Medi Assist Healthcare GMP jumps after share allocation as investors await listing.

If the current trend continues, it is expected to be listed at a 7% premium over the IPO price. The company has priced the offer in the range of Rs 397-418.

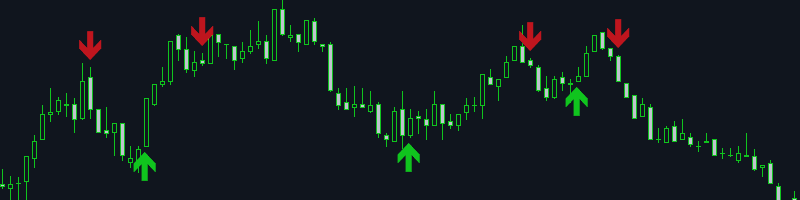

However, it is important to keep in mind that the gray market premium is only an indicator of how a company’s stock price stacks up in the private market, and can change rapidly.

Medi Assist Healthcare IPO Subscription

Medi Assist Healthcare’s public offering was subscribed 16 times at closing, supported by strong demand from institutional investors, with the category subscribed 40 times.

Also Read: Axis Bank, Bajaj Auto Q3 earnings among 10 factors driving D-Street in holiday-shortened week

Medi Assist is fully OFS and will not receive any funds from the IPO as the entire proceeds will go to selling shareholders.

Analysts believe the IPO has provided investors with an opportunity to invest in leading third-party administrator (TPA) medtech and insurtech companies. In the upper band of the valuation analysis, the issue commanded a market capitalization of Rs 2878 crore.

Medi Assist is a health and insurance technology company that manages health benefits for employers, individual members, and public systems that primarily serve insurance companies. Founded in 2002, the company acts as an intermediary between insurers and healthcare providers, providing health and cash insurance to over 14,000 hospitals in India.

The company serves 78% of Nifty 50 companies and 35% of BSE500 companies.

For the six months to September 2023, the company’s total revenue rose 26 per cent year-on-year to Rs 312 crore, while net profit fell 39 per cent to Rs 22.5 crore.

(You can now subscribe to our subscription. ETMarkets WhatsApp Channel)

(Disclaimer: Recommendations, suggestions, views and opinions provided by experts are their own and do not represent the views of The Economic Times.)