.B): Total Number of Homes Delivered (Own work based on company documents)

Rising interest rates and higher inflation led to an increase in cancellation rates in FY 2022, but cancellation rates moderated during the TTM period, despite including a difficult fourth quarter of FY 2022 and Q1 of FY 2023. Cancellation rates have decreased significantly in 2023. , since the 30-year fixed mortgage interest rate rose sharply to 7.8% in October and then recently fell to the level at the end of August (7.2%), we do not necessarily expect the decline in cancellation rates to continue in the fourth quarter of fiscal 2023. ). Nonetheless, this trend reversal could bode well for homebuyer sentiment going forward, especially if inflation numbers remain favorable.

All told, we expect Lennar to report solid results on Thursday. However, given the recent uptick and the sharp rebound from the October lows, it can be assumed that the market has already factored in continued strong performance.

Bottom Line – Is LEN Stock a Good Stock to Buy Now Before It Earns?

Lennar Corporation is scheduled to report fourth quarter fiscal 2023 results on Thursday. Given that analysts have remained overly conservative with their estimates for at least the past four years, with housing inventory still weak and the recent decline in existing home sales accelerating, we expect another solid quarter for the second-largest U.S. homebuilder. It makes sense to do so. Us. The recent sharp decline in cancellation rates, which are now close to fiscal 2021 levels, also suggests that the robust demand environment continues.

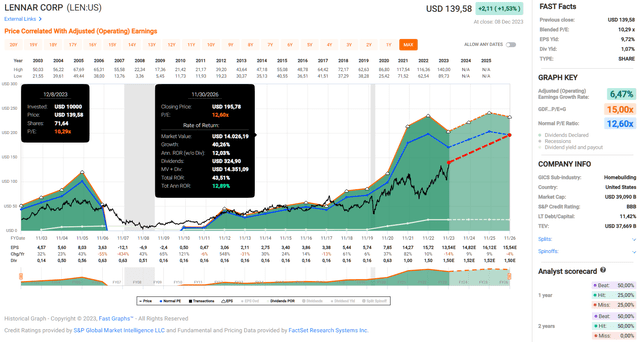

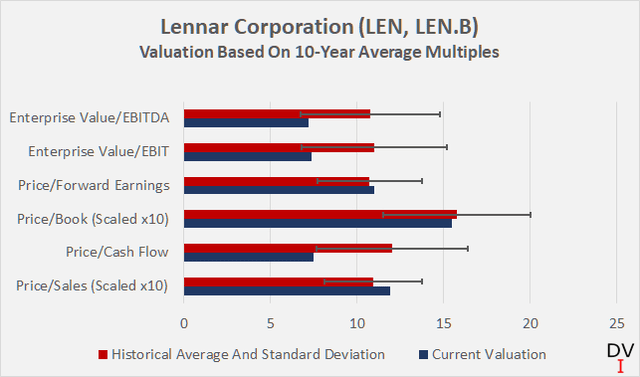

So considering the recent bond rally and the (temporary?) trend reversal in mortgage rates, it’s no surprise that investors have driven Lennar stock to all-time highs. Nonetheless, from a historical perspective, the stock does not look expensive (Figure 9, Figure 10).

Figure 9: Lennar Corporation (LEN, LEN.B): FAST Graph chart based on adjusted (operating) earnings per share. (FAST graph) Figure 10: Lennar Corporation (LEN, LEN.B): Valuation Based on 10-Year Average Multiples; To improve readability, the sales price ratio and book price ratio have been adjusted by a factor of 10. (Own work, based on Morningstar data)

However, as a cyclical stock, Lennar tends to look cheap (or fairly valuable) when fundamentals are strong. As I explained in my last article, I – counter-intuitively – prefer to buy homebuilders with overvalued book-to-value ratios. Inventory valuation impairments that occur during economic downturns can reduce homebuilders’ equity ratios and make their stocks look expensive, when in fact the opposite is true.

So, as an investor looking to build a position in Lennar (or any other home builder), I think it’s better to control your fear of missing out and be patient, despite the phenomenal upside, strong momentum, solid balance sheet, and chronic distress. An undersupplied housing market, and interest rate cuts expected in 2024. Let’s face reality. It is impossible to precisely time and quantify the magnitude of the Fed’s policy changes. For example, who would have predicted a few months ago that the effective federal funds rate would plummet in March 2020 amid the COVID-19 pandemic? Likewise, who would have thought that long-term interest rates would hit the 5% mark in less than 18 months in early 2022? Every time I read a headline from investment banking strategists predicting a significant interest rate cut, I chuckle a little and suggest accuracy.

Thank you for taking the time to read my latest article. Whether you agree or disagree with my conclusions, I always welcome your comments and feedback in the comments below. And if you see anything I need to improve or expand on in future articles, please let me know too. As always, please consider this article only as a first step in your due diligence.