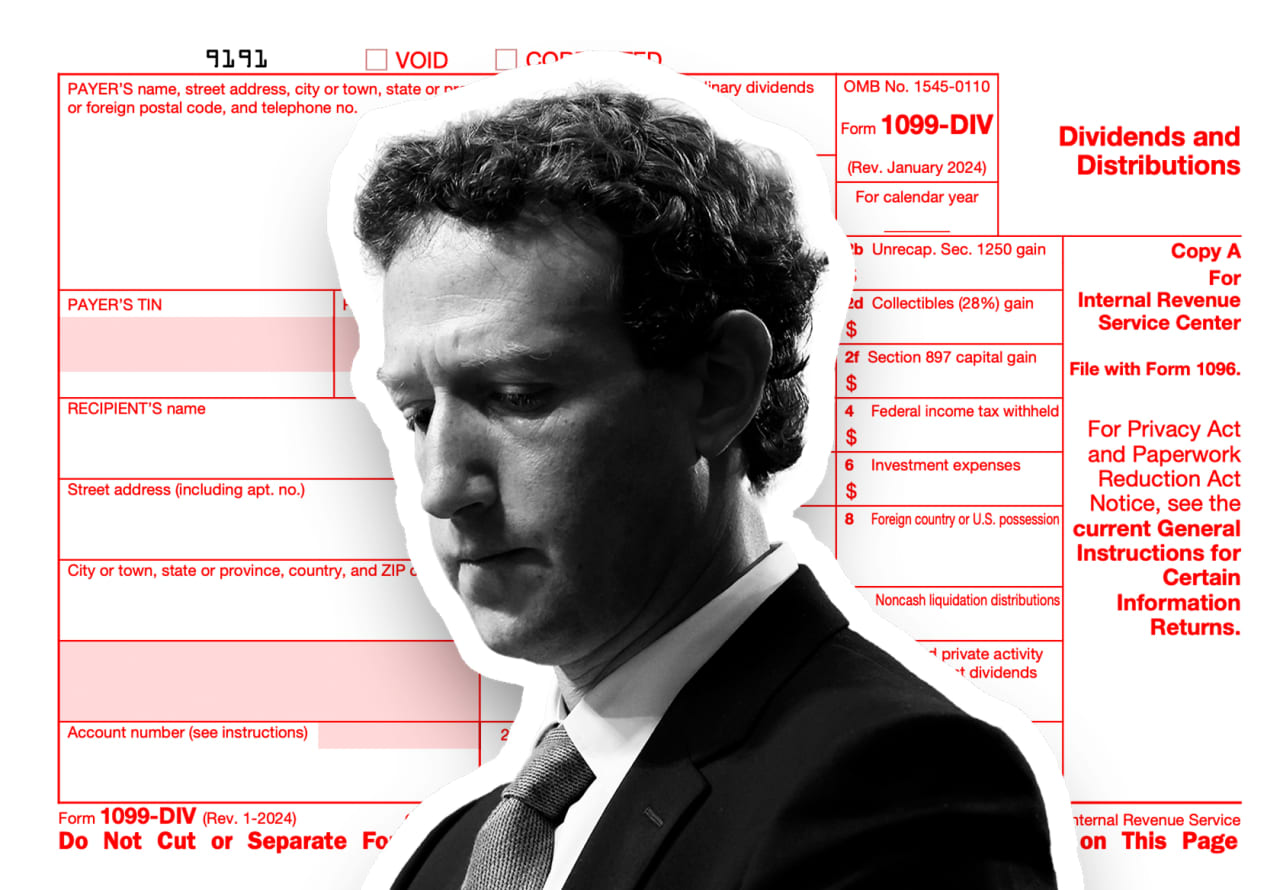

Mark Zuckerberg could owe millions in taxes to the IRS on Meta dividends.

Mark Zuckerberg delighted Meta shareholders and Wall Street this week with news of the social media giant’s first ever dividend.

The IRS may also rejoice, as they are now taxing millions of dollars in Meta stock dividends allocated to Zuckerberg’s portfolio.

Meta Platforms Inc. Zuckerberg, CEO of META

It plans to pay $700 million in dividends annually. He owns nearly 350 million shares, according to FactSet, and the company will begin paying a quarterly dividend of 50 cents per share.

A 20% qualified dividend tax plus a 3.8% tax on investment returns for wealthy households would result in annual federal taxes of nearly $167 million, two accounting experts said.

The 13.3% California income tax on dividends could cost Zuckerberg an additional $93.1 million, said Andrew Belnap, an accounting professor at the University of Texas at Austin’s McCombs School of Business.

In total, this amounts to $259.7 million per year in combined federal and state taxes on Meta dividends, Belnap estimated.

For context, U.S. taxpayers reported more than $285 billion in qualified dividend income to the IRS through mid-November 2023, according to agency statistics. During that time, approximately 30 million tax returns reported qualified dividends.

Meta said it plans to pay quarterly cash dividends going forward and plans to pay its first dividend in March.

Meta shares surged 20.5% on Friday, closing at a record high of $474.99. Dow Jones Industrial Average DJIA,

The S&P 500 SPX and Nasdaq Composite COMP both closed higher on Friday.

‘Zuck is getting his big break’

Meta announced the dividend payout in its earnings results on Thursday, the same week Americans began filing income taxes.

Looking at Zuckerberg’s dividends and their impact on taxes provides a glimpse into the debate over different ways wages and wealth should be taxed.

“Zuck is taking a huge break,” said Andrew Schmidt, an accounting professor at the Poole School of Management at North Carolina State University, who crunched the numbers for MarketWatch.

He said about $167 million “looks like a high tax bill.” But if Zuckerberg had been paid a flat salary of $700 million, Schmidt estimated he would see a tax bill of about $259 million on his wages after being taxed at the top marginal tax rate of 37%.

Federal income tax brackets range from 10% to 37%.

Meanwhile, IRS taxes granted dividends and capital gains rates of 0%, 15%, or 20% depending on income and household status. Net investment income tax adds an additional 3.8% if your individual income is at least $200,000 or your marital assets are $250,000.

For federal and state taxes on Meta dividends, Zuckerberg would face a combined tax rate of 37.1%, Belnap noted. “His tax rate on this is actually quite high,” he said.

The gap in tax rates on wages and income from investments “has been a big criticism of U.S. tax policy,” especially as lawmakers look for ways to raise more tax revenue, Schmidt said.

Schmidt added that ordinary retail investors enjoy the same preferential rates on capital gains and dividends as the top 1% of taxpayers. The problem is that while these dividends and stock gains represent a small portion of your income, your wages, which are taxed at high tax rates, represent a larger portion.

Belnap pointed out that California state tax rules do not provide special treatment for dividends.

Also read: Where Trump, Biden and Haley stand on capital gains, child tax credits and other key tax issues

Zuckerberg received a base salary of $1 in 2022, a figure that has not changed for several years. He is now worth $142 billion, making him the fifth-richest person in the world, according to the Bloomberg Billionaires Index.

Mehta did not immediately respond to a request for comment.

Taxes on Meta dividends are unlikely to be an issue that Zuckerberg or Meta shareholders large and small will have to deal with until next tax season, Belnap and Schmidt said.

But as taxpayers pile up 1099-DIV forms for dividend income, IRS figures show it’s mostly top-tier taxpayers who reap the rewards of preferential rates for qualified dividends.

Households worth at least $1 million accounted for 40% of the estimated $285.3 billion in eligible dividends reported through mid-November, according to agency figures.

For less wealthy investors, “I’d say it’s usually a good supplement, but very few people live on dividends,” Belnap said.