Long-term Litecoin holders wisely exited before halving, data shows

Data shows that long-term Litecoin holders left their assets before the halving, while short-term holders panicked on the day of the halving. Here, ‘halving’ refers to an event in which Litecoin’s block reward is permanently reduced by half.

Long-term Litecoin holders were sold off during the price surge before the halving.

According to data from market intelligence platforms: Into the Block, long-term holders were well prepared for the “selling news” halving event. “Long-term holders” (LTH) typically include any investor who has been holding a coin for at least six months.

Related Reading: These Bitcoin Indicators Are Ahead of Critical Retests Will the bullish trend prevail?

This group includes some of the most determined investors in the Litecoin market, and they do not react easily to what is happening in the broader sector as they typically do not engage in significant selling and hold on to FUD or profit-taking opportunities.

Since the movements of these investors are very rare, the few times they sell can be something to watch out for as they can cause problems in the market.

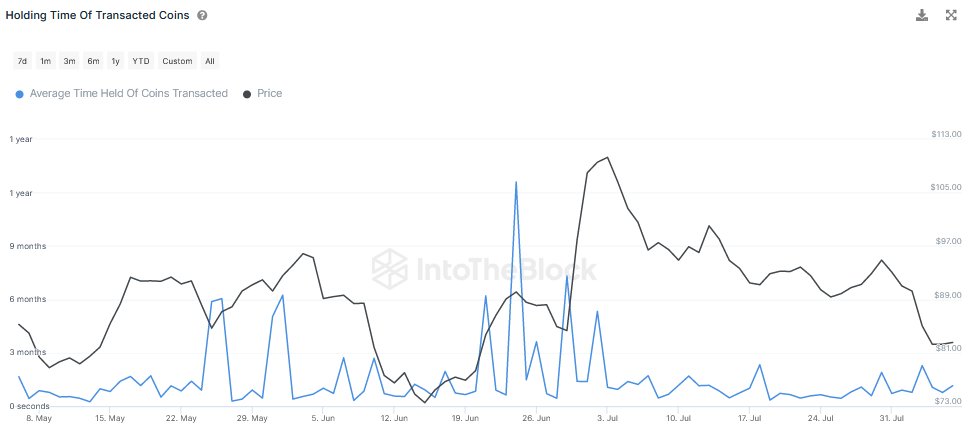

A way to measure whether LTH is participating in a sale is to use the “Holding Time of Traded Coins” metric. This tells us the average amount of time the transferred coins were dormant on the blockchain prior to this movement.

A higher value of this indicator means that the coins being sold on the network are older, which can naturally be a sign that LTH is currently active. On the other hand, a low value usually indicates that short holders (STH) are currently selling.

We now have a chart showing Litecoin holding time trends for coins traded over the past few months.

The value of the metric seems to have been relatively low in recent days | Source: IntoTheBlock on X

As you can see in the graph above, Litecoin trading coin holding time surged in June when cryptocurrency prices were surging.

The largest of these surges saw the indicator’s value exceed one year, meaning some of the market’s most experienced investors broke their silence.

This rally occurred as the market began to exaggerate the halving, which at the time was only a month and a half away.

The event takes place every four years, with the most recent event taking place earlier this month. Contrary to what some had hoped, this event did not prove to be as bullish for LTC as the aforementioned rally did not last too long and the cryptocurrency only fell for the remainder of the halving, before eventually falling sharply in practice. On the day of the event.

It appears that experienced LTHs already predicted something like this would happen, so they made the wise decision to sell while the opportunity arose.

In the post-halving sell-off, the value of the indicator remained low, suggesting that only short-term holders panicked after seeing that the bullish trend could not return to Litecoin with the event.

LTC price

As of this writing, Litecoin is trading at around $84, down 8% over the past week.

LTC has plummeted since the halving | Source: LTCUSD on TradingView

Featured image by Kanchanara on Unsplash.com, chart by TradingView.com, IntoTheBlock.com