Bitcoin mining company Marathon Digital Holdings is preparing. half life.

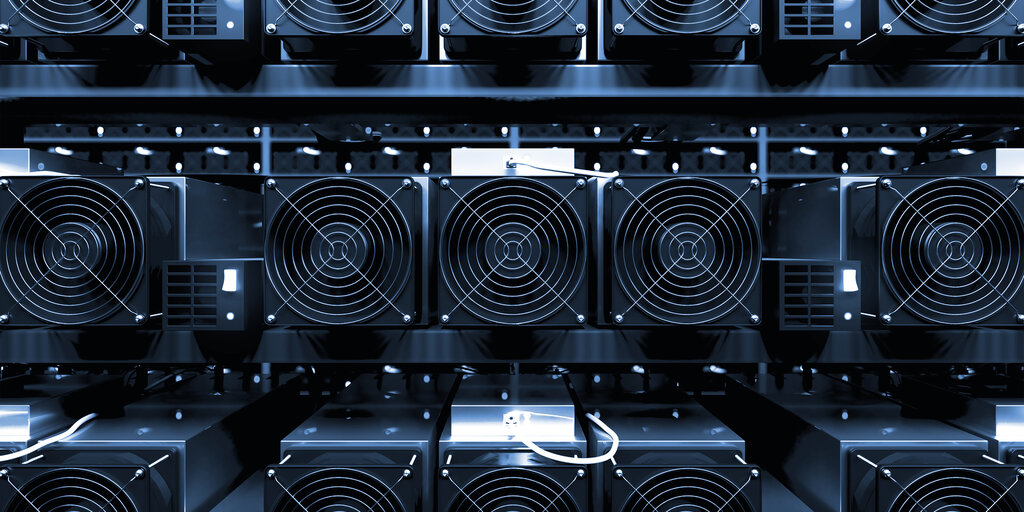

In a statement Tuesday, the publicly traded company announced the acquisition of two Bitcoin mining operations for $178.6 million. Data center sites are located in Texas and Nebraska.

The company said the move will add 390 megawatts of capacity and is expected to reduce mining costs per coin by about 30%.

Bitcoin halving is an event that occurs approximately every four years. This event is implemented in the Bitcoin protocol to keep the network secure and ensure that the reward to the miner processing the transaction is halved. Instead of 6.25 BTC, miners are rewarded 3.125 BTC for each block they process.

Halving the reward is intended to curb Bitcoin inflation. There are only 21 million Bitcoins mined, but halvings periodically slow the available supply entering the market.

“Over the past year, we have strengthened our balance sheet by increasing our cash reserves, increasing our Bitcoin holdings, and reducing debt to prepare for the halving and enable us to take advantage of the growing opportunities.” Salman Khan, Marathon’s Chief Financial Officer, said in a press release:

Fred Thiel, Marathon’s Chairman and CEO, added that the acquisition will give the company “the opportunity to reduce Bitcoin production costs at these sites, leverage energy hedging opportunities, and expand our operating capabilities.”

The fourth halving since the cryptocurrency network launched in 2008 is expected to take place in April.

As with previous halvings, the question on investors’ minds is once again, ‘Is the halving priced in?’ Some believe the halving will be a bullish indicator for the market as assets become scarce. Others say the Bitcoin price will not change much. This is because prospective buyers know that the Bitcoin price is coming and can prepare accordingly months in advance.

Experts have previously said decryption Miners have already begun purchasing more efficient machinery in preparation for the event.

Marathon Digital is the second-largest holder of Bitcoin among all publicly traded companies invested in the asset. The company has 13,396 BTC on its balance sheet, currently worth $567 million.