Lindsay Corporation Q2 Preview: Stock Falls on Weak Farm Income (NYSE:LNN)

george clerk

Even as the broader market rose, there were difficult times for some companies. For example, one struggling company is: Lindsay Corporation (New York Stock Exchange: LNN), a relatively small company with a market capitalization of $1.28 billion. For those people Without knowing this, companies produce and sell a variety of infrastructure products such as irrigation systems and railway signs, terminals and crash cushions. I did it around October last year I reexamined the stock And I have decided to maintain a ‘Hold’ rating to reflect my view that the stock is unlikely to outperform the broader market in the near future. But things have gotten much worse since then.

From the time the article was published to present, the stock price has fallen 2.6%. By comparison, the S&P 500 is up a whopping 24.5%. This performance is due to poor sales and profits compared to the previous year. year. However, it may also be driven by concerns that this year’s low agricultural income will lead to continued weakness throughout 2024 and potentially beyond. Stocks aren’t exactly expensive. However, if you make reasonable assumptions, the price will be a little higher. Furthermore, I have to say that this housing stock is currently priced relative to similar companies and downgrading the stock to a soft ‘sell’ makes a lot of sense to me.

Of course, it is also important to note that the picture may change. While I’m moving to downgrade the stock, management is scheduled to report earnings before the markets open on April 4th. This revenue applies to the company’s second quarter of fiscal 2024. Interestingly, analysts have a somewhat rosy view on revenues, with a view on earnings reflecting stability. I am concerned that these figures may be overly optimistic given the current environment. And if things go bad, it could lead to a bigger downturn. But if management expresses surprise in a positive way, my current call may ultimately turn out to be wrong.

the pain continues

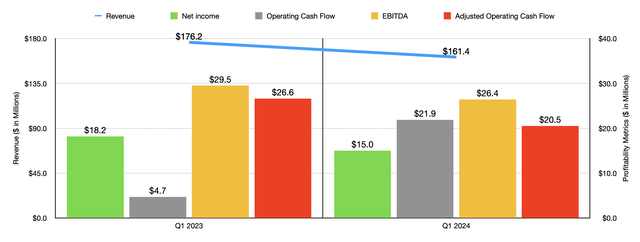

On the operations side, I’m a big fan of Lindsay Corporation. I like companies that have interesting business models or products and services they sell. However, this should not prevent an objective view of how the business in question is operating. Unfortunately, things could get better for Lindsay Corporation. Let’s take the first quarter of fiscal year 2024 as an example. The company’s revenue during that period was $161.4 million. This is an 8.4% decrease from the $176.2 million in revenue generated a year ago. This revenue decline comes despite a 7% increase in North American irrigation revenue, according to management. This was due to increased sales only slightly offset by a less favorable product mix of shorter machines compared to those the company produced in the previous year. Average sales prices in North America also remained stable compared to the previous year.

Author – SEC EDGAR Data

The great difficulty of this enterprise, then, came from the international irrigation operations. They plummeted by 25%. This was due to a decline in sales across Brazil and Argentina. Management attributed this to a decline in the company’s sales, in part due to changes in the timing of financing following a significant financing program in Brazil. But the situation would have been worse without the $1.8 million benefit associated with exchange rate fluctuations. The company’s infrastructure operations also showed some weakness, with revenue down about 12%. The problem this quarter was that the company was missing one of its projects from last year.

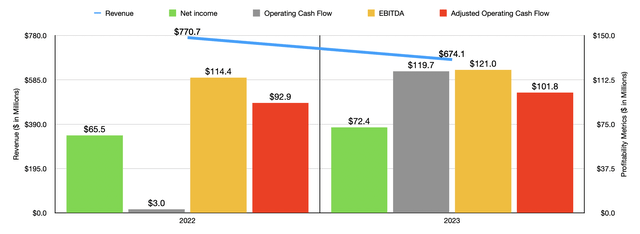

Author – SEC EDGAR Data

As sales declined, profits also took a hit. Net income decreased from $18.2 million to $15 million. Other profitability indicators largely followed suit. The one exception was operating cash flow. It jumped from $4.7 million to $21.9 million. However, when you adjust for the change in working capital, it actually decreases from $26.6 million to $20.5 million. Meanwhile, the company’s EBITDA decreased slightly from $29.5 million to $26.4 million. As you can see in the chart above, looking at fiscal 2023 financial results compared to fiscal 2022, we see that weakness at the top is nothing new. However, last year’s profits and cash flow improved compared to the previous year. And that was one of the reasons that gave me optimism about the company. But now this trend appears to be reversing due to rigid operating costs.

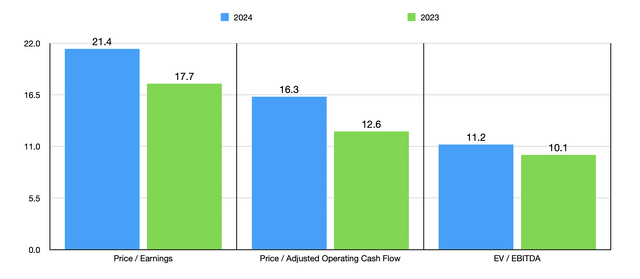

Author – SEC EDGAR Data

Assuming the remainder of fiscal 2024 will be similar to the first quarter of this year compared to the first quarter of 2023, we can expect net income of $59.7 million, adjusted operating cash flow of $78.5 million, and total EBITDA of $108.3 million. . Using these estimates and historical results for 2023, we were able to value the company as shown in the chart above. One thing the business is doing is that it has US$60.3m in cash, which exceeds its liabilities. This helps bring down EV’s EBITDA multiple significantly and provides significant flexibility for shareholders. However, despite this, the stock price is not cheap compared to similar companies. In the table below, you can see how the stock is priced compared to five similar companies. On an operating cash flow basis, only two out of five companies were cheaper, but when using the other two profitability metrics, this figure jumped to four out of five companies.

| company | Price/Revenue | Price/Operating Cash Flow | EV/EBITDA |

| Lindsay Corporation | 17.7 | 12.6 | 10.1 |

| Titan International (TWI) | 9.8 | 4.3 | 6.5 |

| Toro Company (TTC) | 32.5 | 33.0 | 19.9 |

| CNH Industries (CNHI) | 7.3 | 19.0 | 8.5 |

| Deere & Company (DE) | 11.8 | 13.1 | 9.8 |

| AGCO Corporation (AGCO) | 7.7 | 8.2 | 5.9 |

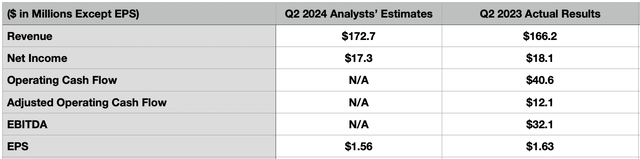

My own pessimism may disappear. We’ll have a better idea when management reports their results in the next few days. Leading up to that press release, analysts currently believe revenue will increase year-over-year to approximately $172.7 million. This is a 3.9% increase over the $166.2 million generated a year ago. Perhaps the timing changes associated with the aforementioned programs in Brazil may contribute to this expected increase. Interestingly, analysts don’t think profits will grow. But they don’t think they will fall materially either.

Author – SEC EDGAR Data

Currently, analysts are forecasting earnings per share of $1.56. This is a slight decrease from the $1.63 per share generated in the second quarter of 2023. This means net income will drop from $18.1 million to $17.3 million. Analysts did not provide estimates for other profitability metrics. However, if you look at the table above, you can see what these important indicators are and the numbers compiled in the second quarter of last year. If income declines, these are likely to fall slightly as well.

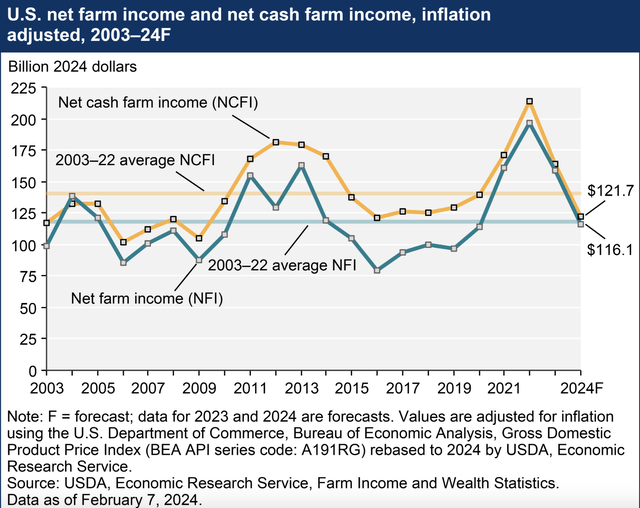

Due to the timing of the program in Brazil, the excess cash Lindsay Corporation has on its books, the way the stock is priced, and lower sales and profits in the first quarter of this year compared to the same period last year, the stock has been upgraded from a ‘hold’ to a ‘sell’ in just one year. Not enough to downgrade. But there is another factor to consider in this picture. This includes the outlook for the U.S. agricultural industry. In 2023, net agricultural income in the United States totaled $155.9 billion. However, by 2024, this figure is expected to fall by about 25.5% to $116.1 billion. Taking inflation into account, the decline will be even larger, reaching approximately 27.1%.

USDA

This pessimism is twofold. First of all, a decrease in cash receipts is expected. This will be primarily driven by corn and soybeans due to trade disruptions and competition from South America. In fact, when added together, total prices in the U.S. are estimated to decrease by $17.2 billion. Reduction in direct government payments coupled with higher production costs are also expected to hit the space hard. Now, it is true that this is only an American problem. However, keep in mind that in 2023, 45.9% of the company’s revenue came from North American irrigation activities. Total exposure to the US alone, including infrastructure businesses, was approximately 51.5%. And as agricultural incomes decline, investments in irrigation and similar costly schemes are likely to appear on the weaker side of the equation.

takeout

Based on the data provided, I would say that we are not very optimistic about Lindsay Corporation’s prospects at this point. In the long run, I fully doubt the company will do well for itself and its investors. But I see weakness continuing throughout the year. Considering this and how the stock is priced relative to similar companies, I would argue that downgrading the stock from a ‘hold’ to a ‘sell’ at this point is only logical.