Litecoin ETF Rumors Fuel 10% Surge, Hints Institutional Interest

Rumors of a potential spot Litecoin (LTC) exchange-traded fund (ETF) have sparked a significant price surge, with the digital asset rising 10% following institutional interest. Fox Business journalist Eleanor Terrett revealed insights hinting at growing institutional interest in Litecoin ETFs in a post on X (formerly Twitter).

terret shared, “SCOOP: We have heard rumors at the institutional level about possible interest in a Litecoin ETF. The logic is that since LTC is functionally similar to BTC, the SEC may be more likely to approve it. Probably even more so than ETH.”

Why a Spot Litecoin ETF is Possible

This statement comes at a critical time as the cryptocurrency market continues to navigate regulatory uncertainty and increased interest from traditional financial institutions. Adding to the buzz, Terrett highlighted Coinbase Derivatives’ recent move to launch futures contracts for Dogecoin, Litecoin, and Bitcoin Cash, scheduled to launch on April 1, 2024.

These futures contracts detailed are part of Coinbase’s strategic move to diversify its products by leveraging a self-certification approach under CFTC Rule 40.2(a). This approach allows companies to introduce new products without explicit approval from the CFTC, provided they comply with the Commodity Exchange Act and related regulations.

Additionally, the Commodity Futures Trading Commission’s (CFTC) classification of Ethereum (ETH) and Litecoin (LTC) as commodities in a recent lawsuit against KuCoin adds another layer of legitimacy to the discourse surrounding Litecoin’s regulatory stance. The CFTC’s action highlights its view of certain cryptocurrencies as commodities.

Amid these regulatory clarifications and developments, discussions regarding the potential approval of a spot Litecoin ETF have intensified. Renowned cryptocurrency analyst Luke Martin echoed this sentiment, suggesting that the approval of an Ethereum ETF could pave the way for other “old altcoins” like Litecoin.

He said: “Once the ETH ETF launches and passes, it raises questions about its performance and the token, especially from the SEC. (…) There are dinosaur-like old altcoins that could almost make a stronger case. It sounds ridiculous, but if you think about it deeply, it’s actually true. “It’s easier to prove that Dogecoin is not a security than ETH. Why don’t they release Litecoin, Dogecoin?”

CFTC Submission: Coinbase File for Futures Listing $DOGE $LTC $BCH

Is this a hint as to where the hell alts will get an ETF next?!

I spoke with: @zhusu A few weeks ago I explained the unique trading opportunity that comes with this exact scenario. $DOGE ETF. pic.twitter.com/tlyFgDvUhR

— Luke Martin (@VentureCoinist) March 21, 2024

In support of this, Alan Austin, Executive Director of the Litecoin Foundation, said: express Enthusiasm about the prospect of a spot Litecoin ETF, “Again, whether you love ETFs or hate them, the first company to launch a Litecoin ETF is going to crush it!”

LTC price is lagging

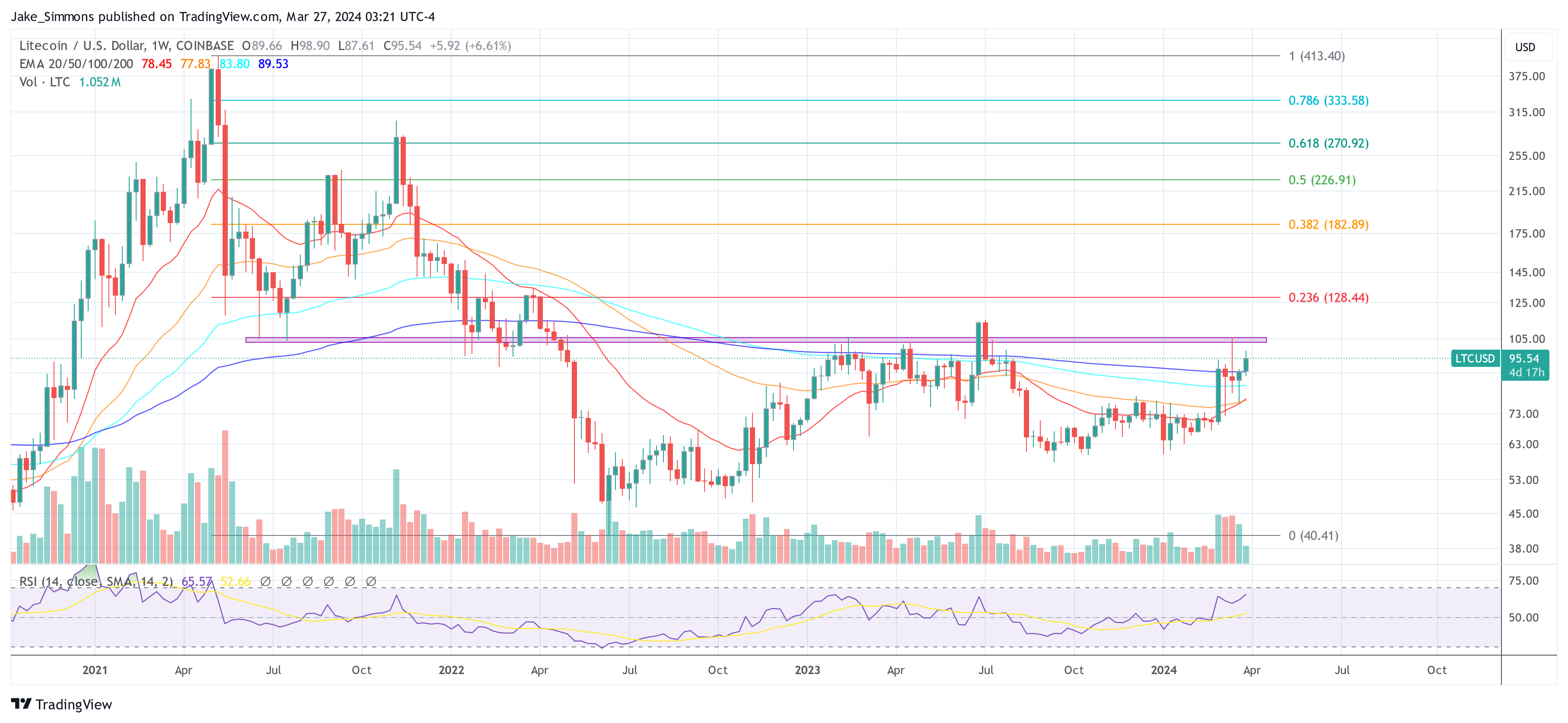

Despite the current rumors, Litecoin’s price analysis shows that it is still down 77% from its May 2021 all-time high, indicating a bearish trend compared to other cryptocurrencies that have already surpassed their 2021 highs. Nonetheless, a recent break above the 200-week EMA sparked some faint bullish momentum.

Overcoming the red resistance area between $102 and $106 could be crucial for Litecoin to reach new highs, with the $128 mark (the 0.236 Fibonacci retracement level) as a potential near-term target.

Featured image created with DALL·E, TradingView.com chart

Disclaimer: This article is provided for educational purposes only. This does not represent NewsBTC’s opinion on whether to buy, sell or hold any investment, and of course investing carries risks. We recommend that you do your own research before making any investment decisions. Your use of the information provided on this website is entirely at your own risk.