Logan Energy: Year in Business Progress (LOECF)

bjdlzx

In our last article on Logan Energy (OTCPK:LOECF), we noted that experienced management would probably be of the greatest help in situations like this. That experience came in very handy when a pipe failure occurred that took almost no time. 1,000 offline BOED in the first quarter. In larger companies, someone will answer the phone and call another department to handle it. This is where executives must “roll up their sleeves and get their hands dirty.” Because in reality there is no one else. Far fewer employees tend to be “jack-of-all-trades” to keep things like this from becoming major problems that ruin the quarter. In the end, the well was drilled and as the Startup Year continued, despite the challenges, there was still plenty of action on offer.

First Quarter Summary

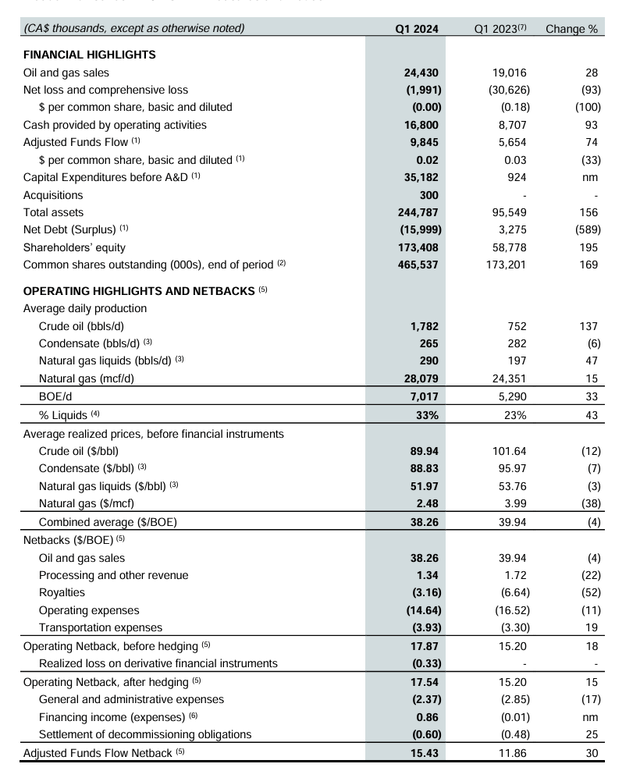

We made solid progress in the first quarter. First quarter of last year. Note that despite first quarter production being offline, both production and (more importantly) cash flow were up compared to the previous fiscal year.

Adjusted cash flow is probably the number you use to measure progress. That’s because the GAAP numbers show a significant decline in accounts receivable balances, up from selling natural gas at significantly higher prices a year ago and now charging lower prices.

One thing to consider is that the company did not exist in the first quarter of last year. Therefore, the information in the Q1 FY 2023 column is likely a representation constructed based on the company’s prior records prior to the spin-off. This must be viewed with the mindset that it was not a priority of the previous management at the time. This management has made these leases a key area of focus.

Logan Energy First Quarter 2024 Results Summary (Logan Energy First Quarter 2024 Earnings Press Release)

Note that production still increased despite the unexpected pipe breakage. Sometimes production becomes so intensive during startup that such failures can actually hinder growth goals. Progress was definitely slow. However, the growth story remained the same.

Moreover, management has substantially increased the liquid content in production. Investors should keep in mind that established production for these assets has been conducted using older technologies. So new wells may or may not produce more gas than older wells.

As will be discussed later, modern wells have been completed deeper in the formation to utilize more liquids. These can range from temporary to permanent benefits. Future cash flows are likely to depend significantly on the outcome.

Liquids actually account for the majority of sales. Therefore, any percentage increase in liquids, especially oil, is likely to be very significant. This will become more important as production periods lengthen and total output decreases.

Because the losses are accounted for by the non-cash derivative valuation process, management essentially achieves a break-even result. This represents a very favorable break-even point (and therefore very tight control over costs).

Some of these costs will fluctuate until there are enough wells for a stable average. Even with good acreage, well results will vary and so will costs. Just because you have a nice or large acreage doesn’t mean there won’t be a lemon or two somewhere.

This is just part of our upstream business. Most of the time, investors don’t see when a company drills (for example) 30 wells in a quarter because there’s an offset to those lemons. That would be a bit different here. There will be exploration wells and these risks will come up occasionally, perhaps quarterly for the first year or two. However, these problems appear to have sufficient footprint to be overcome relatively quickly through large-scale operations as planned by management.

At this stage in the company’s development, capital flow increased despite pipe breakage costs and relatively low production volumes. The profitability demonstrated by this increase indicates that minimal debt is needed in the early stages of building production. Therefore, a sustained balance sheet appears to be a reasonable expectation going forward.

cash burn

Based on information from past articles and current company presentations, it is likely that these executives and board members would also be classified as serial company founders.

Based on the experience of the management team, the company already has a significant banking line. In fact, the risk of your company running out of money is greatly reduced. In reality, these risks are as close to zero as upstream management can get.

Management currently estimates that it will need to borrow an amount equal to approximately half of its current annual cash flow rate. More wells have already been drilled that will come online during the heating season to provide more cash flow. No need to worry about cash right now.

initial strategy

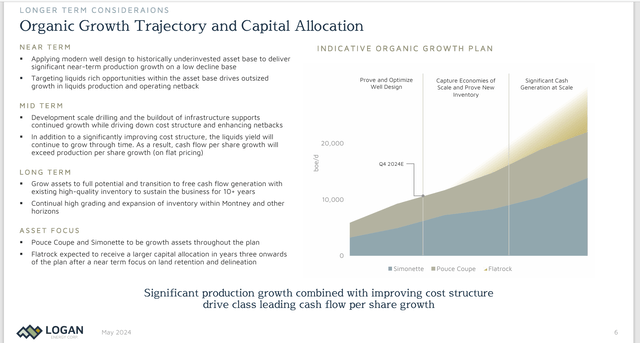

The overall plan is as follows: Despite the first quarter issues, the plan appears to be largely intact.

Logan Energy’s Organic Growth Strategy (Logan Energy May 2024 Corporate Presentation)

The main revision to fiscal year guidance so far is that natural gas prices have been weaker than expected. However, considering the overall plan to increase the amount of liquid in the production mix, it makes sense not to change the plan.

This means that management plans to borrow a little more than originally planned. However, this may change (at least for now) with La Niña expected to develop in the summer and winter.

Activity is likely to be much lower in the second quarter due to Canada’s Spring Breakup. But producing more natural gas to fit the heating season has long been a preferred industry practice.

Due to this period of relatively low activity, significant guidance changes may occur in the second half of the fiscal year. One thing that often happens with Spring Breakup is a “complete halt” to some activities. Psychologically, therefore, executives have a real break to fully assess the industry situation. This is very different from the United States, where most of the year things go on continuously (so there is no “complete stop” for some activities).

Latest Well Results

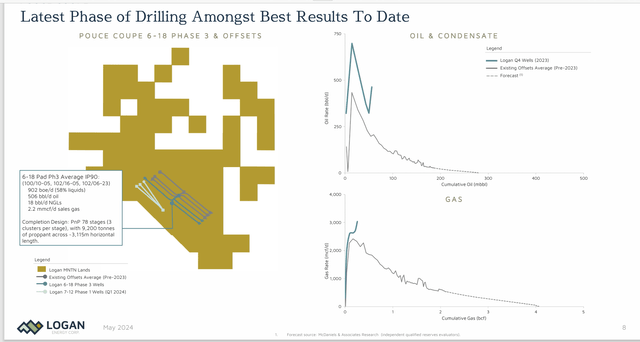

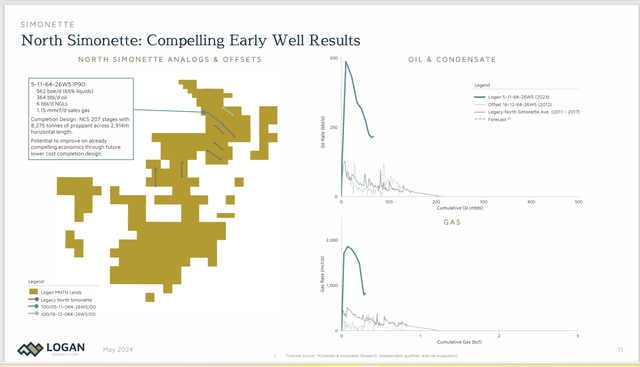

Management became very interested in that acreage because they thought it would yield substantially better results. It would in fact “revolutionize theater” after years of production at certain levels. One example is shown below.

Logan Energy Organic Growth Strategy (Logan Energy May 2024, Corporate Presentation)

As can be seen above, the increase in liquids production is important because it is much more valuable than natural gas production. It is particularly important to target diesel and condensate production as these are the most valuable products. This can often substantially increase the profitability of a well compared to older designs.

Another consideration is to consider the value of the product produced compared to the cost of the well to ensure the shortest possible payback period. These executives are looking for cash flow. Therefore, the faster the payback period, the greater the number of wells that can be drilled with the same capital. The company then gets off to a relatively quick start with low debt. As a result, expected oil and condensate production often have a significant impact on the “go or not” decision of a well.

Logan Energy Production Results Comparison of Well Design with Conventional Wells (Logan Energy May 2024, Corporate Presentation)

These are areas with higher liquid production rates. However, it is the payback period and profitability as measured by management that generally determine the outcome of capital competition. This generally means that the production curves of valuable products such as oil and condensate largely determine the profitability of an area. The production mix itself is a secondary consideration.

Guided Results

Management believes the 2024 budget is still on track. Most executives leave some “room” in their budgets for all the unexpected things that might happen. That seems to be the case here, as the first quarter (so far) hasn’t really brought any real changes to the plans.

This can confuse many investors who often hear about production mix. However, discussions of production mix often “assume” a high level of production for comparative purposes. This is often not the case. Therefore, management often focuses on the production of valuable liquids.

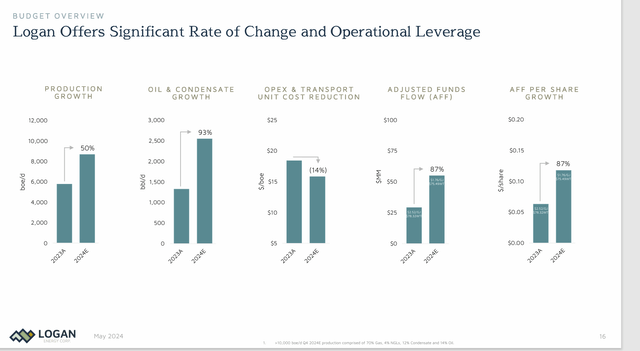

Logan Energy 2024 Guidance Against 2023 Actuals (Logan Energy May 2024, Corporate Presentation)

The second quarter is likely to be the weakest progress toward achieving annual goals. Perhaps the most important part of a natural gas producer’s plan is preparing as much production as possible for the critical heating season. For a company as small as this one, there’s a good chance they’ll meet their goals, even if the heating season lasts longer than expected, since heating season actually starts a few months after spring break.

This means that growth in the third and fourth quarters is likely to be the most significant step forward for the fiscal year.

The graph above also tends to imply a much higher exit rate than the average annual production. This means next year will start with a much higher cash flow rate.

I rate this company a Speculative Strong Buy because, despite its low stock price, it is a legitimate growth company in a market segment known for many stocks that are not close to being legitimate stocks. These executives have founded and sold companies before (listed in the last article and also in the current presentation). That experience is proven by the results so far.

danger

All upstream companies are subject to the volatility of upstream commodity prices and low future visibility. An unexpected, severe and prolonged economic downturn could materially change future prospects.

The cyclical technological advancements sweeping the industry can stop at any time. It appears that management is relying on leveraging the upfront payments to benefit shareholders on the rental assets it currently owns. But that may not be the case in the future.

The loss of a key person could materially disrupt the company financially and slow its future growth plans.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.