Measuring Volatility Using the Average True Range Indicator – Analysis and Forecasting – December 17, 2023

Measuring Volatility: Key Points

- Volatility is a measure of price movements over a specific period of time.

- To measure volatility, the Average True Range (ATR) and Volatility Pro Indicators are used:

Technical analysis can bring significant value to traders.

There is no sign indicator set Since the future can be perfectly predicted, traders can use past price movements to get an idea of what to expect. In May What will happen in the future.

In this article, we will take our discussion of technical analysis one step further by focusing on one of the key factors important in determining market conditions: volatility.

risk of volatility

The appeal of high volatility conditions can be obvious. A higher level of volatility means greater price fluctuations, and greater price fluctuations mean more potential opportunities and more potential for risk.

Traders need to look at the full spectrum of these scenarios. Higher volatility makes price movements much more difficult to predict. Reversals can be more aggressive, and if a trader spots a false move, the increased activity can entail larger price movements for the trader as well as the trader, making the potential losses much greater in a volatile environment. favor.

average true range

The Average True Range indicator is superior to most other indicators when it comes to measuring volatility. ATR was created by J. Welles Wilder (the same gentleman who created the RSI, Parabolic SAR, and ADX indicators) and is designed to measure true range over a specified period of time.

The actual range is specified as the larger of:

- The current period’s high minus the current period’s low.

- The current period’s high price minus the previous period’s close price.

- The current period’s low price minus the previous period’s close price.

Since we are trying to measure volatility, the above calculation uses absolute values to determine the ‘true range’. So, regardless of whether the value is negative or not, the largest of the three numbers above is the ‘actual range’.

Once these values are calculated, short-term fluctuations can be smoothed out by averaging over a period of time (typically 14 periods are used). The result is Average True Range.

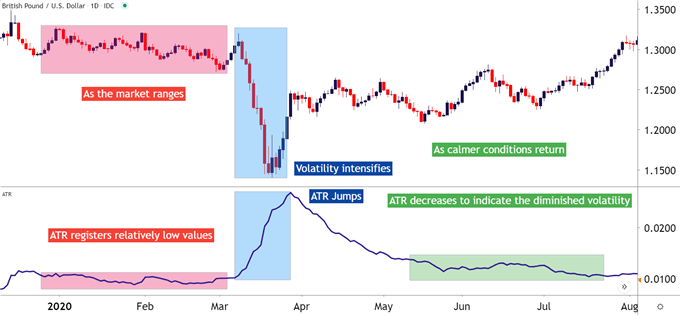

In the chart below, we have added ATR to illustrate how the indicator registers larger values as the price range increases.

GBP/USD with ATR (January – August 2020)

How to use ATR

Once traders learn how to measure volatility, they can incorporate the ATR indicator into their approach in one of two ways.

- Use as a volatility filter to decide which strategy or approach to use

- To measure possible stopping distances when starting a risky spending or trading position.

Using ATR as a volatile filter

Traders can access a low-volatility environment with one of two approaches.

Simply put, traders can expect a low-volatility environment to persist or change. That is, a trader can approach low volatility by trading a range (persistent low volatility) or look to trade a breakout (increasing volatility).

The difference between the two conditions is enormous. Range traders seek to sell resistance and buy support, while breakout traders seek to do the opposite.

Additionally, range traders typically enjoy well-defined support and resistance for stop positions. Breakout traders do not. Breakouts can potentially lead to big moves, but the odds of success are fairly low. This means that false breakouts can be plentiful, and breakout trades often require more aggressive risk-reward ratios (to offset the lower probability of success).

Using ATR for Risk Management

One of the main difficulties new traders face is knowing where to place protective stops when starting a new position. ATR can help you with this goal.

Since ATR is based on price movements in the market, the indicator increases with volatility. This allows traders to use wider stops in highly volatile markets or tighter stops in low volatility environments.

The ATR indicator is displayed in the same price format as the currency pair. Therefore, the value ‘.00458’ is EUR/USD This means 45.8 pips. Or read ‘.455’. USDJPY This means 45.5 pips. As volatility increases or decreases, these statistics also increase or decrease.

Traders can use this to their advantage by placing stops based on the value of the ATR. Whether it is a factor of the indicator (e.g. 50% of ATR) or a direct reading of the indicator itself. The key here is that the indicators read react to recent market conditions, allowing an element of adaptation for traders using the indicators in their approach.