Litecoin, sudden exodus of retail investors: Why this could be bullish

According to on-chain data, Litecoin has recently seen a sudden exodus of small investors, which could be beneficial for the LTC price.

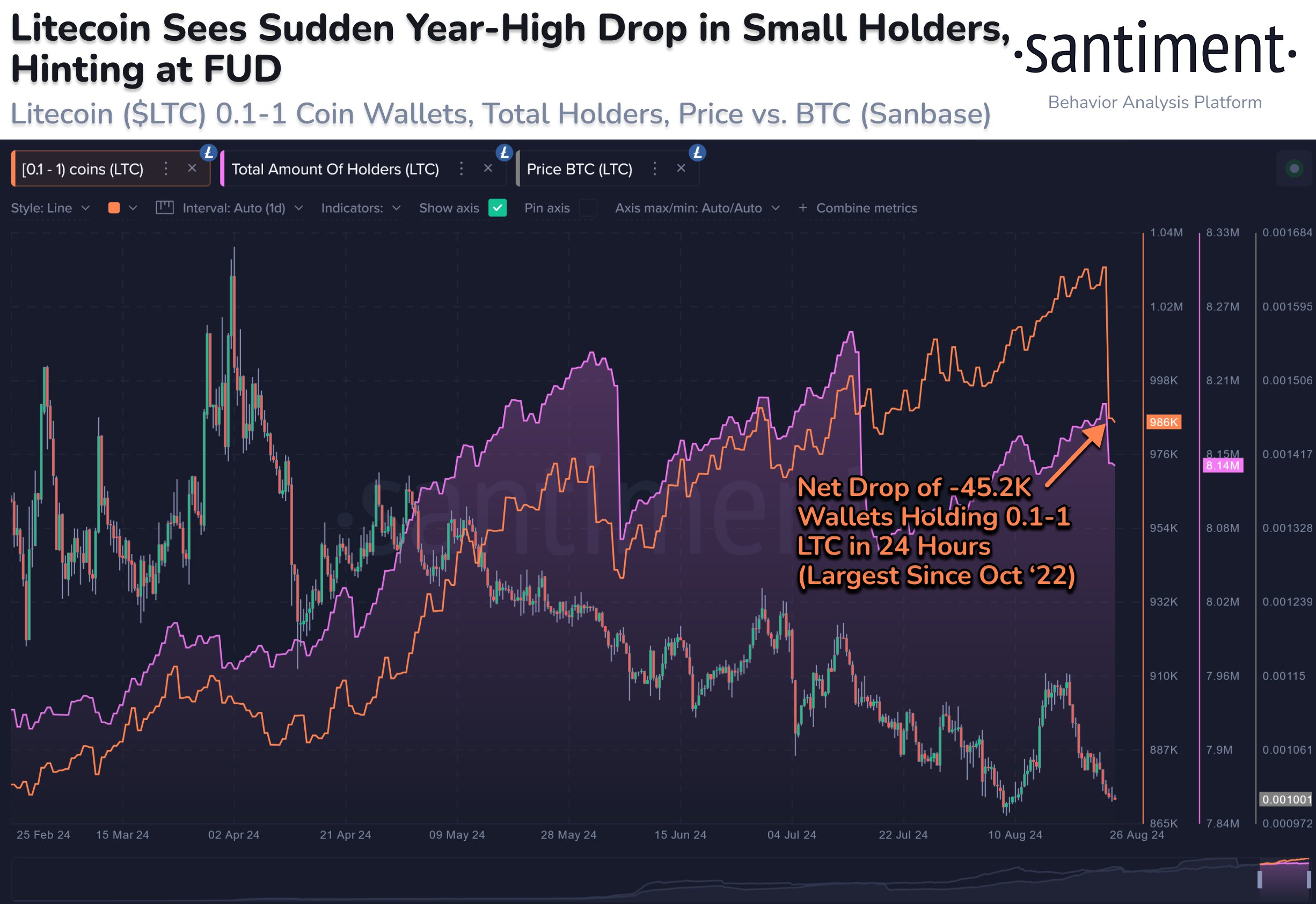

Small-Scale Litecoin Investors Have Been Showing FUD Lately

In a new post on X, on-chain analytics firm Santiment discusses the latest changes in Litecoin’s user base, which involves a couple of relevant metrics: total holders and supply distribution.

The first, Total Holders, as the name suggests, measures the total number of addresses holding a non-zero balance on the LTC network.

As the value of this indicator rises, new addresses with balances appear on the blockchain. This indicates that adoption is occurring, which can naturally be bullish for the asset.

On the other hand, a decreasing value for this indicator suggests that some investors have decided to empty their wallets in order to get out of cryptocurrencies completely.

Now here is a chart showing the trend of total Litecoin holdings over the last few months.

As you can see from the graph above, the total number of Litecoin holders has decreased dramatically recently, a potential sign that many investors have decided to exit the asset.

The decline shows network churn, but the total number of holders doesn’t tell us anything about what type of investors are selling here.

This is where the second metric comes in. Supply distribution. This metric tells you the total number of addresses that currently belong to a particular wallet group.

In the chart, Santiment has specifically attached supply distribution data for investors whose address balances are in the range of 0.1 to 1 LTC. This is a small amount, so the only holders in this group are the smallest hands: Retail.

The graph shows that the number of Litecoin addresses falling into this range has been dropping dramatically recently. More specifically, around 45,200 retail addresses were suddenly emptied during this crash.

Given this trend, it seems likely that much of the decline in total holders has come from these small investors. While the sell-off itself may be bearish, the fact that retail holders are surrendering here may not be such a bad thing.

As the analytics firm explains, “small fish ‘jumping overboard’ impatiently is often a reversal signal for an asset to turn bullish once again.” So it remains to be seen whether this market FUD will lead to a Litecoin rally.

LTC Price

At the time of writing, Litecoin is trading around $62, down more than 4% over the past seven days.