Mayville Engineering: Demand expected to slow in all five major end markets (NYSE:MEC)

Parradee Kietsirikul/iStock via Getty Images

introduction

We are Mayville Engineering Company, Inc. (New York Stock Exchange:MEC) In September of this year, we reaffirmed our ‘hold’ position. At the time, the company was buoyed by consecutive quarterly results. Following the revenue miss, there was an additional revenue miss in Mayville’s recently reported third quarter results. Although Mayville’s profitability remains under pressure (which we believed the technology team was pricing out at the time), the stock is still up about 30% over the past 14-plus weeks. The question now is whether a new bullish long-term trend has begun in Mayville or whether these repeated earnings failures will negatively impact how the stock trades going forward.

Improvements are being made

What Mayville certainly wants is that the Hazel Park facility will continue to reduce its capital expenditures. It’s finally being completed. $3.5 million was used for capital expenditure purposes in the third quarter of this year, compared to $12.5 million in the same period 12 months ago. This means free cash flow has improved significantly from just $5.2 million in the third quarter of fiscal 2022 to $16.1 million in the third quarter of this year. Free cash flow is the most important metric and key to investing. evaluation driver. Additionally, given the constraints of Mayville, as mentioned. profitability Increasing free cash flow (if margins remain tight) means internal organic investments and acquisitions can accelerate over time. In this regard, the company’s 2026 annual free cash flow target is much improved, reaching $70 million.

For example, the recent MSA purchase provides insight into how smartly coordinated acquisitions can quickly add to Mayville’s finances. Mid-States Aluminum (MSA) helped increase revenue by more than 16% in the third quarter. Additionally, Mayville’s Internal Value Creation Framework (MBX) is tailored to maximize organic growth. What I love about MBX is the company’s constant pursuit to measure and improve commercial excellence (Kaizen’s continuous improvement model). In this regard, the 100 MBX lean events realized by the end of the third quarter are expected to result in significant long-term cost savings for Mayville.

technical resistance

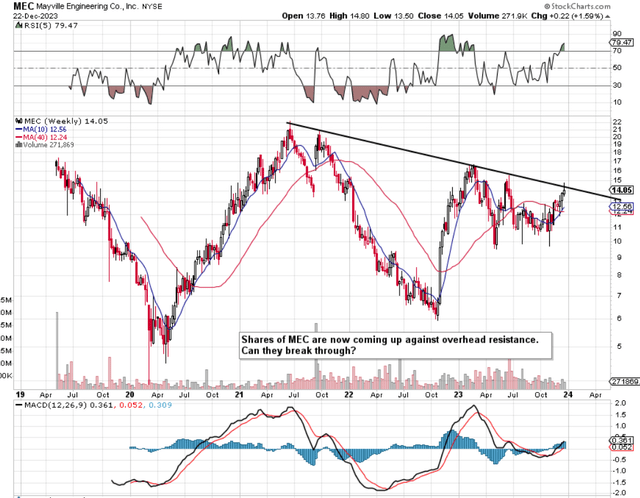

However, after looking at Mayville’s technical and forward-looking fundamentals, we have decided to maintain a ‘Hold’ rating for the time being. As you can see in Mayville’s mid-chart below, the stock is currently rising against overhead resistance, which leads us to believe that the current rally will stall for the time being.

Mayville technical chart (Stockchart.com)

Growth uncertainty in several markets

On a fundamental level, Mayville’s commercial vehicle segment sales grew more than 6% in the third quarter, but the CEO’s comments below on the latest earnings call reveal forward-looking demand trends. Remember, this segment accounts for roughly 40% of Mayville’s last 12-month sales. So, if the market expects a prolonged recession, continued weakness in Mayville’s commercial vehicle segment will certainly impact its stock price.

Customer demand requirements continue to indicate a slowdown in demand through the end of the year and into 2024 as the industry navigates regulatory changes and a slowdown in overall economic activity. ACT Research currently projects Class 8 vehicle production to 336,000 units in 2023, up 6.6% from the previous year. Current forecasts show construction pace will slow during the fourth quarter and decline by nearly 4% year-over-year. ACT forecasts for 2024 reflect further weakening in demand through the middle of the year, with current production estimates reflecting an 18.5% decline for the full year of 2024. Furthermore, we are currently experiencing volume disruptions related to the United Auto Workers strike. Our customers. This has impacted production of these products so far during the fourth quarter and will continue to impact them until an agreement is reached.

The ‘Construction and Access’ sector is as open to economic activity as the commercial vehicle sector in that general conditions dictate the level of demand. The market appears to be pricing in a 2024 interest rate cut, but this does not necessarily mean construction levels in the residential housing market will improve. Interest rates have been cut several times due to the decline in economic activity. Moreover, the risk here is that if the Fed adopts an accelerated dovish stance in 2024 (in response to an economic contraction), inflation could easily become inflated if not rise once again (which would not be good for the sector) ). Construction and Access remains an important segment for the company, accounting for nearly a fifth of Mayville’s follow-on revenue.

Mayville’s ‘powersports’ segment is growing, but issues with dealer inventory levels remain. The Agriculture and Military segment reported increased sales in the third quarter, but doubts (about future growth models) remain.

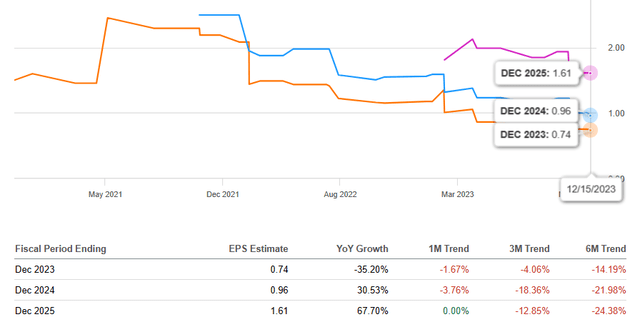

So, when you tie everything together, you can understand why forward-looking earnings estimates have worsened recently, as you can see below. Final estimates for fiscal 2024 have already been revised downward by nearly 4% in the past 30 days.

Mayville Forward-Looking EPS Revised (Look for alpha)

conclusion

So, in summary, Mayville Engineering is expected to see meaningful growth over the next few years, but forward-looking demand trends have led to a decline in EPS revisions in recent months. Now that the company is starting to see free cash flow, it will be interesting to see how effectively management allocates capital going forward. Let’s see what the Q4 numbers bring. We look forward to continued reporting.