Market Excited, But Kontoor Stock Still On Hold (NYSE:KTB)

MoMo Productions/DigitalVision via Getty Images

Contour brand (New York Stock Exchange: KTB) owns world-renowned denim clothing brands Wrangler and Lee.

I started covering Kontoor in April with a Hold rating. I liked many aspects of the company, including the brand, management, and capital allocation. But I considered it. The revenue multiple (about 14.5x P/E or EV/NOPAT) was fair for a high-quality clothing retailer, but not an opportunity.

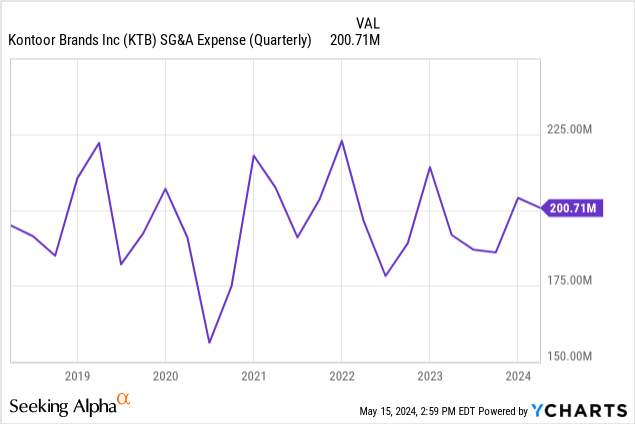

In this article, we will review the company’s 1Q24 performance and earnings release. The company continues to demonstrate challenges in its wholesale and denim segments, where it generates its greatest revenue and profits. Nonetheless, management is excited about growth in DTC and non-denim. SG&A expense management continues to be effective. The company improved its FY24 guidance for revenue and profit.

Despite the relatively unimpressive quarter, the stock is up 25% since I published the article in April and 12% since the earnings release. I take these developments into account. I continue to believe the stock is on hold because it’s hard to justify.

Challenging Wholesale, Better DTC and POS

Wholesale Across the Line: More than 85% of Kontoor’s sales are wholesale. This channel has been challenged, with a year-on-year decline of approximately 7%. This decline is shared between the Wrangler and Lee, as well as the U.S. and non-U.S.

Management blames inventory issues and excessive caution at retailers. But we were surprised to learn that this downturn was shared across regions and brands. For example, the Chinese apparel sector saw sales decline in APAC despite a generally good quarter.

DTC Flat and POS improvements: The DTC sector recorded a similar level to the same period last year, and it was mentioned that the market share at the POS level is increasing through the retail store occupancy service (Circana). Management believes this is a sign that consumers will eventually buy more of their favorite products when retailers restock them. It is unclear whether the POS data also includes non-denim categories, which would be inappropriate.

Intangible assets, products, efficiency

The company continues to invest in brand building. In my opinion, this is the main mission of clothing manufacturers and therefore an important development.

country wrangler: For Wrangler, Kontoor presents a new collection in collaboration with country artist Lainey Wilson (brand ambassador since 2023). The brand has also relaunched a collaboration with luxury clothing brand STAUD, which retails for over $200, and a collaboration with jewelry brand Kendra Scott. All this indicates that the denim brand is focused on the country. In the same vein, country singer Miranda Lambert released a single called ‘Wranglers’ last May.

Young Lee: Lee targets young consumers with a style close to streetwear. This quarter we collaborated with Zara’s streetwear sibling Pull & Bear and classic LA streetwear label The Hundreds. The brand also announced a street art collection featuring the work of Jean-Michel Basquiat, a famous hip-hop and pop artist from the 80s.

Non denim: Management satisfaction with non-denim products is high. According to the request, the launch of the Wrangler Outdoor is in progress, and Lee has launched a golf line. Products excluding denim bottoms already account for nearly 50% of Wrangler sales. While this is positive, it does indicate that denim may be facing problems. In Lee’s case, the focus is on ‘comfortable’ denim, that is, creating a highly stretchy, casual look and competing with performance and athleisure wear.

Maintain efficiency: Despite declining sales, DTC growth (stagnant compared to wholesale decline), and investment in intangible assets, the company’s SG&A expenses are not growing. This is a healthy development, indicating that management is managing the company’s costs effectively.

shareholder return: Kontoor returned $48 million, or 80% of net income, in the form of dividends and share repurchases, compared to capital expenditures of only $6.5 million. This is a sign that the model has a high return on capital.

This year’s outlook and valuation

Kontoor improved its guidance for FY24 due to improved visibility into wholesale and pricing. This year, sales are expected to be flat at about $2.6 billion, operating profit at about $380 million, and EPS at about $3.85.

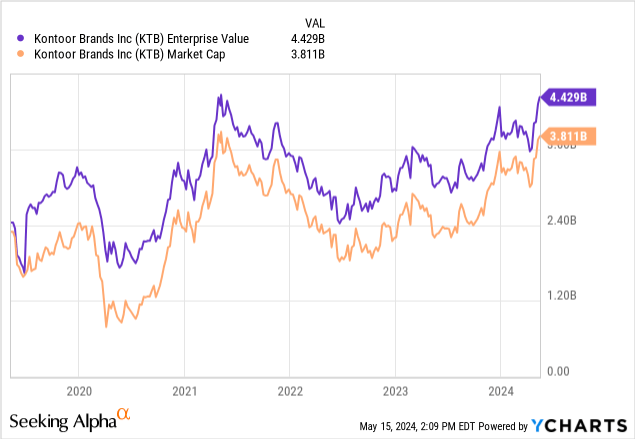

With a market capitalization of $3.8 billion and shares trading at $68, equivalent to an EV of $4.4 billion, management’s numbers indicate a P/E multiple of 17.6x and an EV/NOPAT multiple of 14.5x (taking into account the 20% tax rate). .

I think the above assessment is excessive for two reasons.

First, to meet revenue and profit guidance, Kontoor must halt a downward revenue trend that has already persisted for two quarters. The company also needs to improve its operating margins by 300 bps (from the current 12% to 15%). There is already an inherent optimism here, but the data does not guarantee it.

Second, I don’t think a P/E multiple of 17.6x is fair for a company that is doing the right thing but still needs to return to pre-pandemic earnings and is in a highly cyclical market like apparel. If we mentioned in the previous article that less than 15x is fair, opportunities will only appear below the 12x multiple.

Given the current price action, waiting for improvements or price cuts may make some readers anxious. Missing out on some opportunities, such as Kontoor’s recent valuation, is the price you have to pay for the margin of safety that increases investment profitability while protecting investors from large losses.