Litecoin has a strong prospect as an MVRV ratio signal strength -analyst.

Reason to trust

Strict editing policies focused on accuracy, relevance and fairness

It was produced by an industry expert and examined three severely.

Best standard of reporting and publishing

Strict editing policies focused on accuracy, relevance and fairness

Lion’s soccer prices and players are soft. Each Arcu Lorem, all children or ULLAMCORPER FOOTBALL MATE is Ultricies.

This article is also provided in Spanish.

Litecoin (LTC) showed elasticity in market uncertainty and sales pressure despite the wider decline of cryptocurrency. The LTC returns to $ 100 from $ 130 to $ 100, indicating that the bull is still actively involved in defending its main levels.

Related reading

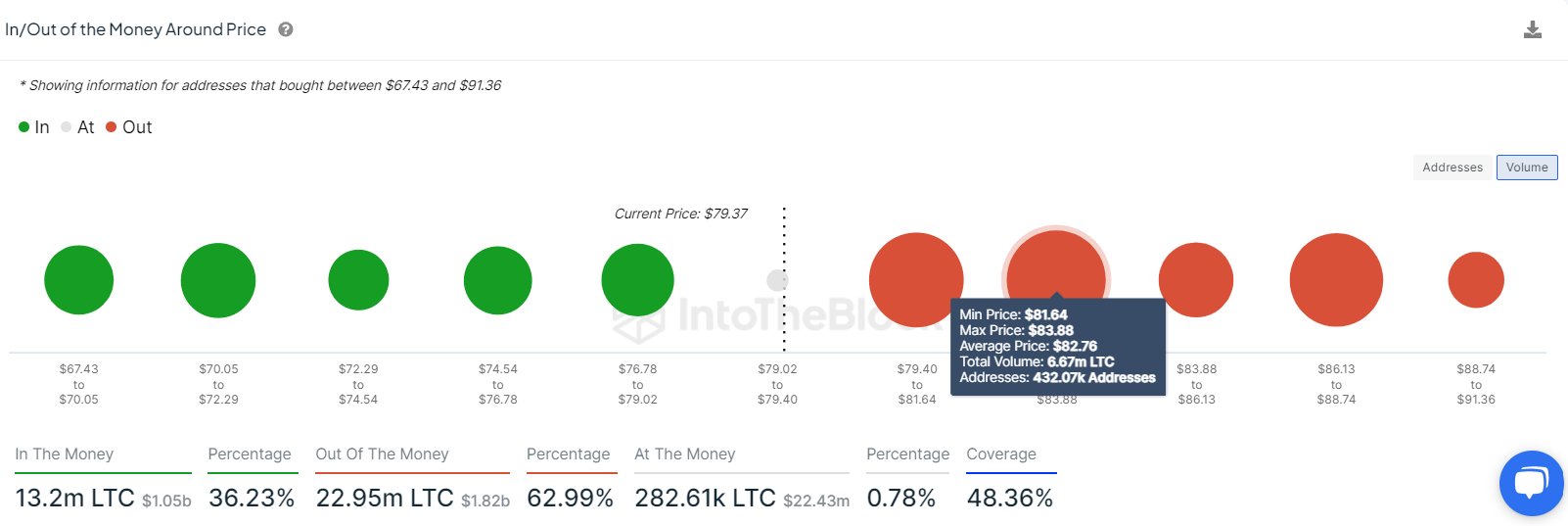

Most Altcoins suffered, but Litecoin seems to maintain some strength. According to Santiment Data, the LTC continues to show the strength of the hot chain metrics. Investors still have LTCs, and there are few incentives to be sold at the current level, opening the way for recovery in the near future.

However, because Bitcoin is under pressure, the day is struggling below the main level. Market uncertainty continues to lead volatility, and if BTC experiences more disadvantages, LTC may face sales pressure. On the other hand, if Bitcoin is stabilized or higher, Litecoin can quickly utilize powerful foundations and start a new upward trend.

Litecoin Bulls defends important demand

Litecoin is currently trading between major liquidity levels and explores months of volatility and uncertainty in a wide range of markets. Despite the recent market downturn, LTC has shown relative strengths over the last few weeks, and other Altcoins continued to struggle, while maintaining important support.

Related reading

However, price action is uncertain because Litecoin could not cross the main supply area. The bull tried to raise the price, but when the pressure was sold at the resistance level, the LTC was maintained within the strict range of transactions. Until a clear evacuation occurs, traders are cautious about the following main movements.

The chief analyst, ALI Martinez, shared insight into X and emphasized that Litecoin maintains a strong prospect based on warm chain data. According to Santimate’s MVRV ratio, LTC is showing strength, suggesting that investors maintain their position despite the recent volatility of the market. This metrics often indicate whether assets are undervalued or overestimated, and in the case of Litecoin, coins still have a strong potential.

When a wider encryption market begins to recover, Litecoin can emerge as one of the most powerful assets, considering the relative stability and a strong warmth signal. At present, all gaze remains in whether or not the bulls can confirm the new upward trend by breaking the past resistance of the LTC.

LTC price measures: Technology level to watch

Litecoin is currently trading for $ 104 after a few days of selling pressure. But despite the weakness of the weak, the seller struggled to push LTC under an important $ 100 demand area. This level has been a strong support to prevent more disadvantages, and every day LTC exceeds this score of LTC increases the probability of recovery movement.

Litecoin must soon find a $ 115 level to reclaim control rights. The decisive rest of this resistance can lead to a high level of $ 130- $ 145, causing a renewed purchase momentum. The area represents the next major liquidity zone, which can face strong resistance, but can attract a lot of optimism.

Related reading

If Litecoin keeps over $ 100 or more, you will buy confidence at a low level to set potential breakout steps. However, if the $ 115 is not recovered in the short term, the LTC can be maintained in a long -term integration stage, and the next main movement is uncertain.

DALL-E’s main image, TradingView chart