Major changes occur as low interest rate bets rise | MEM edge

Coming off a very positive earnings season, both the S&P 500 and NASDAQ are hitting record highs. To date, nearly 80% of S&P 500 companies have reported positive earnings surprises, and year-over-year earnings growth is at its highest since the second quarter of 2022.

Amid this corporate growth, we could see interest rates falling after Wednesday’s key CPI data came in lower than expected. Accordingly, the yield on major 10-year government bonds fell to a low of 4.3% and then rose to today’s closing price.

This is good news for growth stocks like technology, which have been struggling as the market marches to new highs. A rising interest rate environment is negative for growth stocks such as technology stocks.

Technology Sector Daily Chart (XLK)

Technology Sector Daily Chart (XLK)

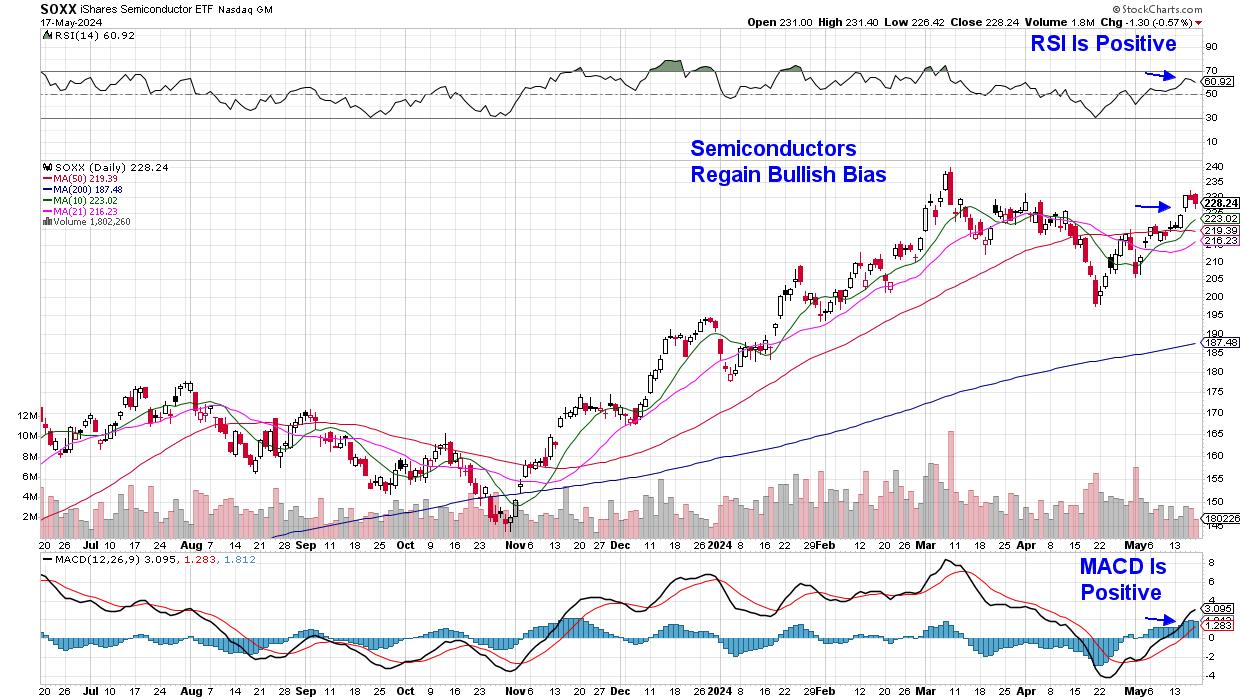

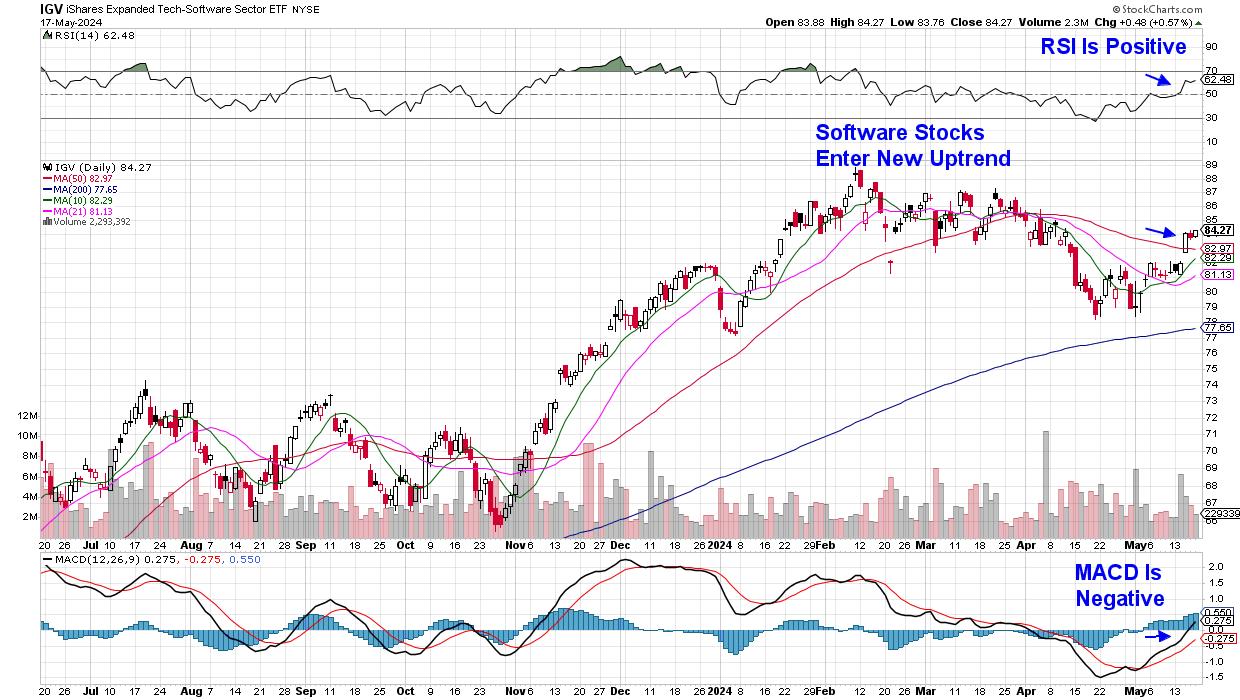

While Apple (AAPL)’s 12% rise since its earnings release three weeks ago is certainly a factor in Technology’s new uptrend, last week’s turnaround in both semiconductor and software stocks is expected to be the latest driver.

As subscribers to my MEM Edge reports know, I have been anticipating renewed interest in these high-growth areas. Because our watchlist had some of the top Semi and Software names that have now been added to our suggested holdings list.

Semiconductor Group (SOXX) daily chart

Semiconductor Group (SOXX) daily chart

Software ETF (IGV) daily chart

Software ETF (IGV) daily chart

Next week could be a pivotal week for these groups with earnings reports from key players. The biggest impact will be Nvidia (NVDA), which is scheduled to report earnings next Wednesday after the market closes. Going into the report, analysts are expecting significant revenue growth driven by the data center segment, primarily driven by AI demand.

Among software stocks, Palo Alto (PANW) is scheduled to report quarterly earnings after the market closes on Monday. Software security stocks are recovering from price losses following the company’s last quarterly report, in which management announced a product rollout shift. PANW has entered a new uptrend as it gets closer to closing the gap.

As AI growth prospects rise and interest rates become more likely to fall, other non-growth sectors are also becoming more popular. To learn about these new areas and which stocks can best leverage them, try out the MEM Edge report twice a week for a small fee using this link here.

warmly,

Mary Ellen McGonagle

MEM Investment Research

Mary Ellen McGonagle is a professional investment consultant and president of MEM Investment Research. After working on Wall Street for eight years, Ms. McGonagle left the company to become an experienced stock analyst, where she worked with William O’Neill, where she identified sound stocks with the potential to take off. She has worked with clients around the world, including renowned firms such as Fidelity Asset Management, Morgan Stanley, Merrill Lynch, and Oppenheimer. Learn more