MacroGenics: Rating a Buy After Prostate Cancer Outlook Surges 200% (MGNX)

Klaus Vedfelt/DigitalVision via Getty Images

introduction

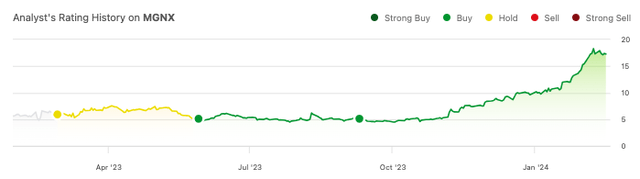

macrogenics‘ (NASDAQ:MGNX) The stock is up 230% since my “buy” recommendation in September.

pursue alpha

Two main variables contributed to the implementation. First, macroeconomics (interest rate cut expected at the end of this year) The Federal Reserve (Fed) has been friendly to the biotech sector. Many stocks have risen significantly without any fundamental changes to the company. Second, there is high interest in developing antibody-drug conjugates (ADCs). For example, ADC developer Immunogen (IMGN) was acquired for more than $10 billion. AbbVie (ABBV) November.

In the next article, we’ll reassess MacroGenics’ current valuation to see what’s changed internally and whether there are advantages to the stock being more expensive besides the fact that it may have been undervalued when we last looked a few months ago.

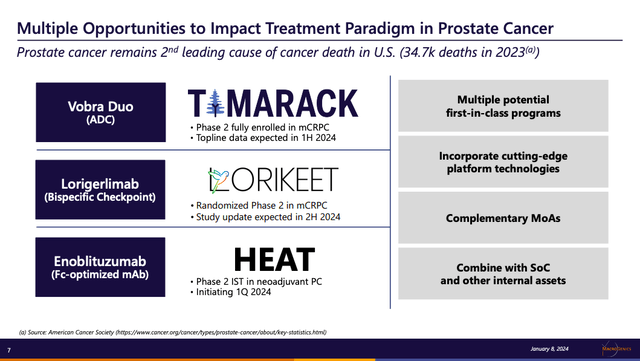

Vobra Duo: Bid on MacroGenics’ Paradigm Changes in Prostate Cancer

Macrogenics announced in November that enrollment in the TAMARACK Phase 2 study of its ADC, vobramitamab duocarmazine, also known as vobra duo, was pre-completed. The company is testing a biologic agent for the treatment of metastatic castration-resistant prostate cancer (MCRPC).

Patients with MCRPC are typically treated with androgen receptor axis-targeted therapies such as abiraterone, chemotherapy such as docetaxel, immunotherapy such as pembrolizumab, and radiopharmaceuticals. However, these treatments have variable response rates, serious side effects, and resistance.

Vobra duo delivers a cytotoxic payload specifically targeting B7-H3 expressing cancer cells. This will be a unique goal of MCRPC and will provide patients with another option with potentially fewer side effects than less selective alternatives such as chemotherapy. It may also be utilized with other agents for synergistic effects. MacroGenics can also use biomarkers to identify patients most likely to respond.

This is an interesting target because high B7-H3 expression is associated with faster and more lethal progression of prostate cancer. B7-H3 is being studied for a variety of indications. Another MacroGenics asset, enoblituzumab, a “humanized, Fc-engineered, B7-H3-targeting antibody,” seemed relatively safe and showed promising early efficacy in prostate cancer.

Both Vobra Duo and Enoblituzumab are core to Macrogenics’ pipeline focused on prostate cancer.

macrogenics

While there is promise for new mechanisms of action in therapeutic areas with high unmet need, investors should approach the TAMARACK data with caution as the obstacles to success are formidable. This data, expected later this year, will be a significant event for the company and any positive news could push the stock higher.

financial health

MacroGenics’ balance sheet shows that it has a total liquid assets of $256.4 million, with a combined value of ‘cash and cash equivalents’ ($89.9 million) and ‘marketable securities’ ($166.5 million). The ‘current ratio’, which divides total current assets by total current liabilities, was about 5.68, indicating strong short-term liquidity.

Over the past nine months, ‘net cash used in operating activities’ was $50.2 million, which translates to a monthly cash loss of approximately $5.6 million. Dividing liquid assets by this monthly cash burn gives a ‘cash runway’ of approximately 46 months, suggesting a longer period before funding problems arise. However, these values are based on past performance and cannot directly predict future results.

Given MacroGenics’ current financial position and its ability to service short-term liabilities with a significant amount of liquid assets, it is unlikely that additional financing will be needed within the next 12 months.

market sentiment

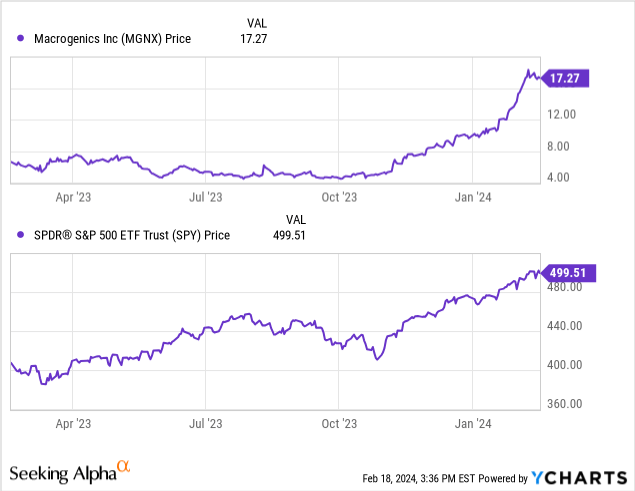

According to Seeking Alpha data, MGNX presents a nuanced investment profile marked by contrasting elements. With a market capitalization of $1.07 billion, the company has a decent financial base. Analysts expect revenue growth to increase from $80.88 million in 2023 to $153.38 million in 2025, indicating solid growth prospects. MGNX’s stock momentum is exceptional and has significantly outperformed SPY over all periods observed over the past year, highlighting strong market confidence.

Short interest is at 8,338,224 shares (~5%), suggesting moderate investor skepticism or hedging activity and worth monitoring for potential volatility. Institutional ownership is high at 99.64%, with notable moves including Bellevue Group, Blackrock, and T. Rowe Price increasing, while Armistice Capital and Vanguard decreased, reflecting dynamic institutional sentiment. Insider trading over the past 12 months shows net positive activity with more shares purchased than sold, which may indicate insider confidence in the company’s future.

Considering these factors, MGNX’s market sentiment can be classified as follows.robust,” This is supported by growth prospects, strong stock momentum, and positive insider trading activity.

Should I buy, sell or hold MGNX stock?

I continue to like Macrogenics stock. Even if you triple it, it doesn’t seem that expensive here. They are making exciting progress in prostate cancer with their unique mechanisms of action. The rapid completion of enrollment in the TAMARACK Phase 2 study highlights operational efficiencies and potential market impact. According to Data Bridge Market ResearchThe global market for MCRPC is expected to reach $17.7 billion by 2029, highlighting the importance of Macrogenics’ efforts.

Financially, MacroGenics is resilient with a solid liquidity position, reducing short-term funding risks. However, investors should monitor the upcoming TAMARACK data and remain aware of the volatility inherent in biotechnology investments. Even if clinical, regulatory, and market success occurs (a low-probability event), MacroGenics remains a speculative investment as it is still many years away from generating meaningful returns.

Nonetheless, given the company’s strong pipeline, financial strength, and positive market sentiment, MacroGenics presents an interesting, if speculative, “buy” opportunity.