MCJ Capital Partners Q4 And 2023 Year End Update Letter

tonefotografia

Dear Partners & Friends,

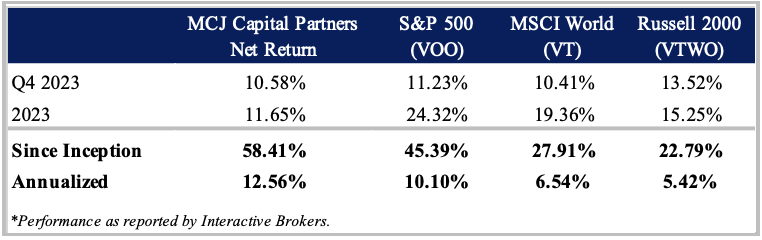

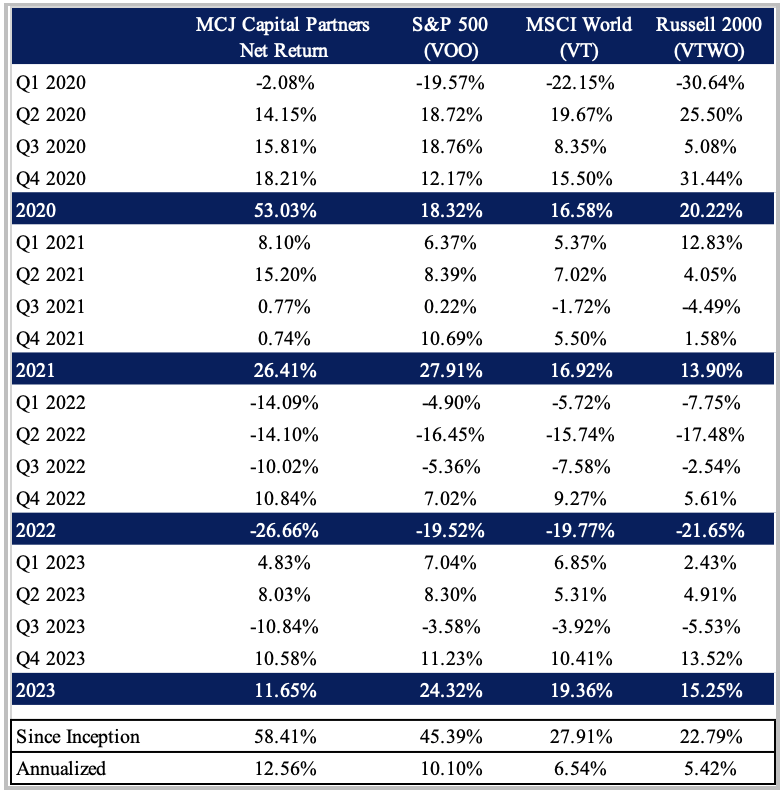

For Q4 of 2023 our total return was 10.58% compared to 11.23% for the broader S&P Index, 10.41% for the MSCI World index, and 13.52% for the Russell 2000 index (RTY).1

For 2023, our total return was 11.65% compared to 24.32% for the broader S&P Index, 19.36% for the MSCI World Index, and 15.25% for the Russell 2000 index.

Since inception (as marked February 12, 2020), our total return is 58.41% compared to 45.39% for the broader S&P Index, 27.91% for the MSCI World index, and 22.79% for the Russell 2000 index.

Thoughts and Commentary on 2023

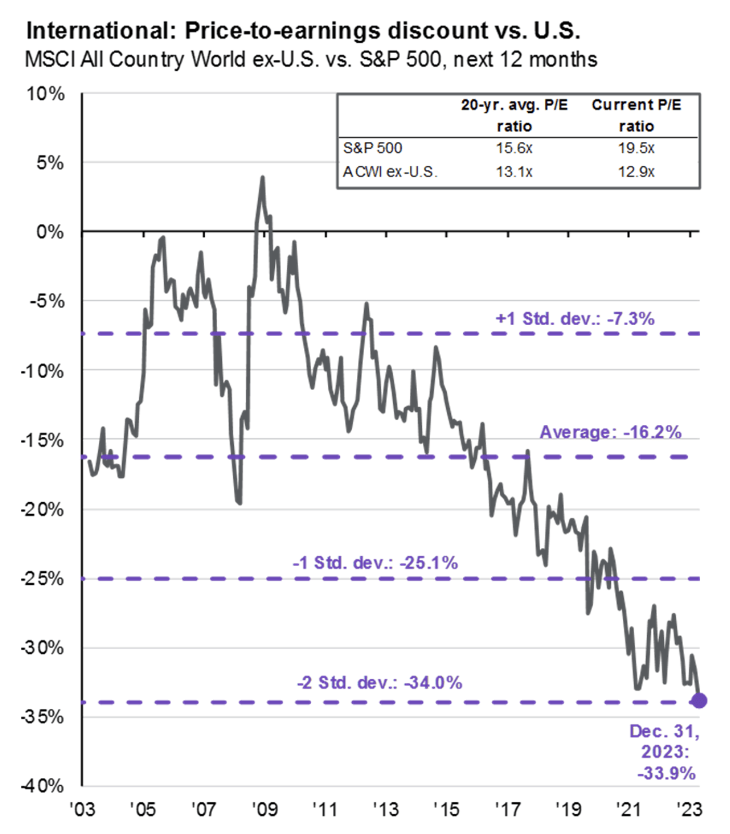

Source: Source: FactSet, MSCI, Standard & Poor’s, J.P. Morgan Asset Management. Guide to the Markets

2023 started with a mini-banking crisis that toppled Silicon Valley Bank (OTC:SIVBQ), Signature Bank (OTC:SBNY), and Credit Suisse. Before the ink could dry on newspapers, it was over and markets directed their attention to the AI craze. The magnificent seven (made up of Nvidia, Meta, Tesla, Microsoft, Amazon, Alphabet and Apple) pulled markets higher with promises of a world engulfed with Artificial Intelligence. Towards the end of the year, market focus shifted from AI to overall optimism that the hiking cycle of the Federal Reserve was indeed complete.

At the risk of sounding like a broken record, we head into 2024 with a persistent and significant disconnect between large and small company valuations, and that of the International securities in relation to their S&P 500 counterparts. I’ve mentioned this in prior updates and there is nothing new to add.

Lastly, I’ll add like so many in the investing community, I celebrated and reflected on the life of Charlie Munger around his passing. How lucky I am to have stumbled across Charlie early in life. His wisdom and wit breathed meaning into the idea of a life well lived is often accompanied by an endless joyful pursuit of learning. He lived with purpose and served as North Star of rationality and consistent improvement. Here’s to you Mr. Munger.

Musings on Serial Acquirers

As investors, we must pick our “spots.” Spots are areas of the market where we think we have an edge at both understanding the underlying business model and maintaining a behavioral advantage in how we act as owners of our shares during the duration in which we hold them. Different investors are attracted to different types of businesses and frameworks.

Like a moth to a flame, for as long as I recall I’ve been attracted to serial acquirers. I can trace my initial interest to an early time in my investment journey when I stumbled across the concept of a Conglomerate (a type of serial acquirer). Just the word “Conglomerate” carried a mystique that begged further investigation.

What I quickly discovered was that each Conglomerate seemed to be constructed differently, with the main common thread being that funds from one line of business operation could be used to shift into another, often unrelated vertical. For whatever reason, this concept of acquisitive growth felt more intuitive to me than trying to decipher purely organic growth in a dynamic marketplace.

Over the years my understanding and thoughts about serial acquirers have evolved. Considering we own quite a few of these beauties, I would be doing you an injustice not sharing more of my reflections on this type of business.

For those of you less familiar with the concept of a serial acquirer, I’m not referencing companies that dominate headlines with splashy announcements of mega-blockbuster acquisitions. It’s quite the opposite. What we’re after is the oddball company that pragmatically completes acquisitions of small, tiny, niche operators.

Often these niche operators have little to no reinvestment opportunities making them unattractive to traditional buyers. The structure of a serial acquirer allows them to scoop up these niche businesses and add a new value component in that the free cash flow of the niche business is now recycled into the overall machine and redeployed on future acquisitions (all in a tax-efficient manner).

A simple way to understand what makes these businesses so attractive is the relationship between their Return on Equity (‘ROE’) and Reinvestment Rate. This equation gives us a clue as to what type of returns we might be able to expect as owners of the shares. For example, if our company achieves a 30% ROE and retains 50% for reinvestment, we can expect a rough compounding rate of 15%.

If our company achieves a 25% ROE but can retain and reinvest 90% of that, we can expect to see a compounding rate of around 22.5%. Over the long term, as owners of serial acquirers, we can underwrite our returns to roughly follow this output (on a per-share basis), with fluctuations compensating for course correction in valuation.

The core competency of a serial acquirer is capital allocation. If the entity has an above-average structure to execute on this model (easier said than done), the business can defy the gravitational laws of capital and reinvest at higher rates of return longer than most. When discussing serial acquirers inevitably someone will pose the question “But how long can they do it for?” “It” being the magical endeavor of reinvesting capital at high rates of return by acquiring other businesses. To answer the question requires a little thought around the constraints of the model.

Typically, I find constraints pop up for serial acquirers in three areas:

- The Pipeline

- The Management

- The Redeployment of Capital

The Pipeline – Like arteries for a body, the pipeline of a Serial Acquirer is essential to execute the model. Remember, most serial acquirers target businesses that have little to no growth. The path to growth for these entities is dependent on having targets to acquire. When analyzing the pipeline of a serial acquirer we can start by asking how many targets exist and what portion becomes available for sale each year. This question becomes more difficult to answer depending on the variety of ranges in business types and geographies a serial acquirer is willing to venture into.

With the pool of targets defined, our serial acquirer must wrestle with the logistical fate of how to reach these targets and cultivate the necessary relationship that wins the right to purchase. Proprietary deals generally are of higher quality and come with the benefit of avoiding a bidding war brought on by brokers. However, using brokers brings a higher quantity of deal flow without the constraint of having to manage as many ongoing one-on-one relationships.

The pipeline challenge can be managed in several ways. Some of our businesses dedicate internal teams and specific individuals to source and cultivate deals. Others task the executive team at headquarters with the responsibility. And yet others blend the process with a healthy reliance on brokers. There’s no perfect formula. What is important is to understand how the constraints of the pipeline unfold as the serial acquirer grows in size and needs more targets. A good indicator to monitor in this area is trailing headquarters headcount (or internal M&A headcount) to successful deals and, or total capital deployed. If the company uses brokers having management provide color on how many brokers they tend to work with year over year also gives an idea of growing capacity of the pipeline.

Over time, the pipeline becomes a competitive advantage for a Serial Acquirer. Mark Leonard once said, “The barrier to starting a conglomerate of vertical market software businesses is pretty much a cheque book and a telephone.” While this might be true, I’d kindly point out to Mr. Leonard that most businesses do not have a pipeline of over 100,000 targets which they maintain contact with in hopes of one day acquiring. The moat of a serial acquirer begins small but can snowball into something great. In time, a good Serial Acquirer builds their reputation and grows their pipeline, constantly pushing the first major constraint of the model.

The Management – Once a business is acquired, the integration and ongoing care of the business becomes a constraint. Serial acquirers that champion decentralized models have an upper hand. Decentralized models allow the business to operate independently with a few exceptions such as reporting metrics and how capital expenditure decisions are handled. The decentralized model works better with Serial Acquirers that specialize in acquiring highly niche operators.

Often niche operators wrestle less with market forces. Their market size serves as a deterrent to competition, and with less competition margins can remain (and grow) at healthy levels. This allows these individual business units to operate “as is” requiring less hands-on management from the parent organization. Serial Acquirers that implement a more integrated model run into bottlenecks much sooner than their decentralized counterparts. Integration is easier said than done and capturing efficiencies proves more often to be illusional than not. Needless to say, integration risk is a serious concern.

The best Serial Acquirers that execute on a heavily integrated model typically stick to specific verticals. Here they can leverage best practices and compound their experience of integration with each new business unit they add.

The integration constraint is interesting because the impact often lags surface-level results. A few good indicators to follow are organic growth, the sales-to-working capital ratio, and changes in capital expenditures. Organic growth is tied to the underlying businesses. Most Serial Acquirers operate in mature markets with steady low growth rates. If the organic growth rate deviates from the trend, it could indicate trouble with integrating acquisitions (customers aren’t sticking around, key employees aren’t producing, the list goes on…). The sales-to-working capital ratio provides insight into efficiency.

If the ratio worsens, it could indicate the plumbing of the organization is strained. Comptrollers and CFOs are unsung heroes of Serial Acquirers, and their architecture of how funds move within the entity plays a significant role on returns and capacity constraints of the organization. Finally changes and trends around capital expenditures can also serve as a clue to successful integration. Good Serial Acquirers do not starve their business units of necessary capital. If changes in capital expenditures occur, it’s important to ask why and to make sure management isn’t slipping into negligent owners of their end businesses.

The Redeployment of Capital – One of the most overlooked positive attributes of Serial Acquirers is the durability that comes from having a collection of unrelated cash flows. Whereas many businesses die if one product line goes under, a Serial Acquirer has a basket of individual companies, often with multiple product lines. This dynamic allows for cash to be cycled into the organization constantly. As cash builds, however, this strength can mutate into an odd deficiency. Inevitably if the Serial Acquirer does not have the proper architecture and leadership to redeploy cash at high rates of return, the entity collapses upon its weight. Consider this statement by David Barber, former Chairman and CEO of Halma:

We deliberately chose to develop a group which would be completely self-financing but which would also be able to sustain a growth in EPS in the range of 20%-30% compound per annum or, as we later defined it, 15% plus inflation. This latter target was our overriding corporate objective.

We determined that in order to achieve this in that very inflationary climate, we needed to be achieving an average Return on Capital Employed of 40%. Was it a good idea at the time? Without doubt the establishment of these very demanding targets was a key driver in achieving the results we did.

I can tell you that once you have created and find yourself running a group with such a high rate return on capital, it is a position you will relinquish only with extreme reluctance!

If the targets are too complex, then this quick mental reference can be very difficult to achieve. The salient points arising from it must be simple and easily understood. There is a virtue in having relatively simple, relatively understandable key targets.

The route we adopted at Halma as long-term operators was to focus on mix. In broad terms, simply doing less of anything that gave returns below the target level and doing more of what gave returns above this level. It sounds simplistic but given time, the cumulative effect of chis can be massive, even in a large group.

– David Barber, former CEO and Chairman of the Board Halma, October 1997 Strategy Speech(*)

A Serial Acquirer must fight the never-ending battle against entropy in the redeployment process. It requires a level of pigheaded stubbornness to not lower hurdle rates. Good Serial Acquirers demand a good return on their capital. This is contrary to many businesses that hand out capital and ask “What return can you get me?” When accessing this component of a Serial Acquirer I’m reminded of a quote by James Clear:

You do not rise to the level of your goals, you fall to the level of your systems.

– James Clear

The system design of a Serial Acquirer is the leading combater against the inevitable march to capital mediocracy. Constellation Software pushes capital redeployment decisions down within the organization. This allows better redeployment at higher rates of returns in smaller targets for longer. Companies like Lifco and Judges Scientific have clear hurdle rates on acquisition multiples and communicate this target constantly.

This system design creates clarity for internal leadership along with public accountability. The redeployment of capital is a delicate balance of maintaining high hurdle rates but ensuring a healthy amount of cash is reinvested. We can understand the constraints by dissecting the system. For better or worse this is more of a qualitative exercise that is best pursued with genuine curiosity as to how the inner moving parts of the “machine” work.

Overall, Serial Acquirers continue to offer enticing return profiles. They’ve worked across an assortment of geographies, in differing periods of history, and with differing core models. Understanding their constraints can help us ballpark how long a single Serial Acquirer can execute on the model. The task of studying these businesses is an enjoyable endeavor, and I’ll continue to share my thoughts on these businesses in future updates.

Changes in 2024

In 2024 I’ll be substituting two quarterly letters with written Q&A’s compiled from my interactions with fellow investors. This will be open only to partners (clients of MCJ Capital Partners). I’ll be selecting which questions to publish based on what I perceive adds the most value to you as a partner of MCJ Capital Partners. I’ve found in conversation there’s often a good question that pops up that I wish I could share with more of you. I’m hoping this will be a way to do just that.

Until next time,

M. Carter Johnson

|

FOOTNOTES (*) Hat tip to a REQ Capital and their Deep Dive on Serial Acquirers: https://req.no/wp-content/uploads/2023/12/REQ-Deep-Dive-Acquisition-driven-Compounders-December-2023.pdf 1) The performance results shown are those of the first account under management of MCJ Capital Partners LLC (“MCJ”) and are the result of the application of MCJ’s proprietary investment process. These performance results are presented net of all fees including brokerage, margin, custodial, and a 1% management fee beginning in January 2021. No management fee was charged in 2020, all other fees were present. A client’s return with respect to an investment would be reduced by any fees or expenses a client may incur in the management of its investment advisory account, including advisory fees in the future. The performance results include the reinvestment of dividends and interest on cash balances where applicable. All performance results are unaudited and are not an estimate of any specific investor’s actual performance, which may be materially different from such performance depending on numerous factors. No representations or warranties whatsoever are made by MCJ or any other person or entity as to the future profitability of an investment account or the results of making an investment. All information provided is for informational purposes only and should not be deemed as advice in relation to legal, taxation, or investment matters. Past performance is not indicative of future results. Each of the S&P 500 Index, the MSCI Index, and the Russell 2000 Index (each, an “Index”) is an unmanaged index of securities that is used as a general measure of market performance, and its performance is not reflective of the performance of any specific investment. The Index comparisons are provided for informational purposes only and should not be used as the basis for making an investment decision. Further, the performance of an account managed by MCJ and each Index may not be comparable. There may be significant differences between an account managed by MCJ and each Index, including, but not limited to, risk profile, liquidity, volatility and asset comparison. The performance shown for each Index reflects no deduction for client withdrawals, fees or expenses. Accordingly, comparisons against the Index may be of limited use. Investments cannot be made directly into an Index. The S&P Index return was determined using the performance of Vanguard S&P 500 ETF (VOO). The MSCI Index return was determined using the performance of Vanguard Total World Stock ETF (VT). The Russell 2000 Index return was determined using the performance of Vanguard Russell 2000 ETF (VTWO). MCJ offers investment advisory services and is registered with the state of Colorado. Registration does not constitute an endorsement of the advisory firm by the Colorado Securities Commissioner nor does it indicate that the advisory firm has attained a particular level of skill or ability. All content on this webpage is general in nature, not directed or tailored to any particular person, and is for informational purposes only. Neither this webpage nor its contents are offered as investment advice and should not be deemed as investment advice or a recommendation to purchase or sell any specific security. In addition, neither this webpage nor its contents should be construed as legal, tax, or other advice. Individuals are urged to consult with their own tax or legal advisers before entering into any advisory contract. The information contained herein reflects the current expectations and opinions of MCJ as of the date of publication, which are subject to change without notice at any time. MCJ does not represent that any expectation or opinion will be realized. While the information presented herein is believed to be reliable, no representation or warranty is made concerning the accuracy of any data presented. Neither MCJ nor any of its advisers, officers, directors, or affiliates represents that the information presented in this tear sheet is accurate, current or complete, and such information is subject to change without notice. No representations or warranties whatsoever are made by MCJ or any other person or entity as to the future profitability of an investment account or the results of making an investment. Past performance is not indicative of future results. Additional information is available from MCJ upon request. MCJ is not acting as your adviser or agent unless and until you and MCJ sign an investment advisory agreement. Readers are advised that the material herein should be used solely for educational purposes. This memorandum expresses the views of the author as of the date indicated and such views are subject to change without notice. MCJ Capital Partners LLC does not purport to tell or suggest which investment securities members or readers should buy or sell for themselves. Readers should always conduct their own research and due diligence and obtain professional advice before making any investment decision. MCJ Capital Partners LLC will not be liable for any loss or damage caused by a reader’s reliance on information obtained in any of our newsletters, presentations, memorandums, special reports, email correspondence, or on our website. Our readers are solely responsible for their own investment decisions. The information contained herein does not constitute a representation by the publisher or a solicitation for the purchase or sale of securities. Our opinions and analyses are based on sources believed to be reliable and are written in good faith, but no representation or warranty, expressed or implied, is made as to their accuracy or completeness. All information contained in our newsletters, presentations or on our website should be independently verified with the companies mentioned. The editor and publisher are not responsible for errors or omissions. MCJ Capital Partners and accounts actively managed by MCJ Capital Partners have long positions in Constellation Software (CSU.TO), Judges Scientific PLC (JDG.L), and Lifco (LIFCO.B.SFB) and would benefit from overall price appreciation of the stocks. At any time we may close these positions without notice. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.