LivePerson: A Cautionary AI Story (NASDAQ:LPSN)

dizzy 3d

You can never change things by fighting against existing reality. If you want to change something, build a new model that makes the old model obsolete.. – Buckminster Fuller

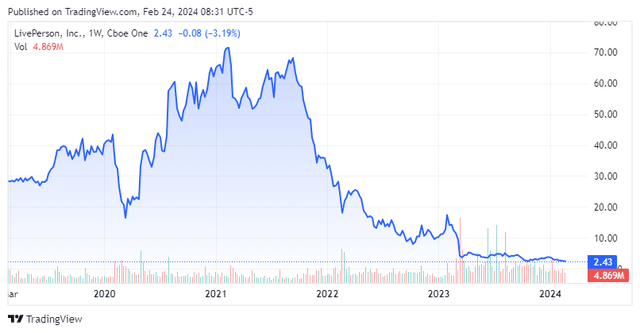

Interest in conversational commerce and AI software Live Person Co., Ltd.NASDAQ:LPSN) fell more It has increased by more than 95% since hitting an all-time high in February 2021 as AI bot technology has lost its luster. Although the company’s restructuring has resulted in $200 million in cost savings and $70 million in non-core business exits, growth prospects and meaningful profitability remain elusive. Impressive technology, a tractable market, but the risk of commoditization made recent beneficial ownership purchases worth digging deeper into. The analysis is as follows.

pursue alpha

Company Overview

LivePerson, Inc. is a New York City-based provider of AI-powered customer experience solutions that powers over 1 billion AI bot conversations between brands and consumers every month. place The company’s Conversational Cloud, which evolved from synchronous (one-to-one) web chat in 1997, enables interaction across a brand’s digital channels and offers the appeal (for consumers) of not being stuck in a queue or having to navigate a unique conversational voice response system. give. in) Existing 1-800 channel. LivePerson was founded in 1995 and went public in 2000, earning $28.1 million in net revenue at $8 per share. The stock currently trades for less than $2.50 per share, giving it a market capitalization of roughly $200 million.

interactive cloud

The company’s ultimate goal is to use AI bots to convert voice conversations into messages. Although it sounds horribly dystopian, it offers benefits to both brands and consumers.

From a brand perspective, using AI bots eliminates the need to provide traditional call centers staffed by internal staff or third-party providers, and connects you to customer experience agents located in foreign countries with accents that are typically difficult to understand. AI bots increase the productivity of brand customer agents, allowing them to manage dozens of AI bot messages at once rather than one customer at a time, and only need to intervene in up to 10% of conversations. This has resulted in increased agent productivity and increased retention in jobs with high turnover. It also most certainly saves brands a significant amount of money on the cost of these items. It’s worth noting that global customer service calls cost brands up to $1.3 trillion annually.

From the customer’s perspective, if they are not on hold for your brand and can get an instant response to their queries (even from an AI bot initially) on a desktop browser, mobile app, SMS, social media, etc. then spending all day waiting on the phone will change their life. It improves. This process completes a virtuous cycle for LivePerson customers by increasing brand satisfaction.

The company has statistics to support the aforementioned claims, including a 25% increase in agent productivity, a 50% reduction in agent attrition, a 30% reduction in brand operating costs, and a 25% increase in customer satisfaction based on queries handled. 90% of the time it is done solely by AI bots.

market

This fact has enabled LivePerson to penetrate 50% of the Global Fortune 500 airlines and 55% of their carriers. That said, the market opportunity is still significant, with approximately 70% of all customer service conversations still taking place through voice channels. LivePerson’s total services market size is approximately $64 billion, more than half of which is conversational AI ($33.1 billion), conversational cloud as a service ($20.7 billion), digital messaging ($5.8 billion), and conversational intelligence ($5.8 billion). 4.5 billion dollars). ) complete the opportunity.

That said, the company’s focus is on B2B, and executives estimate that it currently serves about a quarter of all conversation volume. B2B demographics are expected to contribute $339 million in FY23 revenue.

Operational and inventory performance

That said, the company’s business hasn’t been very profitable, and it last generated positive GAAP net income in 2012. Losses grew quickly from $0.42 per share in FY18 to $3.03 per share in FY23. Also in Adj. On an EBITDA basis, the company hovered between a loss of $16.2 million (FY22) and a profit of $37.9 million (FY20) in the same period. Despite this performance, after trading in the low double digits and low teens for most of the 2010s, LPSN’s stock has begun to weather a meaningful and relatively uninterrupted pandemic sell-off. A 528% rally in early 2018 eventually peaked. – All-time high of $72.23 in February 2021, as everything related to AI has received nose-bleeding valuations – Profitability be damned – in much the same way as all the dotcoms in 1999 or ‘cryptocurrencies’ in 2017 were driven to irrational levels . The peak price equates to a market capitalization of $4.9 billion, or 10.4 times 2021 sales.

Moving further away from profitability despite a 28% increase in revenue in FY20 compared to FY21, management initiated a restructuring in the second quarter of 2022 to reduce its inflated cost structure to generate double-digit adjustments. EBITDA margin and positive free cash flow in FY23. Despite eliminating ~$200 million in costs and ~$70 million in low-margin revenue, the course correction can be considered a significant disappointment, estimated for FY23 Adj. For the first nine months of FY23 (YTD23), EBITDA margin was 6.5% and negative free cash flow was $54.6 million. This shortfall compared to expectations led to the ouster of founder and CEO Robert LoCascio in August 2023. A successor was eventually named in January 2024.

As LivePerson struggled to restructure, inflation raised market concerns about unprofitability and the company’s stock price plunged 97% to a 14-and-a-half-year low of $2.33 per share in October 2023. FY23 top line is expected to decline 16%-19% compared to FY22. Even if this reflects a reduction in non-core businesses, the core focus of the B2B business is expected to grow only 2% in FY23 compared to FY22. Although the company boasts up to 450 patents and patents pending, it’s not hard to imagine competition from customer relationship management providers such as: Oracle (ORCL) and Salesforce (CRM) We are commercializing our business.

LivePerson has launched a series of products to boost sales, the most important of which is voice AI. This allows customers to converse with AI bots while still allowing companies to engage in approximately 70% of customer service conversations that take place via voice channels.

Performance and outlook for the third quarter of 2023

Despite reporting poor GAAP headline results, LivePerson struggled with profitability on a non-GAAP basis throughout FY23. As of November 8, 2023, it recorded earnings of $0.04 per share (non-GAAP), Adj. EBITDA of $10.6 million on revenue of $101.3 million, or $0.03 per share (non-GAAP) and Adj. 3Q22 revenue of $129.6 million, EBITDA of $9.1 million. For YTD23, we lost $0.04 per share (non-GAAP) on revenue of $393.3 million, compared to a loss of $0.42 per share (non-GAAP) on revenue of $393.3 million in YTD22. Restructuring tailwinds also improved free cash flow, but still resulted in outflows of $7 million in the quarter, compared to outflows of $25.1 million in the prior-year period. This resulted in the aforementioned outflow of $54.6 million in YTD23, compared to an outflow of $114.7 million in YTD22.

November corporate information session

The company said it added 19 new customers and renewed or expanded 31 more in the quarter, and reported average last-12-month revenue per enterprise and mid-market customer of $595,000, up 13% year-over-year. However, the revenue retention rate for this group was lower than the comparable period in 2022 (100% to 105%). No further details were provided, but rough calculations show that a revenue retention rate of around 90% is very concerning.

November corporate information session

Based on the range midpoint, the company expects to generate Q4’23 Adj. EBITDA of $3.5 million on revenue of $94.7 million, FY23 adjusted EBITDA of $25.5 million on revenue of $394 million. No FY24 guidance was provided.

November corporate information session

Balance Sheet and Analyst Commentary

Despite improved year-over-year cash outflows, the company’s liquidity remains an issue with a notable net leverage of 21.9, at $212.2 million against $583.3 million in 0% convertible notes as of October 31, 2023. Naturally, the company neither repurchases shares nor pays dividends.

It is also predictable that the Street is overwhelmingly bearish on the outlook for LivePerson, which is down more than 95% from its peak. It features 1 Sell rating and 9 Hold ratings with just one Buy, and 1 Outperform with an average price target of $4.25. On average, they expect the company to see a loss of $1.08 per share (non-GAAP) on $401 million in revenue in FY23 and a loss of $0.84 per share (non-GAAP) in FY24 on similar revenue.

Holding out against the Street’s negativity is beneficial owner Vector Capital, which has added more than 1.8 million shares since mid-December 2023, bringing its ownership to over 12%.

verdict

Despite the new products, LivePerson’s restructuring appears to have changed the company’s mantra from ‘no growth at all costs’ to ‘no growth, no revenue, no cash flow.’ Trade in EV/TTM Adj. With EBITDA just over 30, the best-case scenario is that a deep-pocketed suitor lets its technology shine. While this is impressive, it is likely to be commoditized and squeeze margins, negating any growth from product line expansion. Despite the lure of profitability, it’s better to sit on the sidelines until you see a case for top-line growth.

Computers are useless. They can only give you the answer. – Pablo Picasso